Backblaze: earnings and multiple growth potential, AI tailwinds

Microcap SaaS has history of capital efficiency and huge runway to deploy capital

Backblaze (NASDAQ:BLZE) IPOed in 2021 as a promising cloud storage play with a product far cheaper and in some cases a drop-in replacement for Amazon’s S3. The company has ~100,000+ business customers using it and 430,000+ consumer / smaller scale users. It regularly wins middle market customers over from Amazon and business use cases range from streaming companies and NFL teams storing videos to satellite data analysis for AI training. I first learned about BLZE at the QCon Developer Conference where they presented on their storage solution in Oct. 2022 and have kept tabs on them since.

BLZE has lost 70% of its value since IPO and now trades at ~25x forward EV/EBITDA (with only 8% EBITDA margins that can grow significantly IMO) and 2.1x price / forward sales despite guiding to 20%+ growth this year, growing 28% y/y last quarter and having substantial operating leverage.

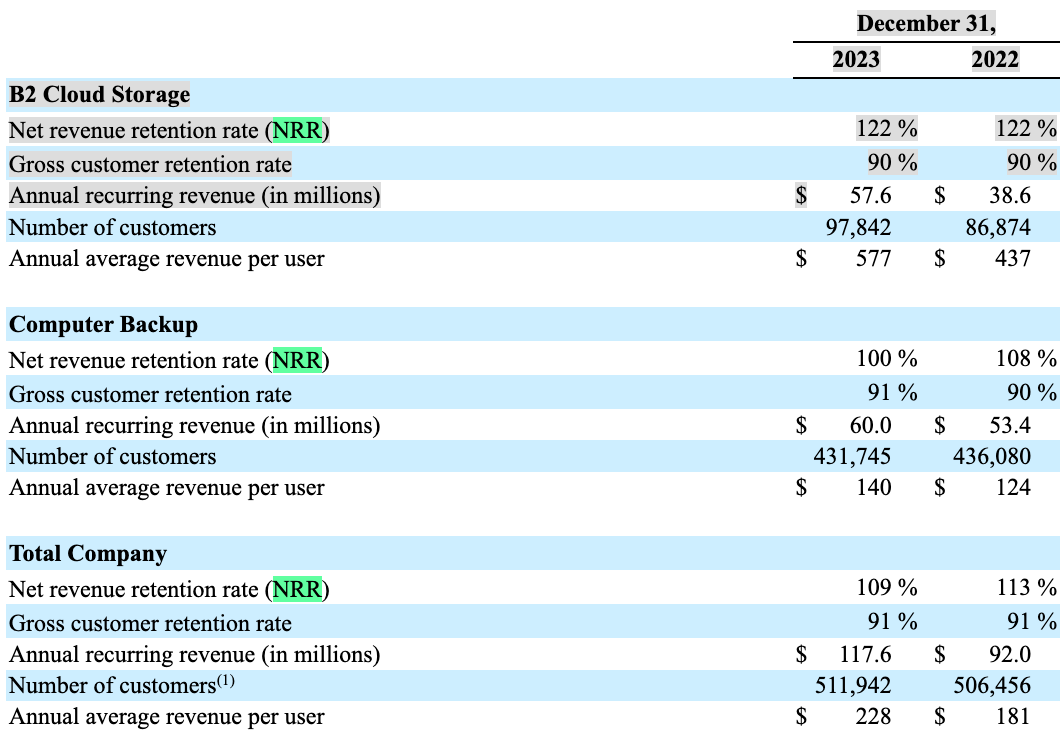

BLZE has a consumer facing business line (“Computer Backup”) that is the majority of its revenue but slowing down on growth and a business facing consumer line (“B2 Cloud Storage”) growing at 40%+ with customers like Fortune and PagerDuty. Nearly all of BLZE’s revenue is recurring and expanding. Overall NRR is 112% but on the B2 Cloud line it is 126%. You can see how attractive B2 is on NRR and other metrics compared to the consumer line in the table below from their 2023 10K:

I think B2 is going to ramp significantly over the coming years and will eventually be the majority of revenue. As B2 in addition to having higher NRR is about 4x the ARPU of computer backup and growing faster on total customers (computer backup is shrinking / flat) and price, I think BLZE’s business metrics will continue to look more attractive with time. You can see in the three years since the company went public the revenue shift to B2 is already happening:

I also think the B2 sales motion / GTM effort is a fraction of what it could be. The company’s roots are in self-serve. From CEO / founder Gleb Budman:

The company also is hiring an SVP of sales and moving over the existing VP of Sales to focus exclusively on AI use cases:

So before even discussing AI, I think BLZE is near or at an inflection point in its business on top line and bottom line:

Revenue mix about to cross over to be mostly business customer driven, which is much higher quality revenue than self-serve. B2 has grown 40%+ the last two years and I think investing in sales force / GTM paired with the general growth of data across businesses could keep growth in this range / 30s for years

Adjusted EBITDA positive for first time since public company and guiding to cash flow breakeven next year. Company constantly cites operating leverage and has reduced headcount growth (actually down from 22 to 23). BLZE has a history of capital efficiency and is the rare mostly bootstrapped startup to IPO story, using only $3m of capital from founding to IPO

This writeup comes on the heels of my Iron Mountain one and the overall investing theme is similar. To be clear - I am not saying data storage is a great business and I think the examples of Dropbox and others show storage is in some ways a commodity. However, data ingress, egress (a huge part of the company’s business value prop - egress is expensive for the major cloud vendors, that don’t want you to get out of their cloud), automations associated with it, performance and other factors can impact price and vendor stickiness. The amount of data stored growing way faster than GDP+ is something you can bank on, so if you can find companies that have stable price, volume x price should result in growing sales. I believe all of this to be true irrespective of what happens with AI.

AI is where things get interesting. From the CEO:

Since the beginning of 2023, the number of AI companies using B2 for data storage has doubled with a wide range of use cases, such as wildfire management and monitoring, manufacturing optimization, satellite data analysis and much more.

For AI use cases, we presented a session with CoreWeave, a specialized cloud provider of large-scale GPU-accelerated workloads to show how paring our services supports AI workflows, which consume and generate data at an exponential rate. B2 Cloud Storage is an ideal cost-effective storage solution for AI workflows and processes, including the AI model, training and inference data.

And finally, I'd like to share a developer story, which highlights our ability to serve innovators in the AI space and illustrates how we continue to make headway within our application storage initiative. One of our joint customers with CoreWeave is an application developer using AI to reinvent how 3D motion capture works. With this customer's SaaS offering, there's no need for special environments, clothing or sensors, creators can simply capture human movement and their AI translates it into usable 3D animation, but they needed a cloud storage provider that could scale with their ambitious growth plans while also providing free egress for them to easily migrate their data into CoreWeave to run AI workloads and archive those results. After considering other traditional providers, they found that Backblaze could best serve their needs. This is a great example of how AI use cases require both powerful servers for processing large volumes of data as well as affordable, accessible object storage.

BLZE is already seeing AI use cases from customers and those use cases are likely to ramp for new and existing customers. For some context, Backblaze reached 1 exabyte of stored data in 2020 and stores 3+ exabytes today (an exabyte is a massive amount of data / 1bn gigabytes - they actually have a good writeup putting in context). Accessing that data for AI training and inference for many of their business customers is going to require using Backblaze’s APIs. Backblaze already IMO is seeing where the puck is going here and building features like Event Notifications (basically, trigger one or more workflows from a trigger) to support the use of data for AI. I don’t think the AI tailwind has shown up in results yet and estimates may be too low.

Even without moving BLZE to the 30-40% growth I think could come in a bull case, I think a 15% IRR from here is not a stretch. The company with a 15% IRR on a stock would trade at single digit EV/EBITDA if you assume 35% EBITDA margins (IMO reasonable given what some cloud vendors do for margins) and growth slowing to ~10% into 2030:

~$300m of sales in a few years feels extremely reasonable to me. The company has about 100K paying businesses right now on B2 at about $600/y. I think B2 ARPU could jump significantly. My guess is many companies are paying AWS more than $600/m for S3 (good article with some reasons S3 pricing is hard to wrap your head around and optimize). If you’re already on AWS, S3 is an obvious choice, but I believe we are still in a period of developers / finance teams being pressed to justify costs and BackBlaze is the easiest way to save a bundle on storage.

One thing I should note - BackBlaze and S3 are not the same, and there are features in S3 that make it significantly more suitable (mainly, reliability) for enterprise customers than BLZE. This Reddit thread discussing puts/takes from sys admins has a good overview but it does hammer home the point that for midmarket customers BLZE presents significant savings and is highly reliable. BLZE has their own page comparing data savings versus the cloud vendors. Here is what their default case looks like for 500TB of stored data:

This calculator is obviously biased but there is no denying BLZE has years of customer wins against S3. The company has been around since 2007 so actually pre-dates Azure / GCP and was coming up around the same time as S3. Gleb Hubman is still there as founder / CEO 17 years later and has a history of successful exits with the same co-founder before this.

I have decent conviction the value add here is proven out and makes sense for many companies looked to quickly realize storage savings. BLZE successfully raised prices last year with minimal churn and the savings are so large I think they have a lot of white space to work with. In terms of why B2 can be so cheap versus S3, I’ll be honest in saying some of the technical reasons are over my head, but the main one from my understanding is BLZE does not have to pay for all the backup data centers AWS has and customers sign on with the understanding it is slightly less reliable in a disaster scenario (Hacker News thread, that said I think the company would say their design is more efficient on storage pods and they have technical advantages).

I do have two big “pre-mortem” risks worth discussing before I wrap up here:

Not understanding the tech / competitive advantage / race to bottom possibility - The market clearly is fading the possibility that BLZE is for storage what Cloudflare is for networking (a comparison management makes all the time). The BLZE cost savings I have seen posted almost seem “too good to be true” and I worry S3 and the other vendors could try to kill their business by slashing prices. That said, BLZE is a microcap SaaS with just a shade over $100m ARR. The big cloud businesses would be going through a lot of trouble for minimal pickup

Security / reliability incident that makes big vendors only game in town - Cybersecurity has come up in a few calls and obviously is top of mind for many of BLZE’s current and prospective customers. An incident would fuel the narrative that the big vendors are the best way to go

Overall though, at 2x sales / 25x EBITDA I think these risks are largely priced in. The potential for continued 20-30%+ growth here feels reasonable given the data storage and AI opportunity. I also think Backblaze is a natural acquisition target for GCP/AWS/Azure and would benefit from having their built in GTM / sales motion. As an independent entity, I think there is a good track record of success with Digital Ocean, Cloudflare and others that have successfully taken a small part of megacap tech’s business by being cheaper and easier to set up. BLZE I think is strong risk / reward and even without AI materializing the way bulls think it will has 15%+ IRR upside.