This is a more philosophical post on trading strategies. Feel free to skip if you’re just here for the stock picks.

A buddy of mine has a boss who after they close a big deal at work will take them to the casino and give them money to bet. They get to keep the winnings. I know, amazing right? This is free leverage.

This idea seems absurd on the face of it. Why would you ever get to borrow money for free or get paid to borrow money (we can skip the negative interest rates discussion for now)? If you check your brokerage, you’ll probably see something like below for your margin account (this is from Fidelity):

Margin loans are going to run you a couple percent, so conservatively most trades on margin need to be a 10%+ IRR to give you some buffer.

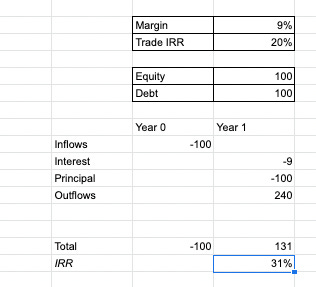

Everything works out fine if you do get that 10% IRR, but if the trade moves against you your equity begins to disappear and you’re down more money than if you just made the bet unlevered. Here’s a very simple breakdown showing you how 100% leverage with 9% interest gets you to a 31% IRR on a 20% unlevered trade (20 bucks original return, 20 bucks from leverage, and take away 9 from interest):

And how the same trade cuts harder if you lose money (say down 20%), because you’ve both paid interest ($9) and had equity taken from you ($40, $20 original and $20 from paying back debt):

This simple example to me shows you the pros and cons of leverage and isn’t anything new.

Where things get more interesting is if you have a way of paying for the leverage that is highly reliable and comes from having the leverage itself. Some examples:

Levering up to buy real estate and then having the tenants pay your principal and interest (you couldn’t have started the rental business without leverage)

Levered covered calls (you couldn’t have bought the stock to sell the calls against without leverage - as a side note, I’ve recently done this on a very small scale with AMPY (see my podcast with Twebs for coverage here), where you can get paid an annualized 25% for selling $7.50 calls (May 20th expiry, I got $0.27 on Friday here, 0.27 / 5.60 cost basis → 4.82% for 63 days till expiry, annualize…) )

The last one I have here is a little off the beaten path and I’m not sure if it will work. Some readers know I’m big into sports betting and have spent way too much time working on a project that will build DraftKings lineups for you. The idea I’ve been messing around with recently is using Sportsbooks (traditional bookmakers that let you place player prop and other bets) to hedge Daily Fantasy Sports (DFS) bets.

As an easy example, if you decide to build lineups that don’t contain a “chalky” player, you could bet the chalky player doing well with player props in a Sportsbook (ex. for basketball, maybe do an even odds bet that guy scores over 20 points). If this actually is a real hedge (and big if there - from my experiments this is far from perfect), the hedge always at least zeroes out your bet ($10 on lineups fails, then $10 on sportsbook pays for it, $0 to you).

As DFS players know, many contests pay out a large multiple of the entry fee, so there may exist a scenario where the cost of the hedge is more than paid for by winning a DFS contest. If opportunities like this really exist, then you could have your Sportsbook hedges pay your DFS entry fees and then pocket the DFS winnings. This is “costless” leverage if it works (which again, I think it’s more complex than this, but you get my point). The dream is that you get to take risk and pocket the reward for free.

With investing, there are many ways to win, and I think using leverage to enhance returns is probably not the best one because of the amplified risk. That said, if free or even cheap leverage can be found, I think it’s worth exploring.