Challenging the macro

I don't think this selloff has anything to do with Ukraine / rates and has everything to do with expectations

I think the major market indices YTD performance has nothing to do with the two prevailing theories (Russia - Ukraine, rates going up) I have seen in headlines. Yep, this is a take, but it’s always interesting to think through explanations that are not getting attention. Let’s walk through two boring explanations to explain what has happened so far this year.

Explanation 1 - A New Cycle Has Begun, Risk Appetite Has Shifted

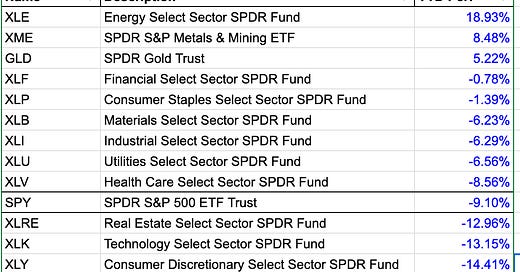

Here is what sector performance looks like YTD for some major sectors and gold and BTC proxies:

In case you prefer in horizontal bar chart form:

Energy up 19% and bitcoin down 20% (and tech down 13%)? Kind of seems like a big reversal from 2020 and 2021. Cycles happen and it doesn’t surprise me at all to see the big winners of the last cycle sell off and the big losers replace them. Call it reversion to the mean or risk appetite coming back to “normal”, but I think this is a decent explanation for what’s gone on YTD that arguably holds more water than “onset of WWIII” or “oh no! rates!”.

Explanation 2 - The S&P Is Highly Tech Exposed; Tech Had Too High Expectations; Market Is Lowering Expectations

Here are the top components in SPY as of close on Friday (2/18) and their YTD performance (I’ve combined Alphabet A and C shares into GOOGL). These 9 companies (one of which is Berkshire and holds Apple in size) are close to 30% of the index:

I think readers here have read enough about Meta missing the mark on 2022 guidance, but suffice to say a major component of the S&P disappointed and proved out expectations were too high (disclaimer: I own FB and am considering buying more).

By sector, Information Technology is 28% of the index:

Large cap IT names worth mentioning:

NFLX, about 50bps of index, down 34.5% YTD (earnings miss)

CRM, about 50 bps of index, down 23.0% YTD

ADBE, about 50bps of index, down 21.6% YTD

PYPL, about 33bps of index, down 46.8% YTD (earnings miss)

I don’t think it’s controversial to say a confluence of FB + NFLX + PYPL’s earnings misses, TSLA and NVDA having frothy valuations and correcting and tech generally leveling off are decent explanations for some of what has happened to SPY.

It’s easy to cherry pick examples of names selling off “for no reason” (I am guilty of this). I’d point to the influence of passive tracking ETFs and everything becoming more correlated in sell-offs. While my proposed explanations are definitely too simplistic here, I think Russia / Ukraine and fear of rising rates is even more simplistic and doesn’t consider at all that expectations for some companies likely became way too high over the last two years.

Last thing here - my post on “Is SaaS Cheap Yet?” gets into why I think some SaaS names have a lot further to fall and explains why I think inflated expectations will be a huge headwind for tech. My mental model on share prices will always be that they represent expectations. Unless you want to blame non-economic sellers or passive ETFs or algos or something else, selling is just expectations getting lowered.

What’s also interesting here is that chatter about previous factors that would pull down the market has died down. Two things I’m not hearing about nearly as much:

Omicron… maybe because:

Supply chain crisis

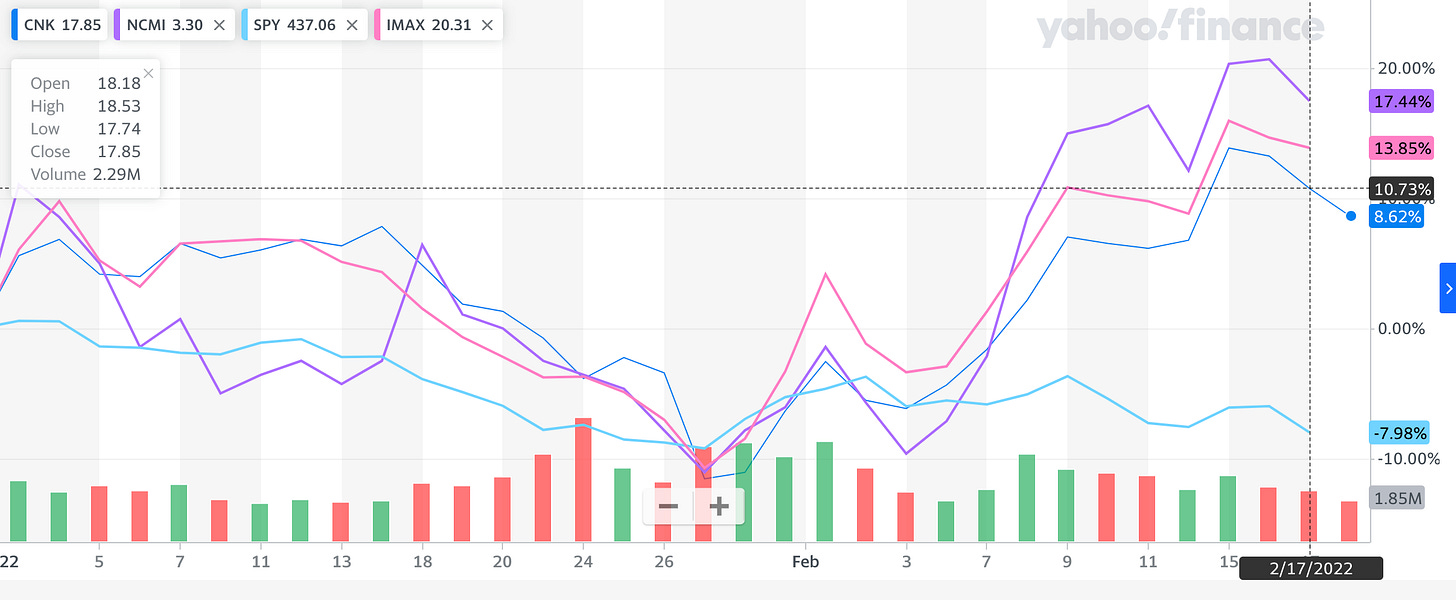

On omicron - we’ve seen movie theater names rally and a chart really does it justice:

Dare I say the market is finally beginning to price out COVID risk and/or tell us movies are coming back (and IMO they already are back, we have plenty of data to show us from 2H 2021 and most notably Spiderman’s recent performance)?

On supply chain crisis - I wrote about TGH’s last earnings where the company said the container environment is “normalizing” (they used that exact word). TRTN said the same thing on their call. On this one, I’ll admit the stocks involved don’t tell the exact same story. The reason here may be related to market expectations going in (said another way, the market a while back already expected the supply chain crisis to end but it lasted longer than expected - my podcast with the great Twebs has some good thoughts on this and if you want a great write-up check out his Double Dog Index). I think though it’s highly likely we see a better supply chain environment in 22 than in 21.

There’s always something every few months talking heads can point to on why stocks are selling off. Off the top of my head - the Eurozone crisis, Brexit, the end of QE, China tariffs, COVID, 2020 election uncertainty, default of large Chinese construction company, COVID variants, Russia / Ukraine, rates, etc. I think this chatter can be mostly ignored and market selloffs usually have much simpler explanations.