LRFC - PTMN merger, Mt. Logan and BC Credit Partners

Looking at opportunities from the deal not approved by Portman Ridge yet

I was going through the ~50 public BDCs looking for opportunities this weekend when I realized 1) BC Partners is heavily involved in merging two of them (LRFC, Logan Ridge Finance Corporation, PTMN, Portman Ridge Finance Corporation) and 2) the special meeting to approve the merger took place for both last Friday (LRFC approved, PTMN was 2% short & extended the vote date). I was familiar with BC Partners from Mount Logan’s attempted merger with TURN.

I think the new LRFC - PTMN entity (which will traded under BCIC, or BCP Investment Corporation) is worth owning assuming the merger is approved:

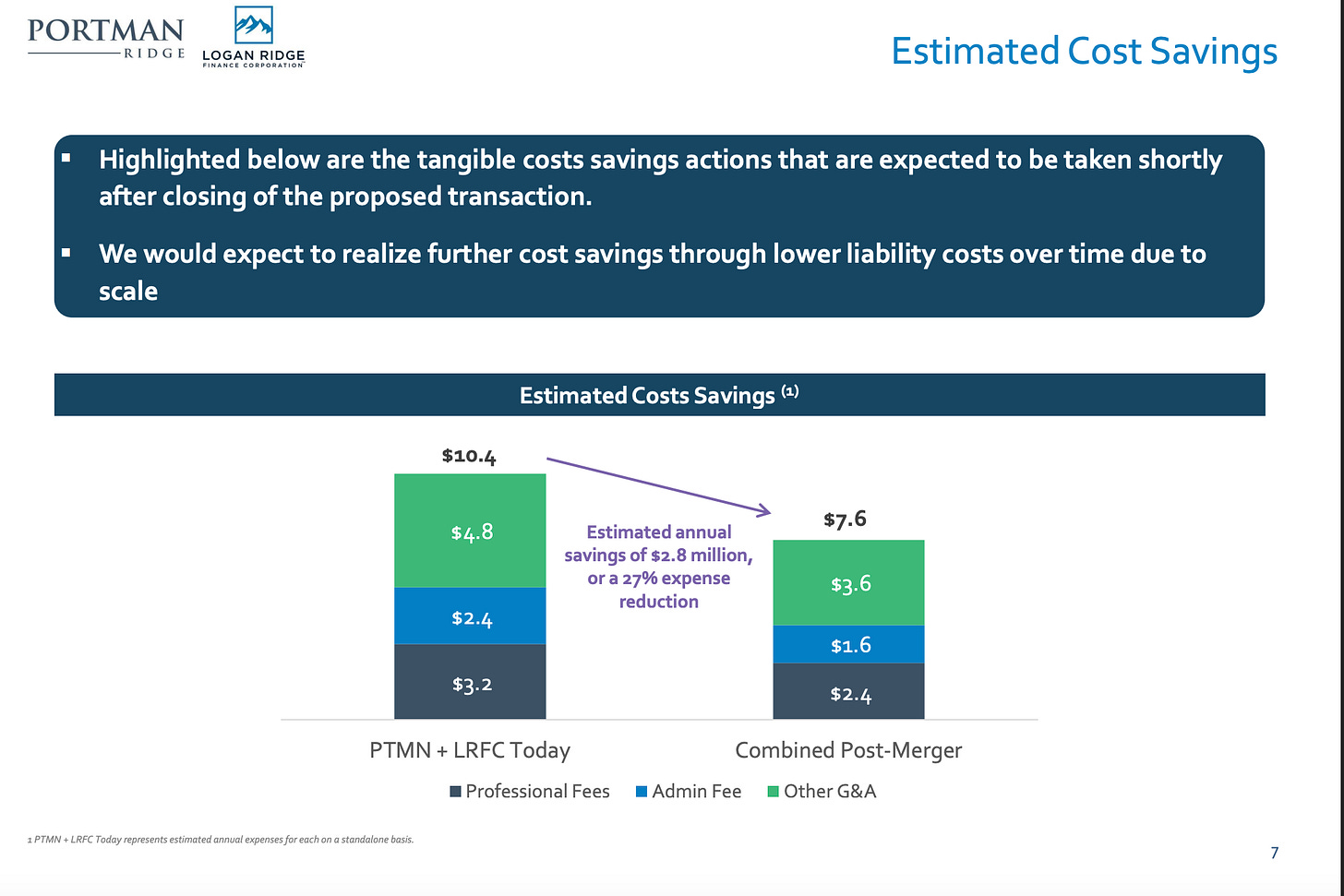

I buy the merged company will have opex savings and synergies given both currently have the same CEO and connections to the same credit pipeline in BC Credit

Both BDCs trade at a 30%+ discount to NAV and management has already announced a program to close the discount to at least 20% when the merger closes. The merger is also 1%+ accretive to Portman Ridge. The buyback plan has enough interesting pieces I’m quoting it in full here:

To further align our interests with shareholders and drive additional value creation, the Company, along with its management, its adviser and their affiliates intend to acquire up to 20% of the Company’s outstanding common stock over the next 24 months to the extent the Company’s shares continue to trade below 80% of net asset value (“NAV”), which implies a share price of $15.08 based Portman Ridge’s March 31, 2025 NAV per share, or a 31% premium to PTMN’s June 16, 2025 closing market price. These purchases will begin no earlier than 60 calendar days following the date of the closing of the LRFC merger and may occur through various methods, including open market purchases and privately negotiated transactions, and may be conducted pursuant to Rule 10b5-1 and Rule 10b-18 trading plans. In this regard and as previously announced, PTMN’s Board of Directors has authorized an open market stock repurchase program of up to $10 million for the period from March 12, 2025 to March 31, 2026.

Ted Goldthorpe, the CEO of Mount Logan and also the head of BC Credit Partners ($8bn AUM), is the CEO of the two BDCs merging and affiliated with BC:

Logan Ridge Finance Corporation (LRFC)

Portman Ridge Finance Corporation (PTMN)

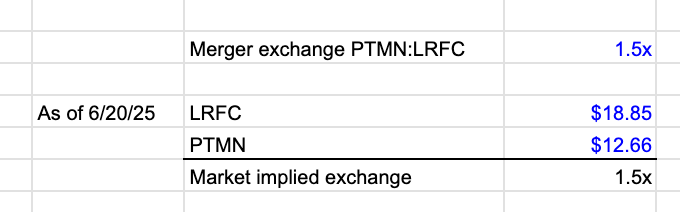

On 6/20, both BDCs voted on the merger. The merger swaps 1.5 shares of PTMN for one of LRFC. The market essentially priced in this merger as of Friday:

LRFC approved with 89% voting yes. PTMN just barely missed the finish line, arriving at 48% when they needed 50%. They extended the meeting an extra 7 days to try to get the additional votes.

LRFC shareholders voted overwhelmingly in favor of the proposed merger, with approximately 89.4% of voting shareholders supporting the proposal. Of note, PTMN’s June 20, 2025, special meeting of shareholders was adjourned and will reconvene on June 27, 2025, to allow additional time for shareholders to consider and vote on the proposed issuance of PTMN common stock in connection with the merger. Subject to PTMN shareholder approval and the satisfaction of customary closing conditions, the merger is expected to close shortly after approval is obtained.

The PTMN Special Meeting, convened on June 20, 2025, has been adjourned and will reconvene on Friday, June 27, 2025, at 10:00 am ET… At the time the PTMN Special Meeting was adjourned, stockholders who had already cast their votes showed strong support for the Share Issuance Proposal, with favorability in excess of 85% of voting shares. Under PTMN’s organizational documents, the proposed merger requires the approval of a majority of the quorum of holders of PTMN Common Stock. Currently, over 48% of PTMN’s outstanding shares have voted or abstained from voting their shares. Accordingly, less than 2% of shares outstanding still need to vote or make an election to abstain from voting their shares in order to reach the required quorum threshold of a majority of PTMN Common Stock issued and outstanding. The Board of Directors of PTMN unanimously recommends that stockholders vote “FOR” the Share Issuance Proposal.

I think it is highly likely the Portman Ridge merger gets approval by Friday. PTMN is an $116m nanocap and I’m guessing many shareholders simply did not show up for the meeting and will be able to be reached via active outreach. Credit ChatGPT for citing this article, which notes delaying votes is a common tactic in M&A. Pushing only a week suggests to me confidence Goldthorpe believes he can get the 2% of remaining votes, which on a dollar basis means finding shareholders who own about ~$2.3m of stock.

I want to emphasize here this merger stood out to me because of the many connections between the two BDCs. In addition to Goldthorpe being the CEO of both:

Sierra Crest is the external investment advisor to PortmanRidge. Sierra Crest is an affiliate of BC Credit

Mount Logan Capital - where Goldthorpe is also the CEO - is the external investment advisor to Logan Ridge. Mount Logan’s founding team has many connections to BC (if my read is right, Goldthorpe and both his co-presidents are still partners at BC Credit) and the two companies recently did a deal together to acquire Runway Capital and share a fund together.

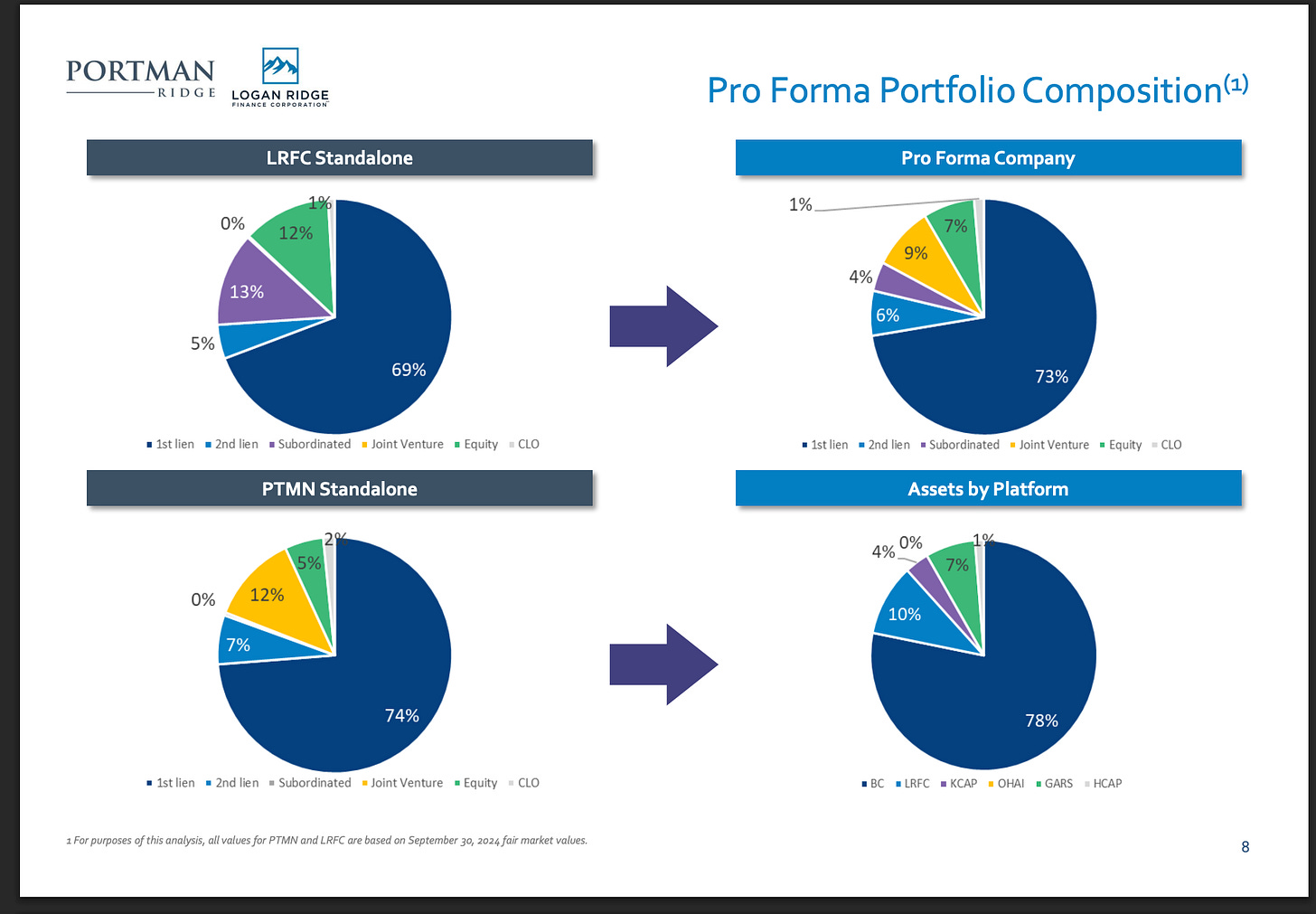

Overall, the two BDCs merged will have greater scale and streamlined operations. The two portfolios already are very similar. It’s a rare merger where the CEO of both companies is the same person. From the PR release and deck:

Portfolio Overlap: The Proposed Merger will result in the acquisition of a known, diversified portfolio with significant portfolio overlap between the two Companies. PTMN and LRFC employ the same investment strategy, and the BC Partners Credit Platform has been allocating substantially similar or the same investments to both Companies since Mount Logan Management, LLC (“Mount Logan”) became LRFC’s external investment adviser on July 1, 2021. As a result, more than 70% of the investments in LRFC’s portfolio at fair value are expected to be BC Partners-originated assets at the time of closing, with over 60% of the portfolio overlapping with PTMN. The combination of two known, complementary portfolios, originated and managed by the BC Partners Credit Platform, is expected to substantially mitigate integration risk.

Increased Borrowing Capacity & Optimized Debt Capital Structure: As a result of the recent refinancing of LRFC’s credit facility with KeyBank National Association (“KeyBank”), LRFC currently has additional available borrowing base that can be used for future deployment at the combined company. With LRFC’s refinanced credit facility with KeyBank and PTMN’s existing senior secured revolving credit facility with JPMorgan Chase Bank, National Association in place, the combined company is expected to be able to further optimize its debt capital structure based on differing eligibility requirements and advance rates.

I think you can good conviction here that opex and cost of debt are both going down.

The combined company will mostly be first lien debt is 78%+ sourced from BC Credit:

PTMN portfolio as of 3/31/25:

LRFC portfolio as of 3/31/25:

The combined company is likely to trade at a 30%+ discount at close and I think will have around a 10% distribution (15% currently on Portman, 8% on Logan Ridge):

I am viewing my return here as about 10% from return of capital via dividend and at least 10% or so from the buyback - remember the company is buying up to 80% of NAV, which is a 31% premium on PTMN - and deal synergies. Both in some respects rely on Goldthorpe delivering on the deal savings, managing the portfolio well and timing the buyback. I am comfortable with this “jockey bet” as I like Ted’s background (Goldman and then many exec level positions at Apollo, Partner at BC and now CEO of three public companies). His history as a CEO of public companies only goes back to 2019 with Portman Ridge (Logan Ridge he joined in 21’ and Mt Logan Capital IPOed in 2020) and I think if you averaged all total shareholder returns he hasn’t outperformed.

That said, the time period is short and valuations were definitely stretched relative to now in 20/21. I like this entry point as you’re getting a BDC at a wide discount (30%+). Surprisingly, per BDC Investor, the average BDC trades at an 8% discount and 14 of the 48 public ones trade at premiums. Outside of the buyback, the increased size and scale should also be a reason the discount should close.

This trade obviously has risks and want to outline a few here:

More permanent capital vehicles merged together means more incentive fees and that could be a motivation here as opposed to doing the best for shareholders

BDCs don’t have the best track record with growing NAV and it’s an asset class I admittedly am still learning

Given most of the loan assets are floating rate, rate cuts are not going to help the future BCIC. This slide from Portman shows the impact on earnings:

Overall, I’m comfortable with these risks as I think you’re being compensated to take them through dividends and the NAV discount. I think there is more upside in BC Credit becoming a lending platform that proves itself in the public markets - $8bn AUM already is sizable. The corporate rebrand / BCIC as ticker also doesn’t hurt to better affiliate the BDC with BC.

Of course, at the end of the day a recession / bad macro results in defaults, and the merged entity will have loans in non-accrual and PIKing that never gets paid in cash; these issues are a constant on both company’s calls. I could be right about the advantages of the merger and just wrong on BDCs doing well the next few years. Time will tell.