Textainer and Triton - ~6x forward earnings with better fundamentals than market

Whenever these sell off, I think about the math

I write a lot about my favorite “boring” holding Triton (TRTN) - some recent posts here, here and here and from pre December 2021 here. I used to cover the container leasing company in a previous life as well as its competitor Textainer (TGH). I also did a fun podcast with J Mintzmyer where we debated whether TRTN or TGH was the better pick (we both own both / Apple and Spotify links). Both companies are selling off close to 3%+ as the market once again seems to be deciding the supply chain crisis / commodity boom is over and tech is back.

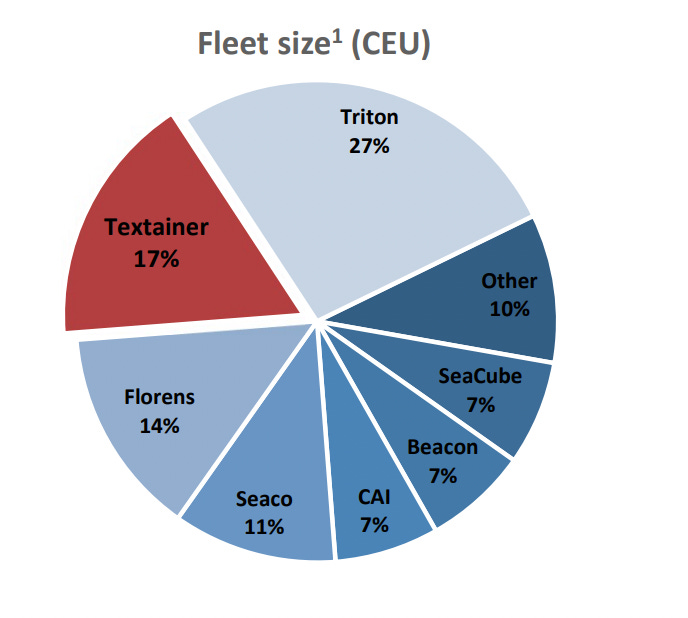

I continue to believe the market mistakenly sees TRTN / TGH as boom and bust cyclicals when in actuality both companies are (good) boring businesses that rinse and repeat the same long-term (we’re talking 12+ years now) container leasing business with high 90s utilization. The business is an oligopoly where TRTN and TGH are the biggest players (over 44% of the market) and the only public companies:

Other parts of the container leasing business have also improved. Lessees (shipping companies like Maersk and Cosco) that were once strapped for cash are now flush with cash. Take a look and then check out the public companies last few quarters:

Cost of capital has decreased significantly as each company opportunistically refinanced a ton of debt, most of which is fixed rate. TRTN even started issuing unsecured debt and got upgraded by the rating agencies. Additionally, each company this cycle is operating with the 2015/16 crisis fresh in mind, and you can hear in the earnings calls that the managers are very thoughtful about capital allocation and giving back to shareholders when the time is right (now). As I alluded to before, leases are now 12+ years at higher lease rates versus the historical 5-7 years pre-2020 (reason being the supply chain crisis is so bad shipping lines will lock in “discounted” rates longer if they can - these discounts are still way above historical rates). Finally, if you’re worried about inflation, this should be a tailwind:

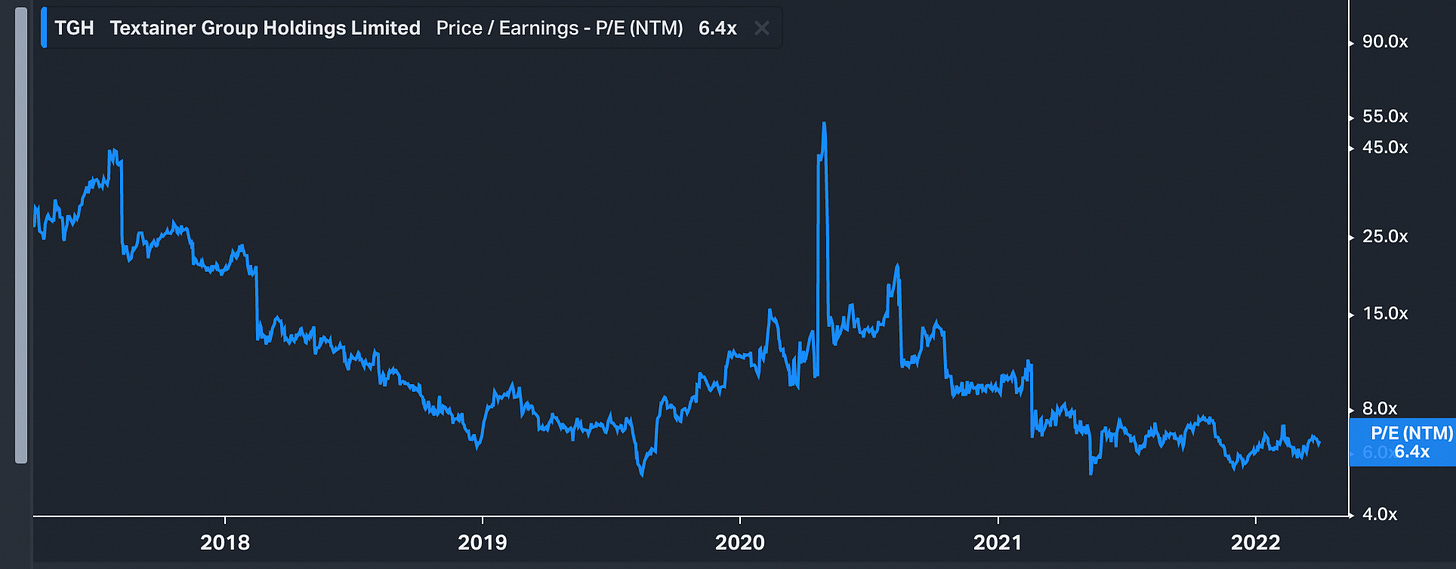

You would think with all of these improvements might come a rerating. Nope - by my estimates both of these guys trade around 6x 2022 earnings (note the steady declines in share count over the last five years which should accelerate this year if you believe the management groups):

Versus historical we’re on the low end:

I actually did a double take here when I saw Textainer bought back nearly 12% of its float in a year when there was a pandemic. Better yet, these acquisitions were made when the stock was about 1/4 of the price it is today:

Textainer’s CFO is basically telling you 2022 might look similar. From the last call:

…we certainly have a healthy amount of free cash flow where we can take care of the CapEx needs that we do have, the equity portion of it. And then also execute on the buyback plan, which we really like. And you're probably (inaudible) the fact that where our shares are trading at right now, certainly still -- we see it as tremendous value to invest in ourselves. So we do have enough cash from just operations to handle that in. Especially with CapEx levels where we are at now, we do have -- we do generate a lot more cash flows in excess that we can use towards returning capital to shareholders, dividends as well as that buyback program that we like a lot.

Call me crazy - I actually think both companies with buybacks will grow faster than the market with more stable cash flows. I have theories on why they trade at such a massive discount to the 20x+ the market does and 10x+ other leasing businesses do - TRTN and TGH are both <$5bn market caps, container leasing is a boring business, people associate both with the shipping lines when they hear “container”, lack of analyst coverage, etc. None of those reasons are related to the economics of the business, one that I really think private equity and banks find extremely attractive (recall CAI, Beacon, SeaCube and a few others have been acquired over the years - CAI was acquired by Mitsubishi in June 2021 for $1.1bn at about ~6.7x). The public markets doesn’t find either interesting (and even conflates both with cyclicals) and that’s the opportunity right now.

Lastly, I don’t think re-rating is the story here even though I think that’s likely. I think Triton and Textainer could go year after year giving me 10%+ back in buybacks and dividends. I would own this business privately even if you told me I could never sell.