When I talk to friends & family and look at FinTwit, I get the sense people have “moved on” from FAANG / megacap tech and now are focused on piling into commodity names that will benefit from one-time supply shocks (oil & gas is back!).

This was a funny tweet that makes this point:

Sometimes the best trade is the simplest trade. FMAAG (Facebook, Microsoft, Amazon, Apple, Google - I’m excluding NFLX since I don’t own) with the exception of Apple is trading on the lower end of five year average multiples right now. I’m very comfortable buying into GDP+ (much higher IMO - read on) basically unlevered businesses with a ton of operating leverage and very little macro risk.

I don’t think the growth outlook has materially changed for any of them, although maybe there’s some short-term bumpiness (IDFA for FB, AMZN had a weak Q1 guide). The outlook for cloud adoption and insert-your-favorite-digital-trend here seems like the same long-term bullish story.

In my own world as a software developer by day, I can tell you every company I’ve worked for has increased cloud spend each year and would only consider using AWS / GCP / Azure. When I hear about much more expensive cloud names with big-time growth forecasts that are built on AMZN / GOOGL / MSFT, I can’t help but think that megacap tech is the safer bet than companies built on the cloud. The up-and-comers in many cases are locking into cloud pricing for several years at a time (ex. AWS has pricing that locks you into a discounted rate in exchange for several years of commitment).

To be fair, I’m not Gartner and I’m not here to tell you what will happen with the Metaverse, who will win the Cloud wars or what the future holds for internet privacy. I’m just saying I think all these companies have enough shots on goal and stable enough existing businesses that they can beat the expectations implied by their prices.

Let’s talk about what forward P/Es and cash balances look like. These are mostly on the very cheap end of the last five years before taking out cash. I’m listing the cash here not just to show you that these names are even cheaper than the multiples from KoyFin, but also that these companies have a lot of options for capital allocation (buy back stock, buy your favorite fast growing SaaS companies…).

Facebook:

This again is before cash - FB had ~$48bn of cash on hand as of FYE21 and no debt.

Alphabet:

Google had $137bn of cash and $57bn of debt as of FYE21.

Microsoft:

MSFT had $125bn of cash and $48bn of debt as of 12/31 (note 12/31 is end of Q2 for Microsoft).

Amazon (using EV/EBITDA here - note company changed its depreciation policy recently so this may be a little funky going forward and earnings have been volatile enough last few years this feels more normalized):

AMZN had $84bn of cash and $52bn of debt as of FYE 2021.

Last but not least Apple:

$202bn of cash (including LT marketable securities), $106bn of debt.

Why wouldn’t I just buy great companies on the cheap with fortress balance sheets? Google just went out and paid cash for Mandiant and that was <5% of its cash. As my brother is fond of saying, “if it has cloud and security, it’s probably going to do well.”

In all seriousness, every one of the companies I mentioned can make a game changing acquisition in all cash. Let’s remember that Instagram, YouTube, GitHub, Whole Foods and a host of others were all “small” acquisitions that made big impacts on the acquirers.

As the market sells off, FMAAG will have an opportunity to buy these types of companies on the cheap. Not saying they’re all going to be home runs, but there are very few companies out there that can write multi-billion dollar checks to acquire growth.

If you prefer table form, without Amazon:

Per this FactSet article published in late January:

Looking ahead to the first half of CY 2022, analysts expect earnings growth of 5.6% for Q1 2022 and 4.3% for Q2 2022… The forward 12-month P/E ratio is 19.2, which is above the five-year average (18.5) and above the 10-year average (16.7). However, it is below the forward P/E ratio of 21.3 recorded at the end of the fourth quarter (December 31)…

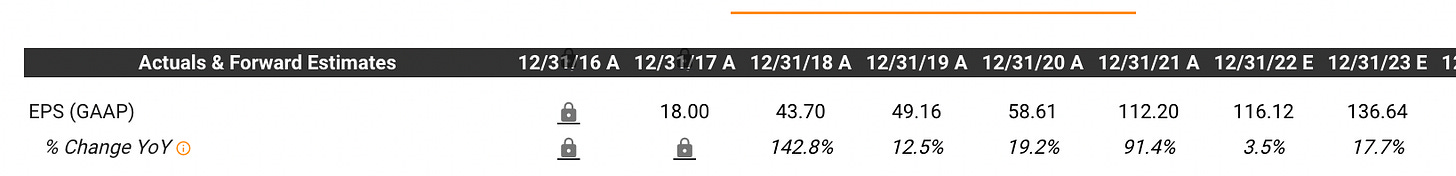

So FMAAG trades at call it a 25%-30%ish premium to SPY, which I’m fine with because I have high conviction these names will grow much faster than 25-30% above the market. Per tikr, here’s what I have for these names EPS growth the last couple years:

GOOGL:

AAPL:

FB:

MSFT:

There’s absolutely some volatility in EPS (and I caveat all of this with saying free cash flow is the number to index on, I’m pulling this since it’s easier to comp to SPY and the data is easier to find), but you can see the CAGRs here are much higher than 5-7% when pulled over the last five years. Other than some crazy anti-trust action, I’m hard pressed to see what would cause these businesses to slow to a normal growth rate. They all have strong digitalization tailwinds, balance sheets they can use opportunistically and, again, tons of operating leverage (margins could get a lot better).

Last thing here - if you’re going “Ben, these companies look “relatively” cheap compared to where they’ve traded, but what about in a vacuum”, I’d refer you to my post on terminal value. The terminal value formula there says I can get a 10%+ return if I pay 24x for a business that can grow above 6% into perpetuity, which I think FMAAG can (and higher in the short to medium term):

Overall, I’d much rather buy into these businesses than make some opportunistic macro trade. I also feel good about holding these till I have to hand them off to my grandkids, so less taxes for the win.