Eagle Point Income Company - the case for double digit IRR with bond-like risk

CEF that owns BB CLO tranches trading under NAV and doing buyback

I’ve spent some time over the last few weeks looking at CEF Connect and trying to find closed-end funds that meet my 8+% IRR threshold via well-covered distributions and NAV that is stable and easy-ish to measure. After looking through some of the deep discount options like HFRO (57% discount to NA w/ real-estate assets), I tightened up my investment criteria to these three points:

Must have assets where it’s difficult / impossible to inflate valuation. The market is smart and funds that traditionally have traded at premiums usually have high-quality assets

Must have a well covered dividend that isn’t reliant on leverage

Manager has good track record (fund total return, distributions, NAV, shareholder friendly actions, etc.).

After some searching, EIC 1) stood out for meeting all three criteria and 2) is trading under NAV for one of its first times ever in its six-year history and just announced a $50m buyback authorization on ~$280m of market cap (~18% of float). My view is EIC long-term should trade at NAV or above and that the dividend can approach 10%+ assuming rates don’t go back to zero. In a non-zero rate environment, I think this is a low to mid teens IRR.

Quality assets

About 3/4 of EIC’s NAV is composed of BB tranches of collateralized loan obligations (CLOs) and the remaining 1/4 is CLO equity. BB tranches are Level 2 assets which can be valued on observable market data. EIC owns over 100 of these BB slices across 100+ CLOs and trades in and out of them in addition to ~50 equity residuals; no individual CLO slice represents more than 2% of the fund. The summary statistics the fund provides shows how diversified the underlying assets are (ex. top 10 obligors are <5% of dollar value of loans):

Per the company, the default rate on the underlying loans in BB tranches is 4bps a year. CLO debt tranches even at BB have much less default risk than high-yield bonds and other loan products (in part because equity takes first loss). My view is that because of the historically strong performance of the debt and to an extent CLO equity (CLO equity has traditionally returned in the high teens and even low 20s), EIC has traded at a premium and dislocations have been opportunities to buy:

While mark-to-market values on the BB will float around because of rates and spreads, if the underlying loans are held to maturity, the BB should pay par. As of Q2, the weighted average mark on the underlying loans was 98 cents on the dollar, so if the fund just held to maturity and defaults were in line with history, you would realize the full principal value of underlying loans. My guess is this value would be higher than NAV given a good amount of the portfolio was acquired when rates were lower than they are now:

Like any type of bond investment, if rates go up or if spreads blow out, the value of BB tranches on paper will go down. The equity is a little different as lower rates means more cash flow gets to the equity as there is less floating rate interest to pay. You can see how the rise in rates in the second quarter of 2022 took ~$3 off NAV:

Distributions

Overall, NAV may be volatile if rates move around in a big way, but distributions have gone in the opposite direction of NAV as higher rates mean more net-interest income (assuming spreads don’t move around too much). EIC’s three series of preferred stock are all fixed rate, so a rise in rates would benefit from liabilities being fixed. Distributions increased when rates flew up even though NAV decreased:

Outside of rates changing, EIC’s common dividends are well protected because of how CLOs are structured. I’m going to keep an overview of the CLO market brief here and highly recommend listening to CEO Thomas Majewski’s appearance on Forward Guidance. The main things IMO worth knowing on CLOs are:

The underlying assets behind CLOs are mostly senior secured loans from a large number of obligors spread across different industries. LTVs are 40-60%. Borrowers in CLO pools include Burger King, American Airlines, Hilton, Petco and Dell. The loans are floating rate (usually SOFR plus some spread) and generally the most senior in the capital stack. Unlike other securitized products like CDOs, they are not extremely sensitive to consumer credit. I expect CLOs to perform better than most asset classes in a financial crisis.

CLOs have structural protections that shut off cash flow to the equity and more junior tranches. Overcollateralization (OC) and interest coverage (IC) tests serve as checks on asset values and interest declining, respectively.

CLOs have reinvestment periods that allow the manager to buy loans after fund start with amortization proceeds. CLOs in some cases benefit from a financial crisis or credit markets locking up because they can buy loans significantly below par during the reinvestment period. If a CLO for instance gets $1 of amortization during a reinvestment period and loans are now trading at $0.50 on the dollar, it has the chance in a good credit outcome to add an additional $1 of returns to the equity.

If you have a five year view on the fund, you can get a lot of conviction in a substantial chunk of your capital being returned. In the last five years, the company has distributed out $10. Granted, SOFR was about 100bps higher in 24’ than in 25, but the new $0.13 dividend reflects the current reality. As I’ll talk more about, there is a path to a 10% IRR even if SOFR declines 100bps more.

Today’s dividend is a ~12% yield at the $13 share price. Majewski in the last call said the cut from $0.20 to $0.13 is because of rates coming down 100bps over the last year and spreads coming down:

Quarterly dividends are now $0.39 and the fund is covering it as of last quarter at $0.40 of net investment income.

If you think rates come down another 100bps, I think some quick math suggests a ~10% distribution is still possible:

EIC has ~$500m of assets (with about $145 of liabilities of preferred stock)

Its current weighted average effective yield is 11% . SOFR is about 4.3%. On average, most BB slices in the portfolio are SOFR + 650bps (this checks out if you look at a sampling of the “Investment Description” column in the portfolio holdings).

WA yield should be closely linked to return on assets (I calculate they’re about the same, see chart below). This last quarter, EIC did $14m of interest income and $4m of expenses (not including fees & waivers) for $10m of net interest income. Because of the 650bps average spread (note this is my estimate), an 100bps decline in rates I think could still result in a ~10% yield on distributions at the current stock price. Even if rates went to 0, you still in that scenario might get enough spread to get a 4-5% yield, which is not a terrible outcome. In the scenario where rates went down, I believe NAV would be likely to go up, resulting in potentially price appreciation for the stock. I also think EIC would take out their preferred stock and get a lower cost of financing.

Leverage and why not own the pref?

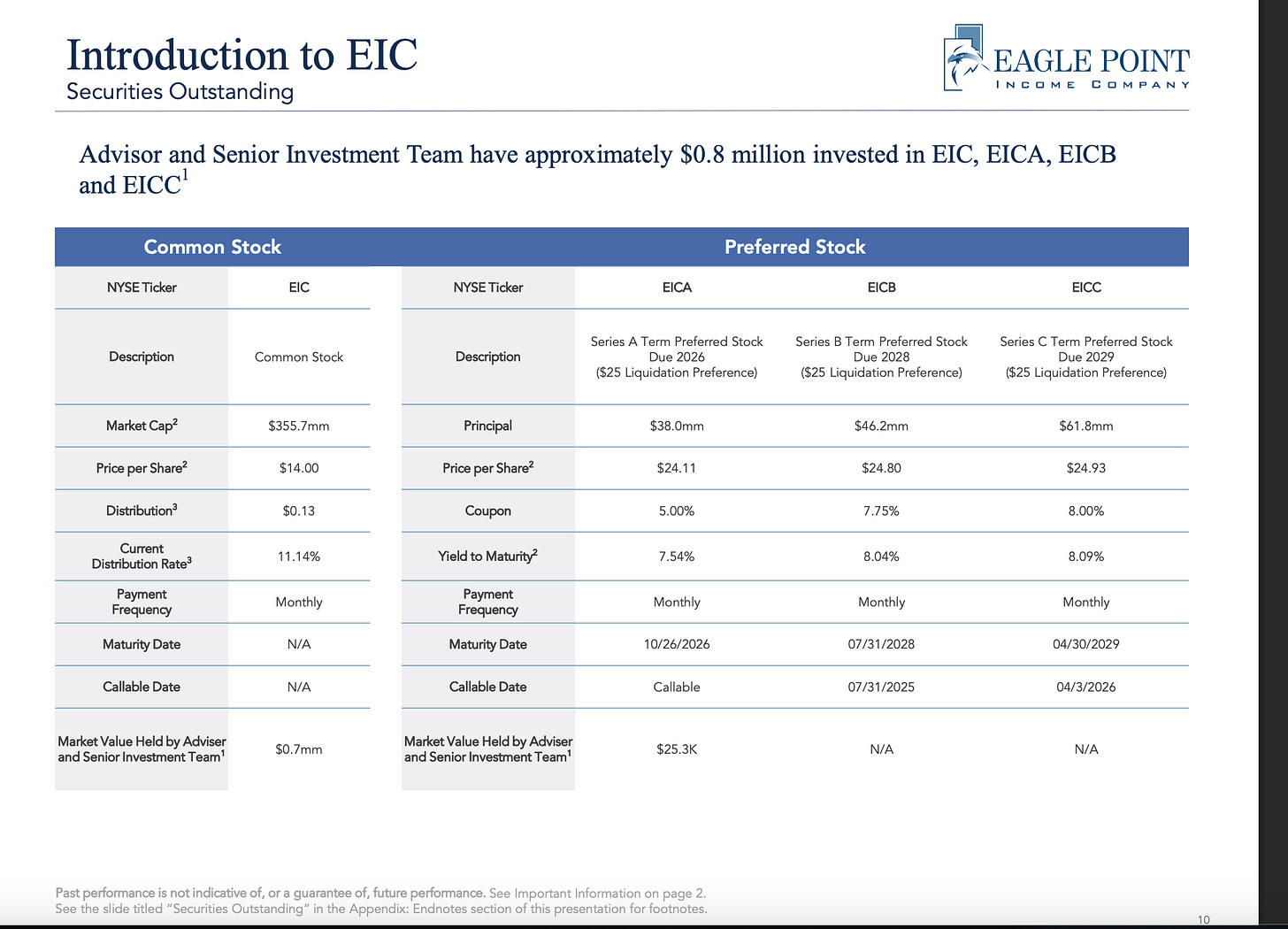

EIC has no long-term debt and three series of preferred stock that are all publicly traded - EICA (5% fixed coupon, matures next year), EICB (7.75% coupon, matures in 28’) and EICC (8% coupon, matures in 29’). Disclaimer: I own EICB and EICC.

The Investment Act of 1940 protects the preferred extremely well. The 1940 rules apply to all registered CEFs and require asset coverage of more than 2x on any preferred stock. From the last call:

As of March 31, the company had outstanding preferred equity securities which totaled 29% of total assets less current liabilities. This is within our long-term target leverage ratio range of 25% to 35%, at which we expect to operate the company on normal market conditions.

The company's asset coverage ratio at the quarter-end for preferred stock calculated in accordance with Investment Company Act requirements was 345%, comfortably above the required minimum of 200%

If this coverage ratio fails, dividends can get shut off to the common, asset sales can be forced, etc. Interestingly, Thomas Majewski himself talks about this protection near the end of the aforementioned podcast and says other Eagle funds are invested in BDC pref & debt. He mentions they have run analysis internally and found only three 1940-bound funds have ever defaulted and all paid pref & debt in full (and the equity still had something after).

I think the 1940 Act basically makes the preferred close to risk-free securities. Depending on your risk tolerance, there is a strong argument to simply buy EICB and C (A is maturing too soon for me and has the lowest yield). Both get you 8%+ pre-tax IRRs with far less risk. I own the common equity because I think closing the NAV discount + 12% yield from distributions is worth the extra risk.

One additional thought on the 1940 Act - I think in many ways this law makes CEFs safer and more attractive than companies that own debt / leases like CPSS and in the past TRTN and TGH. These companies have either no leverage requirements or less draconian ones and don’t have to return capital to you. Of course, they also can grow, but if you have a slightly negative view on credit (which I do), growth is not a positive. I wish more lenders would pull back during boom times and aggressively lend during busts, but there’s a reason all economies are pro-cyclical. Timing is hard.

Timing and the buyback

EIC has never done a buyback in its history before the announcement on 6/9/25. NAV just increased this last month (they provide measurements monthly). EIC has issued stock before and to my knowledge has always done so at a premium to NAV. Most recently:

The first quarter was a strong quarter for capital raising, and through our at-the-market program, or ATM, we raised approximately $64 million of common stock at a handsome premium to NAV. This generated NAV accretion of $0.08 per share. We also raised an additional $14 million from ATM issuance of preferred stock. Daily average trading volume for our common stock continues to increase, with volumes in the first quarter of 2025 more than double the volume of the first quarter of 2024.

I think it is highly likely if we see the discount widen, Majewski is aggressive in using the $50m authorization.

Ownership history

One final interesting note looking at the proxy. Enstar Group (acquirer of insurance businesses & legacy portfolios) has been the largest shareholder since inception, but its ownership percentage has gone down from 62% in 2019 to 15% from the last proxy. In the last year alone, Enstar halved its stake. I wonder if the largest shareholder selling has put pressure on the stock over time and whether Enstar eventually ending its sales could release some pressure. I don’t know the full story here and if any shareholders have information on Enstar’s history with the fund, shoot me a note.

The private credit boom / bubble

Much has been written in the last year or so on capital pouring into private credit. I think it’s a fact at this point that many investment managers are being tasked with significant dollars to find high yielding opportunities in the private credit market. Many future private credit issuers have loans owned by… CLOs. The podcast I keep mentioning was recorded in December 2023, but EIC’s CEO cites the private credit boom as a reason some low-quality loans in CLOs are getting refinanced at par that normally would go into workout. Majewski mentions Triple C Industries and MISAS as lower-rated borrowers that moved from CLOs to private credit and pre-private-credit-boom would have struggled to find lenders. More lenders in EIC’s market is a trend to watch.

Overall, I think EIC hits my return goals and the biggest risk is rates plummeting downward because of a recession. In this scenario, distributions would decrease due to floating rate coupons getting hit and defaults might increase. That said, lower rates benefit CLO equity and there could be some refinancing that benefits the debt as well. In a (modest) rate decline scenario, EIC could outperform the market because of the spread on BB CLOs, gains on CLO equity and its ability to refinance its own preferred.