I took the time to talk to several other Backblaze investors and their head of IR (new reader catchup - after Q1, I was mixed on owning the stock). My updated view is the claims I was most uncomfortable with in the short report I think are either wrong or not relevant for valuing the stock:

I heard from investors and IR that Wasabi based on channel checks, resellers and head-to-head deals is not taking business away from BLZE. IR disagreed with the claim the reason a large customer left in Q4 was Wasabi and (correctly) noted many of the sources in the report work for Wasabi. Backblaze has won selling against Wasabi before and products like Overdrive represent competitive differentiation and responding to new demands in the market. Overdrive specifically is a response to needing to move data around with high throughput and low latency in many cases for AI training and inference. Additionally, Wasabi has raised over $500m to date, including $250m in its Series D in Sept. 2022 - in contrast, BLZE has raised $135m since going public in 2021. BLZE is clearly more capital efficient and has been able to compete and win up to this point.

I appreciate IR walking me through the dangers of using adjusted EBITDA due to the company’s spend on data center and hardware leases. IR said to expect finance lease spend to be 50% of revenue and that capex spend is a recurring spend of the business (you need to add data center space & hardware leases as customers decide to store more data), so EBITDA is not factoring that spend in. Depreciation includes data center and hard drive equipment depreciating over 3-5 years. Per IR, EBITDA is a holdover metric from the last CFO and the company intends to focus on FCF going forward. All Rule of 40 estimates they give use FCF for margins (I have seen companies use EBITDA for Rule of 40 FWIW) and the intent long-term is for 30% growth and 10% FCF margins. Importantly, the short report attacked adjusted EBITDA and adjusted FCF as metrics and it’s telling the company doesn’t want to use at least one of them going forward (given the choice, I’d rather have adjusted FCF).

Investors and IR both argued raising equity in November of last year - a move I was frustrated with - was an opportunity to strengthen the balance sheet and technically wouldn’t be necessary in a base case scenario. The raise was intended to hedge against bad macro scenarios and markets shutting down. This bad scenario played out for much of March and April (IMO capital markets were largely closed for small issuers), so in retrospect adding $35m of cash when it was available despite the dilution I think was a smart choice.

On competition in general - IR reiterated the hyperscalers don’t use the same storage hardware they do because AWS for instance has to offer many services beyond storage that require different hardware. BLZE has been doing storage at scale since nearly 2007 and has worked over time to make its product as focused & inexpensive as possible for customers. I believe this is a durable competitive advantage over the hyperscalers and their cost advantage is not at risk because AWS/GCP/Azure will always pursue “one-stop-shop” offerings for cloud services whereas BLZE is hyperfocused on data storage. As a long-time AWS customer, I can honestly say S3 (its storage unit) has become more and more complex over time, and the amount of things it can do in conjunction with other services actually complicates versus simplifying pricing.

Another interesting takeaway from my calls is that the reason for BLZE’s “acceleration guide” where revenue growth keeps increasing each quarter is the sales team transitioning to a new strategy that optimizes for larger customers. Gleb Budman (CEO) reiterated this guide during the annual meeting.

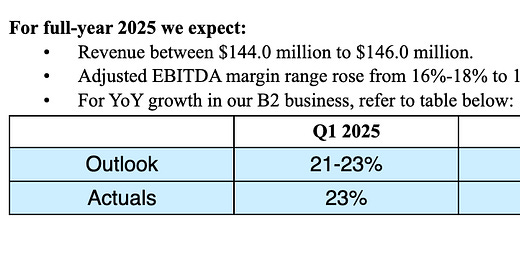

I was pleasantly surprised to hear investors often ask IR why B2 can’t grow faster. The reason here is enterprise sales is a muscle they’re still developing. They hired a new Chief Revenue Officer about a year ago who IMO deserves credit for some of the revenue acceleration to date and helping land their largest customer in Q1. The Q1 deck alludes to the transformation happening:

If B2 continues to grow north of 30% in 2026 and FCF margins do get to 10%, I think you can underwrite Backblaze to eventually reaching $20m+ of FCF (so $200m sales when the guide this year is for $144m on low end). If B2 continues its growth rate for a few years, I think a 5% yield to the equity is more than fair. At 20/5% you get to a $400m valuation - my view is sales can get a lot higher than $200m; the company is closing 7 figure deals now and I believe there are many 8 figure deals in the market they can win from AWS and others.

Notably, I reached out to several funds who own the stock based on 13-Fs, BLZE’s IR email and used the contact form from Morpheus Research’s website to request a meeting. I got meetings with everyone except Morpheus. There may be good reasons for this - and I’d still take any meeting with anyone with thoughts on the stock - but these are the facts.

I haven’t gone deep on the annual meeting and proxy that was filed on 5/27. FWIW, the top shareholder has chanced since 2024 - previously was TMT Investments (8%), now a tie between Blackrock and AWM Investments (5% each), who has been in and out of the stock for a few years. Credit to AWM who was willing to jump on a call with me and compare notes with the company.

2025 edition:

Overall, I believe my investment process now needs to include talking to IR, management teams and other investors. There are many ways to interpret filings and comments on earnings calls. Turning over every rock with major shareholders (and shorts if they want to talk) and the company I am finding extremely helpful.

Quick notes on TURN and upside/downside if deal passes/fails

TURN’s updated proxy for the Mount Logan deal has a line on deal fees of $6-7m that make me nervous:

Paired with my new NAV estimate ($4.20) after the Q1 shareholder letter, I think upside is limited here.

If the deal goes through, you get ~$4.20 in stock of the new combined entity. If it doesn’t, I think it’s very possible after spend on the deal new NAV comes in <$4. Let’s say it’s $5m on 10m shares because they get a $1m breakup fee - that is still $0.50 of NAV gone, versus upside of $0.25 based on yesterday’s $3.95 close. I have been screening a bit for CEFs on CEF Connect and can say confidently a 6% NAV discount is not fantastic compared to other funds out there that own more stable assets (ex. large cap equities, CLO debt).

As always, I may be missing something here - underestimating NAV or reading deal docs wrong - and please reach out if you have a different view.