TURN and Mount Logan Capital (MLC) - a Canadian asset manager ($2.4bn AUM) based in Toronto more or less spun out of to BC Partners ($40bn AUM) - announced an all-stock merger Friday (deck from MLC here). The new entity will trade on the NASDAQ as MLCI and be 60% owned by MLC shareholders and 40% by TURN shareholders; the transaction is expected to close in the second quarter of the year.

TURN shareholders will get full NAV for their shares paid for in MLCI shares, which, based on the “Exchange Ratio” (what the actual merger agreement on SEDAR calls it) of TURN NAV to a $67.1m valuation for MLC. What this means is if TURN NAV goes up you get more shares in the merged entity; if less, you get less. If NAV doesn’t change from 1/15 for TURN (and the market values the new shares at closing at today’s values), I calculate the deal values TURN shares at $4.62, which matches up with the numbers in the press release and TURN’s claim this is a 24% premium above the 1/15 price. This calculation and some other quick valuation / merger math below:

I bought more 180 Friday at $4.00. I can’t say I understand why the market is not pricing in the full value of the deal - some theories:

The market believes TURN’s NAV has a large probability of declining before the deal closes and is discounting the 1/15 NAV as being a firm number

The market thinks MLC’s business could decline prior to deal close and MLCI will be worth way less than the $113.6m pro forma equity above

The market thinks there is a risk to the deal not closing

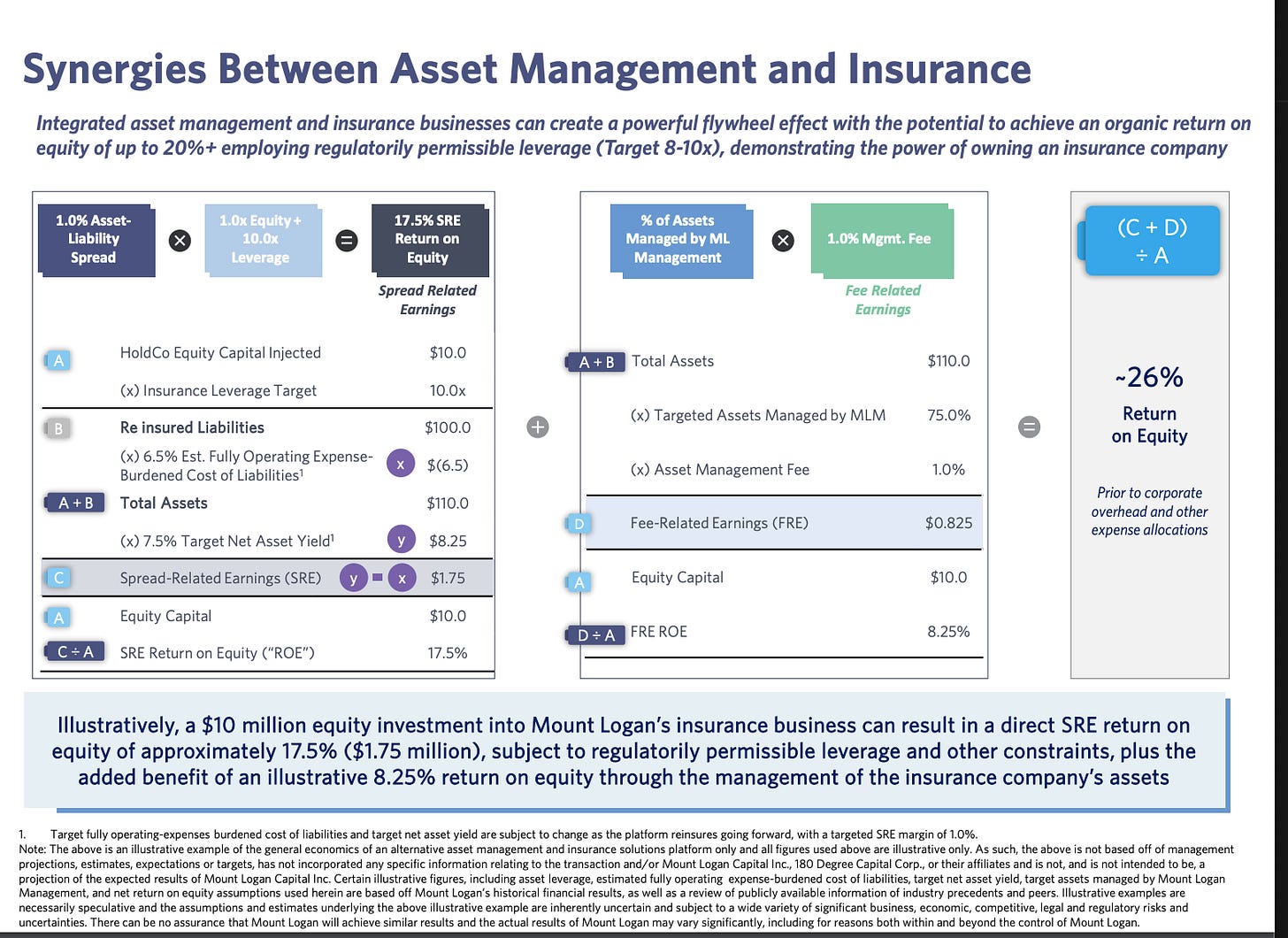

I’m overall excited about this deal, more for the opportunity to own Mount Logan with a small “running head start” (assuming none of the risks above pan out). I am comfortable with the risk of TURN’s NAV declining as 40%+ of the NAV is from PBPB and SNCR, which IMO both recently posted strong quarters. I think MLC is a good business at a cheap valuation from the research I did this weekend. It actually has earnings from asset management fees and collecting the spread between assets and liabilities from the insurance float. MLC can generate 26% ROEs from the combination of the two and is cheaper than public peers, albeit ones that are way bigger:

Putting the spread-related earnings (SRE) aside, it trades at 10x on an fee-related earnings (FRE) basis. The low end of FRE for next year is $12.5m and doesn’t consider the last acquisition they made (Runway Capital) or TURN. The company did $10m of SRE in the 12m ending 9/30/24. Owning TURN shares now means owning MLCI at a <$113.6m valuation. Given the two earnings streams, I think the new company is a bargain (8x EV with $70m of net debt, 5x equity).

Management also is buying stock:

Even though the stock has underperformed over the four+ years it has been on Canadian exchanges, it has paid a dividend for 19 consecutive quarters and the underlying business metrics have improved. It’s worth reading this 2020 analyst report from Cannacord MLC posted on their website. The stock is flat since then despite the company transitioning from an owner of debt securities to an alternative asset manager with an insurance arm and doubling AUM. Interestingly, one of the author’s of the report - Scott Chan - is now a director at the company (joined in September of 24’).

MLC can generate fees off this growing $2.4bn base, which it can then invest in its insurance arm (called Ability). The insurance arm brings in float from insurance premiums which can then be invested. This flywheel has worked for decades for a number of different companies (ex. Berkshire, KKR). I think the management team has the credentials to win more AUM (CEO Ted Goldthorpe has long tenures at Apollo and BC Credit) and their relationship with BC (10%+ equity owner in MLC) should help. I can’t speak to the insurance arm and will flag the insurance business getting over its skis as a risk.

For those who are fans of Andrew Walker’s podcast, MLC’s strategy reminds me a lot of P10 Holdings. P10 has successfully grown shareholder value over the years by completing lots of small acquisitions to grow AUM. MLC in addition to acquiring TURN became a minority owner in Runway Capital for $5m in shares in October 24. BC took a majority stake, further evidencing how close BC and MLC are (nearly all of the C-level previously worked at BC). Some comments from the CEO suggesting the deal pipeline is healthy and BC is helping:

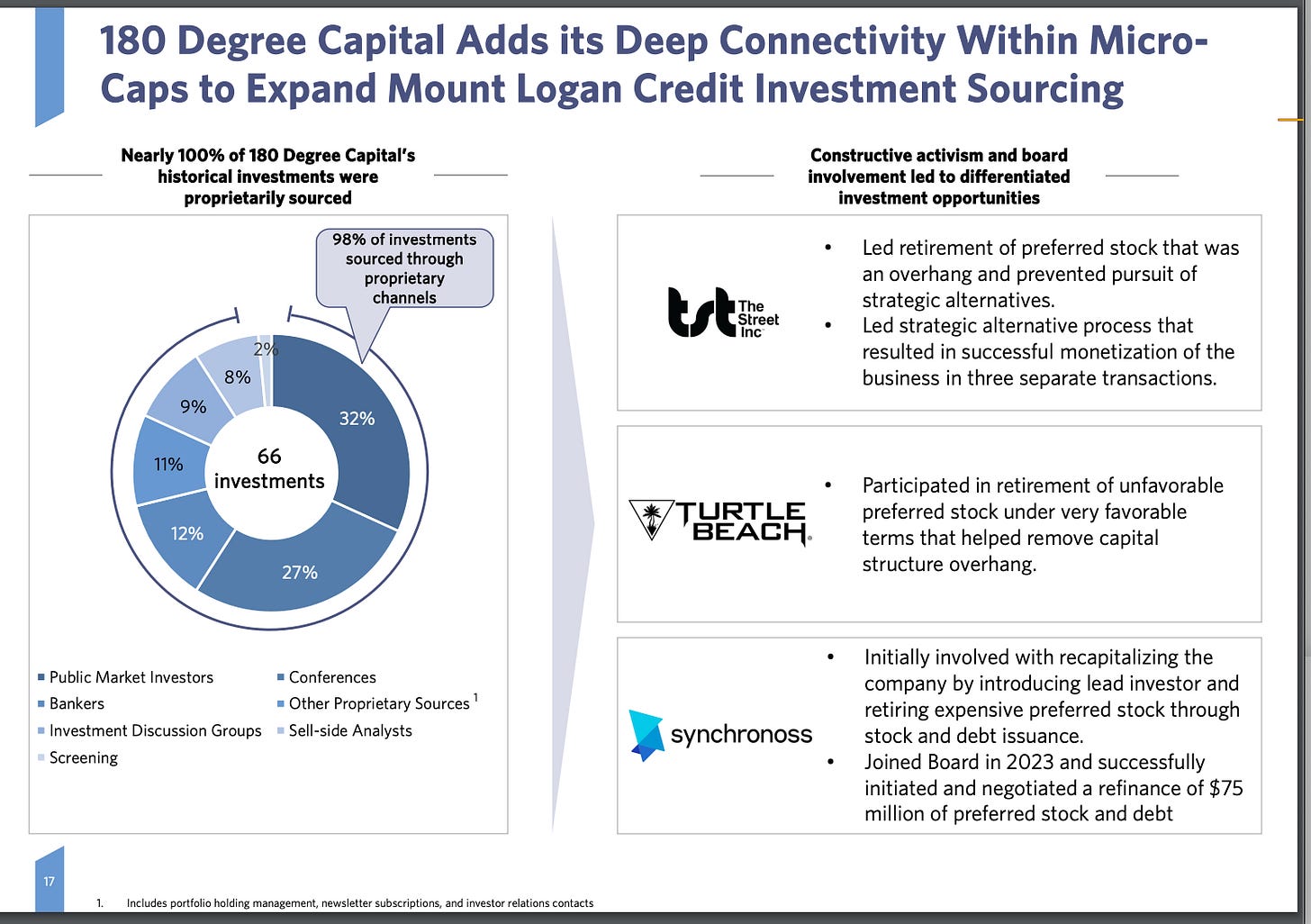

I am choosing to own MLCI in the future because I think MLC is a good business that additionally should benefit from a wider investor base due to uplisting to the NASDAQ; it currently trades on Cboe Canada (NE). I’m looking at owning the new shares as being a completely separate thesis from TURN. I credit TURN with allowing me to discover this idea and I think the synergies are real; Rendino and Wolfe have experience working with small microcap companies and providing credit in times of distress. These relationships should help MLC deploy capital.

Finally, I think there’s minimal risk of this deal falling through. This merger is as small as they come and TURN is highly motivated to close after being targeted by an activist to close the NAV gap (which this deal does, although in stock and not in cash). 23% of MLC shareholders and 20% of TURN shareholders have voted in favor of the deal already.

Sometimes ideas come from unexpected places, and holding TURN turned out to be the source of a new idea here. I could definitely be biased by not wanting to sell and pay taxes. That said, I think MLC has the business model, insider ownership, valuation and potential for growth that makes me want to be permanent capital.