MGM - long-term earnings power with Vegas & buyback tailwinds

Resorts have grown ADR & room count, company could buy back current market cap in next seven years

MGM Resorts (NYSE:MGM) is a serial purchaser of its own shares trading for <14x forward consensus earnings (<11x 2026 consensus earnings) that will benefit from continued strength in its core businesses, non-core asset sales and share buybacks.

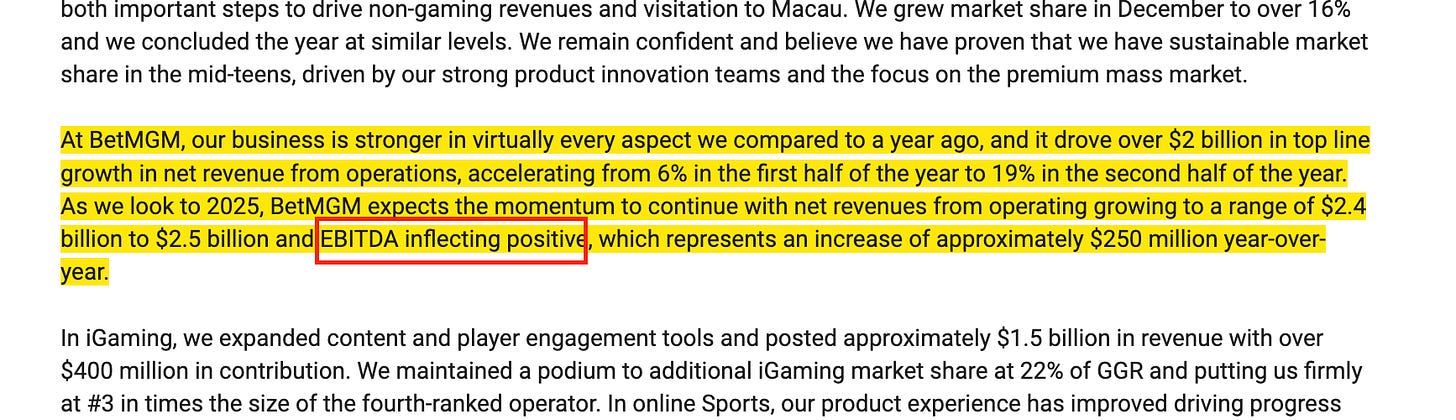

The company operates 18 casino properties (16 domestic, 2 in Macau) and has a 50% ownership stake in BetMGM, which some readers are no doubt familiar with from either downloading the app or seeing the commercials with Jamie Foxx. Management is guiding for BetMGM to inflect to profitability this year after several years of losses. The company also has a 56% ownership stake in MGM China, which produced over $200m in dividends & license fees directly to MGM last year and grew 28% last year.

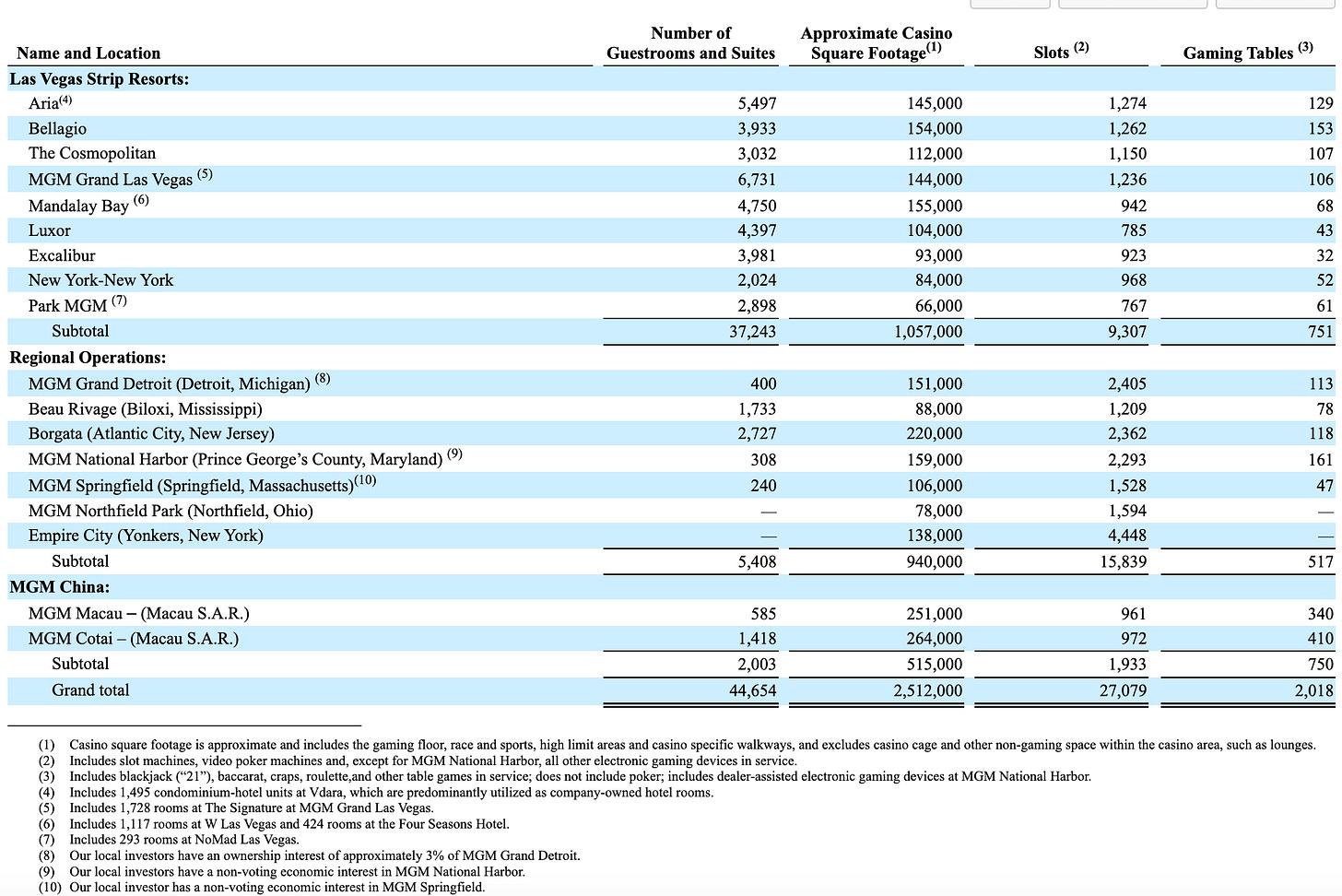

The 18 casinos (all properties leased through triple net leases) have nearly 45K rooms, 27K slots and 2K gaming tables. I mention these numbers to give you a sense of the long-term stability of earnings power.

Occupancy on rooms is 94% at an average daily rate (ADR) of $260; ADR and occupancy have increased every year for the last three years.

Yet, earnings and the stock price are at three year lows. Why?

Earnings

The earnings question is IMO easier to answer than the stock. The company has in 2024 and 2023 benefitted from significant gains on sales on the Gold Strike Tunica and The Mirage. These sales directly translate into earnings and obviously can lead to some volatility in year over year net income.

The Mirage was sold for over $1 billion in cash to Seminole Hard Rock Entertainment in December 22; Gold Strike Tunica sold to CNE Gaming for $450m in cash (gain on sale was $399m).

In the last year, there have been reports of the company exploring sales on MGM Springfield (MA) and MGM Northfield Park (OH). Springfield has 240 rooms and 1.5K slot machines. MGM was a $960m project that opened in August 2018. Springfield has fallen short of MGM's estimates and its possible selling the property results in a loss, but even if the sales don’t translate to earnings on an accounting basis, they are an inflow of cash that can be used for buybacks.

Notably, MGM in its presentation last week mentioned they are still considering non-core asset sales:

These non-core asset sales are not baked into analyst estimates and when combined with share buybacks make the 2025 and 2026 forward earnings estimate too low:

Stock performance and answering concerns

As for the stock, my view is the story over the last three years has mirrored concerns over casinos generally. The main concerns IMO are leverage, a weak consumer and digital sportsbooks overpromising and underdelivering. The VanEck gaming ETF (BJK) which includes MGM, LVS, WYNN and CZR also is underpeforming over the last three years (-5% v. SPY +44%). As rates have increased, refinancing debt is obviously less advantageous to earnings and casinos are more levered than the average S&P stock. MGM has $6.4bn of LT debt:

That said, EBITDA was $2.4bn last year and the market is pricing the equity at $9.5bn. Compared to names like CZR where debt is over $12bn against $3.7bn of EBITDA and equity of $6bn, MGM’s leverage looks significantly better.

Concerns about consumer confidence have weighed on casino names. Consumer confidence just had its largest decline since August 2021 and is hovering near a three year low. Given the reliance of the Vegas strip on consumers taking vacations (travel names are also getting hit) and spending discretionary spending on gambling, I would venture to guess these concerns have weighed on MGM stock.

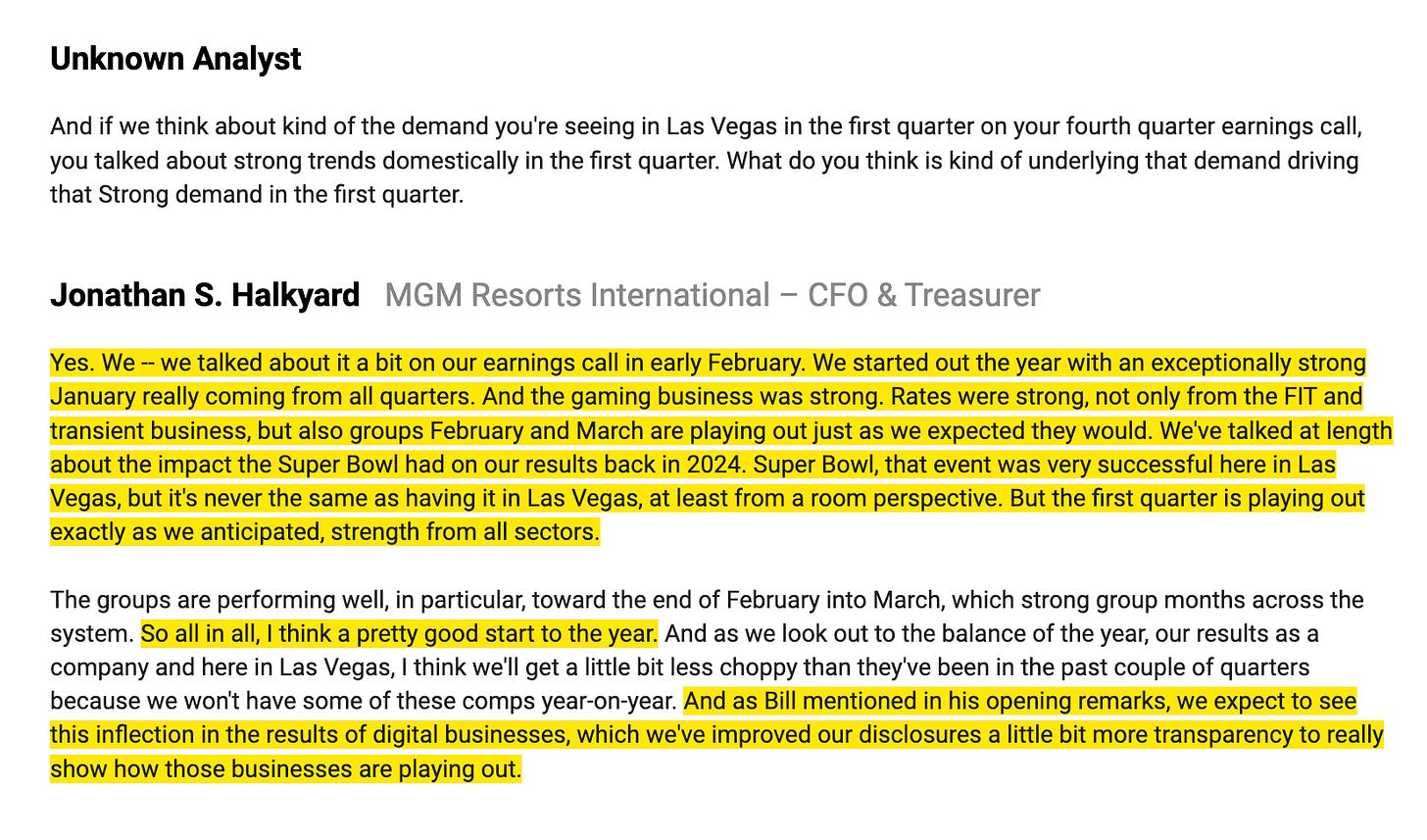

I don’t think these concerns are rooted in reality based on results. The company just had one of its best first two months of the year ever:

The company also is experiencing major consumer tailwinds from the influx of sports events near its Vegas and other destinations. From its last investor deck (and they also played this up last week at the JPM conference):

Finally, it’s possible the legalization of sports gambling hasn’t resulted in the earnings many investors expected. Many books spent the past three years heavily invested in promotional marketing and have only just started to focus on profitability. BetMGM has been a drag on MGM’s earnings for three years now.

In 2025, however, the company is finally guiding to BetMGM producing cash:

The power of buybacks

Among the top reasons to buy the stock here is the company clearly is bullish on its own stock and accelerated buybacks in December when the stock on a weighted-average basis was nearly 10% more expensive than today:

Comments from the CEO from the last earnings call also tell a good story on repurchases:

And from the JPM conference:

But the proof really is in the historical pudding. If you look at the last seven years of repurchase activity, MGM has bought $1bn more than its current market cap in repurchases.

Assuming past repurchases are indicative of the future (yes, big if), the price of the stock will need to increase in the next seven years to avoid the company buying everything.

Share count is also down by 47% since 2018, from 536.9m shares to 285.6m shares. I think this is the rare situation where by 2030 we could see EPS doubling on the strength of buybacks and organic growth.

If that happens, it’s hard to see a situation where the stock doesn’t outperform.