Not every day you see an exchange like this on an earnings call:

Total Site surprised the market with $0.12 of EPS, no dilution, a 5x+ increase in quarterly revenue to $100m (which to be fair from an accounting perspective is going to very choppy) and unchanged guidance despite building a new headquarters / rack integration facility out and a very uncertain macro environment. The stock was up close to 80% the next day (5/16).

All the praise the company got on the earnings call was completely deserved. That said, at the end of the day we are all subject to valuation math, and right now TSSI is a $13 stock that at $0.12 of quarterly earnings has high forward expectations for an asset procurer. I think the next few years of earnings are hard to forecast - the company warned in its last 10-K that revenue will be spiky because of government contracts, and earnings today are benefitting from NOLs that will not be available long-term:

While the company is forecasting to double adjusted EBITDA from $10.2m to $20m+ for FY 2025, the stock now trades at ~20x EBITDA guidance in a low margin industry.

Asset procurement GMs are around 4-5%, which is why many comps like SMCI, CDW and NSIT trade at teens multiples. These companies also are not restricted on growth by a single customer (for TSSI, Dell) that from the recent call may be a concern:

What is good for Dell - getting its own equipment into data centers - may be bad for TSSI - winning data center contracts irrespective of the backing hardware. The limited overlap in incentives is a rate limiter on growth.

I wrote in my initial coverage that GMs could increase from the higher margin Facilities Management (FM) and Systems Integrations (SI) parts of the business but these segments are growing much, much slower than asset procurement. FM actually shrank 40% (the explanation in the call was that data center builds are changing and this business is in flux) and while SI was up a remarkable 253%, it’s still trailing the growth in procurement (676%).

If you prefer EPS multiples, you still get to high teens at where the stock is trading now assuming you more than annualize EPS from this quarter, which is a big assumption:

I am still an owner but on Friday hedged my position via selling the June $12.50 calls against my stock position for $1.35 (10.8% yield) expiring June 20th. It really is a testament to how volatile the market expects the stock to be when you can be paid an annualized 100%+ for an at-the-money option. This caps my upside at $13.85. While in my original post I made a case for a $20 stock price, my enthusiasm has become more muted as I’ve researched comps and considered whether the Dell relationship overall may put handcuffs on growth.

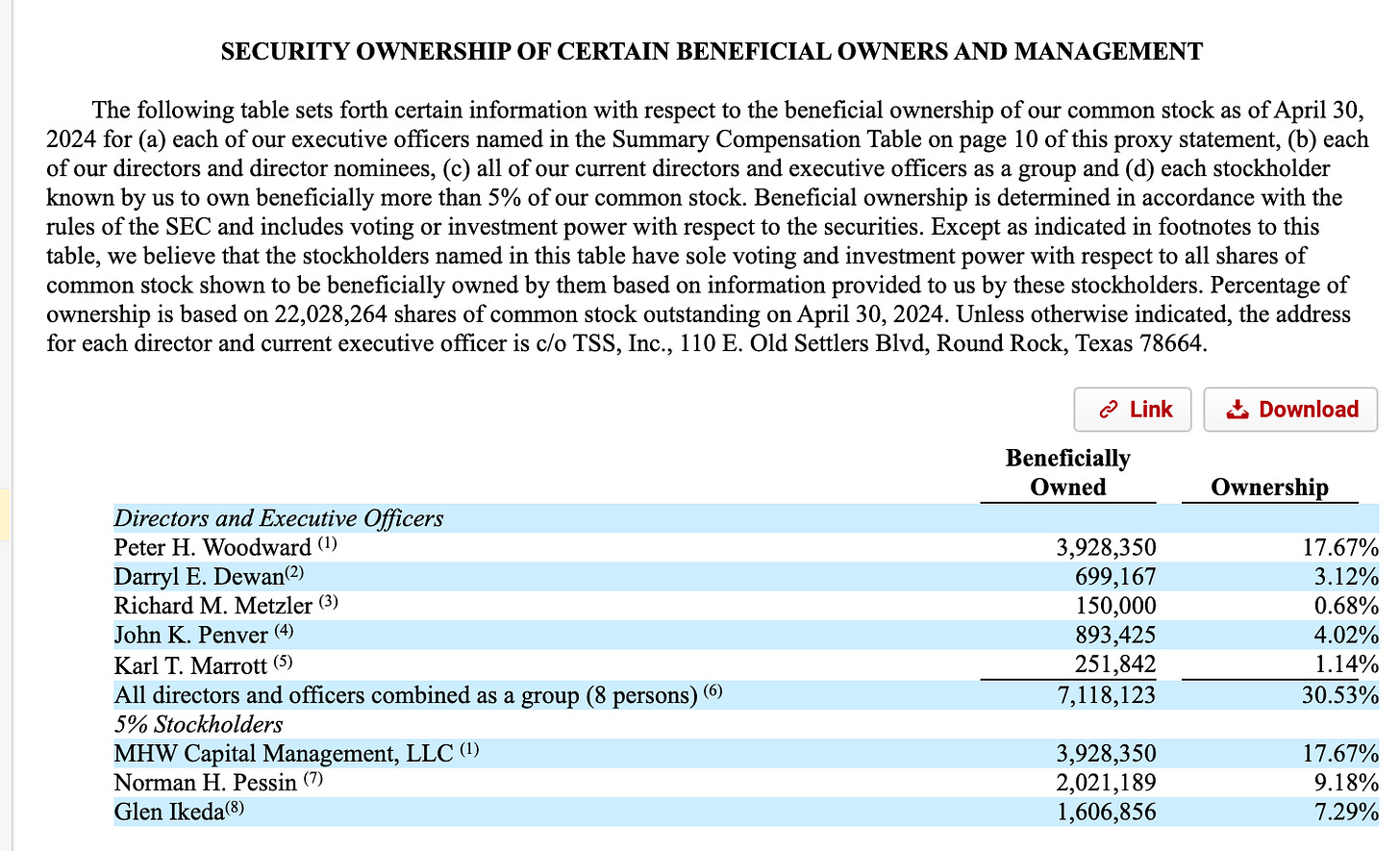

One more interesting thing I noticed from the last proxy from 4/30 - ownership has changed here, with the controlling shareholder (Peter Woodward / MHW Capital) decreasing its position from 17.7% to 10%. Some of that is understandable given profit taking from the incredible run of the stock, but still I thought worth noting.

Here is last year:

Here is this year:

I generally hate selling on valuation concerns and to be clear what TSSI management has pulled off is incredible. Darryl Dewan has deservedly been nominated for EY Entrepreneur of the Year for his region. The company has a necessary set of services in what could be a 5+ year AI boom. I will be wrong here if I’m underestimating where margins and growth could go and the nature of the Dell relationship.

Amazing job ben!