TURN released its Q2 letter after the bell yesterday (call this AM) and in it CEO Kevin Rendino reflects on the difficulty of owning small caps; volatility that makes you go “What am I missing?”. The letter is in the form of a diary entry for a single day in Q2:

9:45 AM: “Daniel, can we get Ryan and Tony from ALTG on the phone? The stock is down 7% on 4,300 shares. I know they just reported better than expected earnings YESTERDAY and provided solid guidance for the upcoming quarter YESTERDAY, but maybe things changed in the middle of the night or maybe we are missing something.”

10:00 AM: Apologize to ALTG’s management for bothering them so soon after we talked to them 14 hours ago, but we are wondering if we are missing anything that came from its conference call (that we listened to) or follow-up calls like the one we just had with them: I REPEAT 14 HOURS AGO. No, nothing changed at 2:00 AM. We continue to believe our thesis is intact (for the 64th time in the last 90 days), so we buy more

10:30 AM: Get a call that there is a block of 300,000 shares of SCOR for sale despite the stock getting cut in half the last quarter on the back of the company BEATING ESTIMATES (that were never cut to begin with). Spend the next hour or so calling around to see what we are missing. Find nothing of note, so we tell the broker we will buy stock at $1.75 with the bid/ask spread at $1.76/$1.80 as long as it’s a clean-up sale by the seller. We are told it’s a “clean up.”

I couldn’t agree more with Rendino that the price action in small caps this last quarter has been puzzling. TURN itself continues to trade at a ~30% discount to NAV despite having nearly 80% of its value in public securities and cash and its largest private asset (AgBiome) likely conservatively valued.

National CineMedia - my smallcap poison of choice - declined at one point 70% YTD before rallying 80% off the bottom, all during the midst of the strongest box office in years (with Minions, Thor, Top Gun and several others all performing strongly by pre-pandemic standards). I have no idea what drove the decline or the rally.

The company’s results yesterday point to how ridiculous the trough valuation was - NCMI 0.00%↑ traded like an almost worthless equity stub (<$100m market cap and $1bn+ of debt) when the company was buying its own bonds in the open market and offering the following guide:

For the full year 2022, the Company expects to earn total revenue of $265.0 million to $285.0 million, compared to total revenue for the full year 2021 of $114.6 million and Adjusted OIBDA in the range of $58.0 million to $75.0 million for the full year 2022 compared to Adjusted OIBDA for the full year 2021 of negative $24.7 million.

On the bond buyback:

Unidentified Analyst

This is actually [Joe Renato] on for Mike Hickey. Just one for me, if you could just talk about the $25 million bond buyback, which is great. But given some concerns about liquidity, what gives you confidence to buy back 2028 maturities now especially maybe with the 2026 bonds trading at lower prices?

Ronnie Y. Ng National CineMedia, Inc. – CFO

Yes. So we looked at all the normal options, quite frankly, within the capital structure and really thought the secured bond, given where it was trading and really, quite frankly, the size of dollars that we want to put to work was really the only place that we can do it very efficiently. And so we thought at kind of that mid-70s range, we've put about $20 million to invest in that, was the right thing to do. And quite frankly, in a way, that didn't really -- that the market actually allowed us to do it really quickly. So -- and we felt confident about the future of business to do that at NCM, Inc.

Adding to the difficulty of owning smallcaps is that it is very hard to find other bulls or bears with opinions (although the internet has made this task significantly easier than it would’ve been twenty years ago). A few years ago I owned refrigerant maker Hudson Technologies ($HDSN); the company had a massive debt problem in 2019-20 and its former CEO tragically passed away.

Owning the stock during this time was a headache and a half, as it was delisted after trading under a dollar for some time and would have wild up and down swings (I recall after the company was able to kick out some of its debt the stock quickly doubled, and this was pre-meme stock era). The core thesis during this entire time was that R22 - a refrigerant slowly being phased out that HDSN produced - would increase in price as supply decreased.

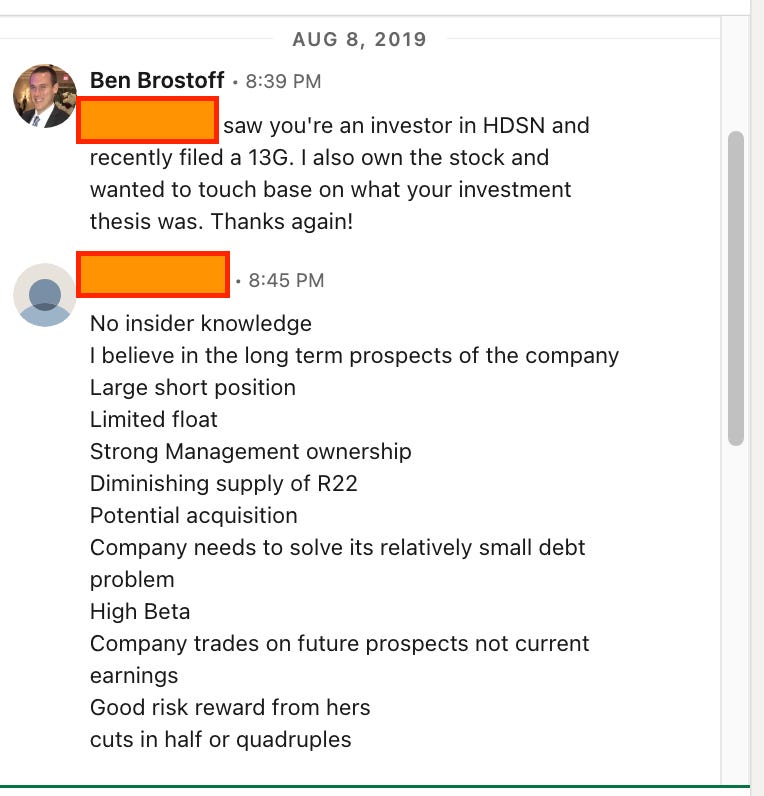

During this time, I saw a 13G for HDSN that revealed ownership in a big way by an individual I was able to track down on LinkedIn. I emailed this person on August 8, 2019:

Let’s look at the stock performance since then:

The stock more than quadrupled and to me shows the value of fundamental research that looks critically at the current price to determine what is priced in and what risk / reward looks like. This LinkedIn message had more truth in it than anything the price of the stock could convey. Eventually and as predicted by my LinkedIn friend, the company did see higher prices and started to de-lever, culminating in record Q2 earnings.

Smallcaps - if you’re going to own them, be prepared to look away from the ticker tape and have conviction in a long-term outcome.