I’ve always enjoyed following Starboard Value (they have great investment thesis presentations you can find here) and remember in December of last year when they took a stake in BTC miner RIOT. Starboard’s goal per the reports that came out at the time was to build out a data center business aimed at AI and HPC (high-performance computing) demand, and they appear to have made at least some progress in six months:

In January, RIOT hired a consultant (Altman Solon) specializing in data center services to evaluate adding an additional 600MW of capacity to a 400MW BTC mining facility in Corsicana, TX. In the release, the Executive Chairman of RIOT notes “…we have recognized for some time the value of having long-term, predictable cash flows from a well-capitalized AI/HPC counterparty. We look forward to providing further updates to our shareholders and the broader market as we and our advisors make progress toward this goal.” RIOT also announced they were cutting capex plans for a second part of a BTC mining project, which would save them $245m

In February, the company added three new directors in part picked by Starboard and D.E. Shaw with AI/HPC expertise. One of the new directors - Jaime Leverton - has experience turning a BTC miner (Hut 7) into an HPC provider via an acquisition. It also engaged Evercore and Northland Capital Markets to help it evaluate power assets for Corsicana. In that PR release, the company indicated there was “inbound interest from multiple potential counterparties” in the AI/HPC pivot. In the Q1 call from May, CEO Jason Les reiterated “advancing ongoing engagement with multiple counterparties.” From the Q1 25’ deck:

On 6/2/2025, the company hired Jonathan Gibbs as Chief Data Center Officer. Gibbs has been designing and building out data centers for 15 years and previously was VP of Product Delivery at Prime Data Centers. The press release had this quote from him:

“With a pipeline of over 1.7 gigawatts of power immediately available and in close proximity to major markets, Riot is uniquely positioned to develop data centers which will address the strong market demand.”

It seems likely to me in the next few quarters we will get an announcement from RIOT on their first AI/HPC data center revenue.

In the last six months when all these AI/HPC pivot developments occurred, RIOT stock is up 7% and has barely outperformed SPY. It has underperformed CORZ and IREN, who I see as examples of miners who successfully made the AI pivot:

I’m writing about the company now because I think reports of CoreWeave (CRWV) looking to acquire once-sole-BTC miner Core Scientific (CORZ) make it an interesting time to evaluate how much data center leasing businesses are worth. I think Cantor Fitzgerald and Jefferies are highly incentivized to inflate valuations for fee purposes, but for what it’s worth:

Jefferies estimates CRWV will pay $16 to $23, which still is a significant premium to the $5.75 offered about a year ago

Note I couldn’t get ahold of either research note (reply to this email if you’r able to share) and am going off public summaries

Semi-Analysis recently published a write-up on Oracle which actually touched on BTC miners turned AI/HPC providers and had this fascinating nugget on Crusoe’s prior experience in AI/HPC (read: none) before signing a 15-year, $15bn+ contract with Oracle:

New entrants, often from the cryptomining world, understood that power was becoming the #1 concern and leveraged their existing interconnection agreements to plan large datacenters, away from population centers but with ample power. Core Scientific’s 570MW deal with Coreweave is a great example. However, due to a lack of credentials and the self-build alternative, “AI-first” developers largely struggled to secure hyperscaler customers. Their target market remained the Neocloud segment, but with many players having a low credit rating and unable to sign a 10+ year contract, securing funding was challenging:

Neocloud GPU contracts are often 2-3 years, with 5 years being the upper end.

The payback period of a datacenter developer is generally 7-9 years.

Oracle saw this gap as an opportunity to participate in the market for huge AI contracts, identified a Gigawatt-scale site in Abilene, Texas, and signed a 15-year datacenter deal with Crusoe – which at that time was, on paper, a cryptominer unexperienced with datacenters. While Crusoe had talent worth believing in, the company had not actually executed on a project of this scale. The first contract signed mid-2024 covered ~220MW of IT capacity (on our estimate), and a ~660MW expansion was signed in early 2025, taking total contract value to about $15-20B.

Crusoe (private) raised $600m at a $2.8bn valuation in December 24 with Founder’s Fund as the main investor (Fidelity also participated). As far as I can tell, the. pivot to AI/HPC began in 2023 - the company was founded in 2018. This is another data point showing the business transition from mining can be done in <2 years and major customers can be signed without a proven track record. This situation IMO only exists because existing data centers are so ill suited to deal with AI demand, where by some estimates power requirements are 15x+ higher.

Back to RIOT - D.E. Shaw followed Starboard into RIOT and has also taken a stake in the company. The two are working together to influence the company per the last proxy, changing the board and adding a director seat:

Interestingly, neither Starboard or D.E. Shaw are 5% owners, and no one in management owns significant stock:

Starboard based on the 13F owns 13m shares and as of 4/28 there were 357m outstanding, so it’s a 3.6% owner.

I want to call out here that RIOT has a very checkered past with regard to corporate governance. I think the risk of history repeating itself is somewhat mitigated by two well known activists with good track records being involved.

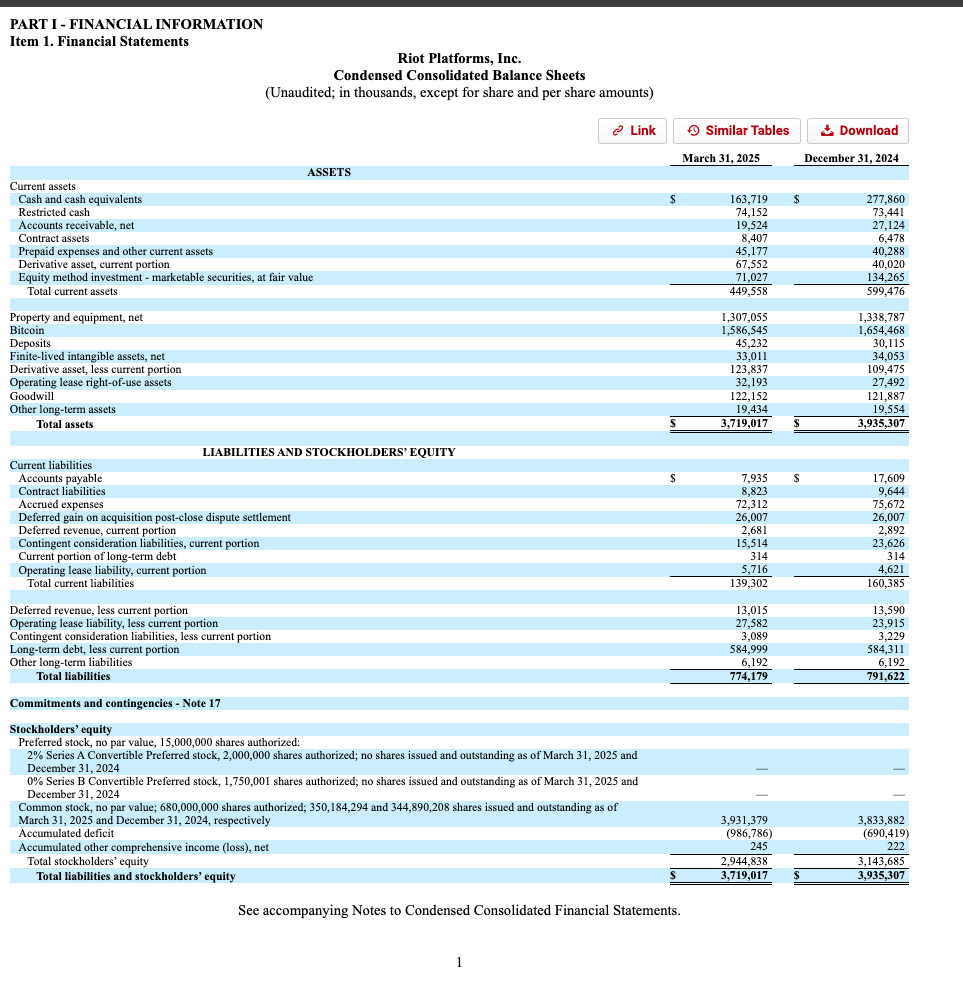

My subtitle to this post is “What’s a 1GW lease worth?” and I think that is the key question to ask when thinking about the upside on RIOT. Even before conjuring up an AI/HPC business, there are hard assets / value right now. The company has a fairly clean balance sheet and real assets - $164m of cash, $1.6bn of BTC (which yes, you can and should IMO haircut to something like $800m) and $1.3bn of PP&E. On the liability side, long-term debt is $585m and the company just upsized from a $100 to $200m revolver with COIN. There is $3bn of equity value here if you believe their accounting, and I think applying a 50% haircut to the BTC you end up at ~$2.2bn.

RIOT is sitting at a $4.3bn valuation as I write this, so I think to get a 7-10% IRR in 3 years here you basically have to believe the not-yet-real AI/HPC business is worth ~$3bn+ (book + $3bn gets you to $5.2 which is ~24% upside).

The new Chief Data Center Officer claims RIOT has 1.7GW of data center power to lease out. If you believe Cantor Fitzgerald’s estimate of $6bn/GW of replacement value, the 1.7GW is worth $10.2bn of replacement value. I don’t think RIOT has 1.7GW of power usable for the neoclouds / CoreWeaves of the world today, but FWIW you could haircut this value significantly and still end up with a sum of the parts more than the valuation today.

I personally like the “lease cash flow” valuation method better. Let’s go to the original 12y deal CoreWeave did with Core Scientific in June 2024:

Under the terms of today’s announced agreement, Core Scientific will modify a total of 100 MW of its owned infrastructure to deliver approximately 70 MW to host CoreWeave’s NVIDIA GPUs for HPC operations. Site modifications are expected to begin in the second half of 2024, with operational status anticipated in the second half of 2025. This new 12-year HPC hosting contract will further increase Core Scientific’s exposure to contracted, multi-year, dollar-denominated revenue. From revenue to gross margin, the new contract with CoreWeave is expected to enhance earnings power and drive shareholder value, adding an additional $1.225 billion in projected cumulative revenue over the 12-year contract timeline to the more than $3.5 billion in projected cumulative revenue associated with previously announced contracts with CoreWeave.

I read this as $1.225bn of lease revenue over 12y for 100MW, or about $100m/y in lease revenue.

You could apply EBITDA margins of 30% (ex. EQIX is close to 50%) on the future $100m/y of revenue here to get to $30m of annual EBITDA and then take 15x (data center REITs are often in high teens / 20s) - this is $450m of shareholder value on 100MW of leased data center. It doesn’t seem like a stretch to say that RIOT’s 1.7GW base is worth $3bn of shareholder value, assuming they can execute the way CORZ has.

Additionally, here are the details from CRWV’s February deal with CORZ:

Core Scientific, Inc. (NASDAQ: CORZ) (“Core Scientific” or the “Company”), a leader in digital infrastructure for high-performance computing (HPC) at scale, today announced an expansion of its relationship with CoreWeave, an AI Hyperscaler. The new agreement brings an additional $1.2 billion in contracted revenue across Core Scientific’s Denton TX location, solidifying Core Scientific’s position as a premier provider of application-specific data centers for HPC workloads.

The 70 MW of additional contracted power at the Denton site increases the full critical IT load to approximately 260 MW. The agreement increases CoreWeave’s total contracted HPC infrastructure with Core Scientific to approximately 590 MW across six sites. We believe this addition aligns with CoreWeave’s growing need for robust, high-density infrastructure to support NVIDIA GPU operations.

If and when RIOT lands with a first customer, expansion opportunities could be there.

As one more data point, CBRE puts Northern Virginia data center lease costs at $120-$140 per KW/month as of March 2024. If I take that to $100, I can get to $1.2bn per year in lease revenue:

So, again, 30% EBITDA margins on $1bn/y results in $300m of EBITDA, which at 10x is $3bn. I think it is a reasonable to assume 1GW of leased AI/HPC data center is worth at least $3bn of shareholder value.

Where could I be wrong here?

RIOT’s AI/HPC business is not nearly as far along as I think it is. It’s unable to extract the same lease rates as CORZ or IREN

My comps / estimates for 1.7GW are apples to oranges or wrong or I’m misreading RIOT’s claims

I’m off on margins / multiples on data center leasing revenue for RIOT

I am a generalist and over my skis on data centers. I’ve never looked at a real data center lease and am going off of examples I could find on public internet

These risks are acceptable to me mainly because of:

RIOT’s core business being worth a $2bn when you haircut book

Starboard and DE Shaw being a combined ~4% owner of the stock and having made real changes over six months; we are still in early innings of this transition

We will see; this is definitely a more “center of the storm” / thematic idea, but if nothing else it’s a good chance to learn more on data centers & AI.

CRWV Looks ready to go!

https://substack.com/@kroptions/note/c-132419355?r=wq7pa&utm_medium=ios&utm_source=notes-share-action