NCMI: Cineworld bankruptcy changed everything

After two years and many learning lessons, taking the L

I’m exiting my NCMI position after three new pieces of information severely impaired the expected value of holding the stock:

Bankruptcy filing of Cineworld

Continued price decline of secured and unsecured debt, suggesting nothing will be left for equity if company restructures / files

Some helpful background quotes, all emphasis mine:

Cineworld Group PLC, the owner of Regal Cinemas, filed for bankruptcy Wednesday after a sluggish recovery in theater admissions fell short of the company’s financial needs.

Cineworld, the world’s second-largest movie theater chain behind rival AMC Entertainment Holdings Inc., filed a chapter 11 petition in the U.S. Bankruptcy Court in Houston.

•“Regal” refers to Cineworld Group plc, Regal Entertainment Group and its subsidiaries, Regal CineMedia Corporation, which contributed assets used in the operations of NCM LLC, Regal CineMedia Holdings, LLC, which formed NCM LLC in March 2005, and Regal Cinemas, Inc., which is a party to an ESA with NCM LLC.

NCMI 10K, 2021

NCM LLC has long-term ESAs with the founding members and multi-year agreements with our network affiliates, which grant NCM LLC exclusive rights in the founding member and network affiliate theaters to sell advertising, subject to limited exceptions. In September 2019, NCM LLC entered into the 2019 ESA Amendments with Cinemark and Regal. The 2019 ESA Amendments extended the contract life of the ESAs with Cinemark and Regal by four years, resulting in a weighted average remaining term of the ESAs with the founding members (based upon pre-COVID-19 attendance levels) of approximately 17.7 years as of December 30, 2021. The network affiliate agreements expire at various dates between March 14, 2022 and December 2037. The weighted average remaining term (based upon pre-COVID-19 attendance levels) of the ESAs and the network affiliate agreements together is 15.5 years as of December 30, 2021.

We believe that the broad reach and digital delivery of our network provides an effective platform for national, regional and local advertisers to reach a large, young, engaged and affluent audience on a targeted and measurable basis…

We expect the 2019 ESA Amendments to ultimately result in an increase in average CPM, revenues and Adjusted OIBDA, however we may not realize any or all such benefits.

NCMI 2021 10-K

Different interests among the remaining founding members or between the remaining founding members and us could prevent us from achieving our business goals.

For the foreseeable future, we expect that our Board of Directors will include directors and certain executive officers of Cinemark and Regal and other directors who may have commercial or other relationships with Cinemark and Regal. The majority of NCM LLC’s outstanding membership interests also are owned by Cinemark and Regal. Such members compete with each other in the operation of their respective businesses and could have individual business interests that may conflict. Their differing interests could make it difficult for us to pursue strategic initiatives that require consensus among NCM LLC’s current members.

NCMI 2021 10-K

Regal’s parent Cineworld filed for bankruptcy in early September and is now working its way through the legal landscape of post-BK filing. This recent article on the closure of some Regal theaters has a good illustrative anecdote:

Cineworld as part of its bankruptcy asked the court to reject 20 unprofitable but still active Regal leases because its U.S. theater portfolio was a big contributor to its financial hole. It, like most chains, reached agreements with landlords to postpone rent payments during Covid, but said that now average monthly rent owed was up by almost 30% (year-to-date in July from full-year 2019) due to the impact of deferred payments. Unloading the leases would save the Cineworld estates about $12 million, “reduce high fixed operational costs and better position the Debtors to conduct competitive operations going forward,” the filing said.

Cineworld is going to do whatever it can to emerge out of bankruptcy with a more sustainable capital structure and business model, previous contracts be damned, which means anything that might have contributed to the company’s woes is possibly on the chopping block. This potentially includes its 2019 ESA (exhibitor service agreements) with NCMI,

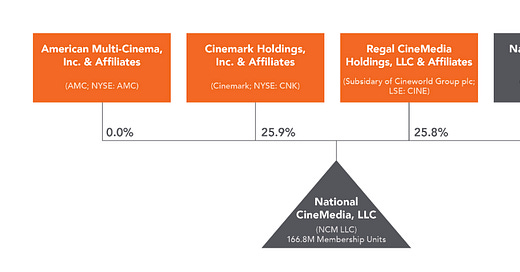

I am not a legal expert and have no idea what happens in court. But I do know there is a possibility that Cineworld - a ~26% equity owner in NCM, LLC, which as a refresher is ~50% owned by the public company NCMI - tries to change its ESA with NCMI to get more profitable terms.

NCMI calls out in its risk sections that “changes to the ESAs and the relationships with NCM LLC's founding members” could detrimentally impact it, and that’s exactly what could happen here. Even without ESA changes, it’s likely Cineworld takes screens out of NCMI’s distribution network. I couldn’t find the exact number in NCMI’s filings, but I did confirm NCMI has 20,700 screens as of FYE 21 (they did add 800 through another agreement recently) and Cineworld has about 6.8K US screens (not sure if all of them are part of NCMI’s network). NCMI’s long-term earnings power will be potentially impaired by Cineworld’s bankruptcy as its long-term economics (2019 ESA in question) and distribution (screens going away) capabilities are now uncertain.

The bond market is all but guaranteeing the equity is worth zero and the current lenders will own all the future equity when the company emerges out of bankruptcy. Here are the April 28’ Senior Secureds ($400m) issue. Fidelity doesn’t show any info anymore when I input the CUSIP (I do not have paid Bloomberg :-)), but I have it from a source this is about $0.20 on the dollar. Notice how the big decline starts right around when it became public Cineworld filed:

This was a hideous call on my end and with the benefit of hindsight my analysis was flawed for a lot of reasons. I’ll list them all out here but the main one I’ll lead with is investing in a company with a mountain of debt. NCMI as I write this has a billion plus of debt with $217mm of revolving debt maturing next year. It’s just starting to post positive FCF, but the recessionary environment and bankruptcy of Cineworld make it unclear what the long term cash flows could be.

When you invest in highly levered companies, you leave yourself little room for error. As I’m finding out now, with the combination of the capital markets basically closing and the company’s long-term earnings power in question, NCMI has precious little leverage with lenders and is likely going to have to restructure. While a very contrarian bull could argue maybe the ESA holds up and they kick the debt out into the future, I’m a value investor at the end of the day and not a legal expert. I’m over my skis now and when that happens the best thing is to sell and move on.

Other lessons learned:

Contrarian impulses must be tamed. I’m a proud contrarian; it informs much of what I do and has worked for me in investing many times. If I hear “X company or industry is dead”, I come running. It’s not surprising the theater industry - center of the storm during COVID - piqued my interest. Being a contrarian only works though if there are legitimate reasons the consensus is incorrect. While one consensus was dead wrong for reasons I still stand by (“movie theaters are dead, everything is going ondemand”) another consensus I ignored was right (“NCMI is overlevered”). No matter how good an industry is, levered companies rely on the capital markets. NCMI had its revolver debt as a going concern for several quarters. I was wrong to not weigh this risk more strongly against how “cheap” I thought the equity was. Which brings me to my next point…

Juicy forward looking FCF yields exist for a reason. “Wow”, I thought a few months ago. “I can’t believe NCMI is guiding to 2022 adjusted OIBDA of $58-$75mm when the market cap is <$100m! And analysts are expected 2023 FCF of $100m+! This is dirt cheap!” What an idiot I was. FCFs have a denominator - the equity value of the company. If the denominator is low, the market is telling you something. Here, the idea was that on a small equity stub, a company has to produce a lot of cash relative to the stub to pay the debt. While FCF is after interest payments, it doesn’t tell you about debt size relative to equity or stability of FCF. Beware of juicy FCF yields on levered companies. If the company takes on more debt or cash flows come in lower than expected, a debt crisis is always around the corner.

Don’t read too much into management statements or behavior. I’d be willing to bet there is a massive graveyard of companies that had very positive sounding earnings calls right before BK or did shareholder friendly things like retire debt or buyback stock at exactly the wrong time. NCMI said all the right things during its 2021-22 recovery. Pricing was trending ahead of 19’ levels as were margins; the scatter market was stronger than ever and upfronts were coming back. They were well on the way to amending and extending their $217m of revolving debt per the new CFO (who worked in HY bonds in a previous career and bought back $20m of the 2028 bonds last quarter). None of it mattered at the end as management didn’t anticipate the Cineworld bankruptcy and will likely be collateral damage (and if AMC is next (bonds implying BK), situation could get worse). Management is paid in part to sell the stock and not warn you of what could go wrong. And in this case, re-reading parts of NCMI’s 2021 10-K it’s actually evident they identified some risks I didn’t flag. I failed in doing my job as an investor by not more seriously discounting management commentary and weighing against risks that didn’t come up in earnings calls.

Overall, this probably goes down as my worst ever investment (cost basis of ~$3.00, sold at $0.73) but live and learn.