Textainer results bode well for container lessors

$TRTN shouldn't have to worry about competitor over-ordering

Cyclical stocks: insert some old aphorism here about timing the cycle. The capital cycle (which is well covered in this book) goes something like this:

The economy appears to be stuck in recession and sentiment is terrible (beginning of cycle)

Demand unexpectedly comes back strong and suppliers seem like they’ll never be able to keep up (middle of cycle, part I)

Suppliers gain confidence and start writing huge capex checks (middle of cycle, part II)

Out of “nowhere”, demand falls off, a supply glut forms and prices crash (end of cycle)

The economy goes into recession… rinse and repeat

This tweet I actually thought covered this well for semis in the 90s:

Note the highlight on “seemed incapable of meeting the insatiable demand” - sound familiar?

When cyclicals start to post record results, the bears (who to their credit nearly always right here) start to bring up that these companies are overearning and the low P/Es actually show the top and not bottom.

I’ve pitched Triton Container ($TRTN) a lot on this blog and many readers will bring up this is a cyclical container leasing company that got punished in 2015-2016 when this exact cycle played out and a glut of containers shocked the industry. I’m here to tell you this time is different (yes, I realize this reads like many other value pitches for cyclicals trumpeting why they are immune from the cycle, but hear me out!).

The big reasons I think container leasing isn’t the same as commodity producers or other types of cyclicals:

Container leases are long-lived assets (now 12+ years, a significant change from 5ish year leases the industry traditionally underwrote since now shipping lines want longer leases at cheaper rates) that allow lessors to lock in cash flows

Triton and Textainer both issue fixed rate debt that has become way cheaper in the last two years. I wrote about this here - in the last two years, assets each company has originated are more valuable and their cost of debt has plummeted

The container leasing industry is basically an oligopoly, with TRTN and Textainer (TGH) owning 44% of leasing supply on a Cost Equivalent Unit (CEU) basis. As I’ll discuss later, the industry is basically five players:

The two leading lessors are hyper-aware of the capital cycle and already starting to pull capex back, as evidenced by Textainer’s actions and remarks yesterday

That last point is what I want to spend the remainder of this post on. Let’s start with some quotes from TGH’s from Q4 earnings:

We continue to expect more normalized demand for new containers until 2023, when new ships will be delivered. And we also expect shipping lines to purchase a bigger share of new containers in the near term, inverting rent trend of lessor accounting for the majority of purchase. These factors will ensure net cash flow generation as our container CapEx moderates from historic level[s]…

But big picture would definitely into an environment where our CapEx moderates from what we have seen last year, which was truly an exceptional year. And that will give us potentially more means to return capital to shareholders through our normal dividend and buybacks.

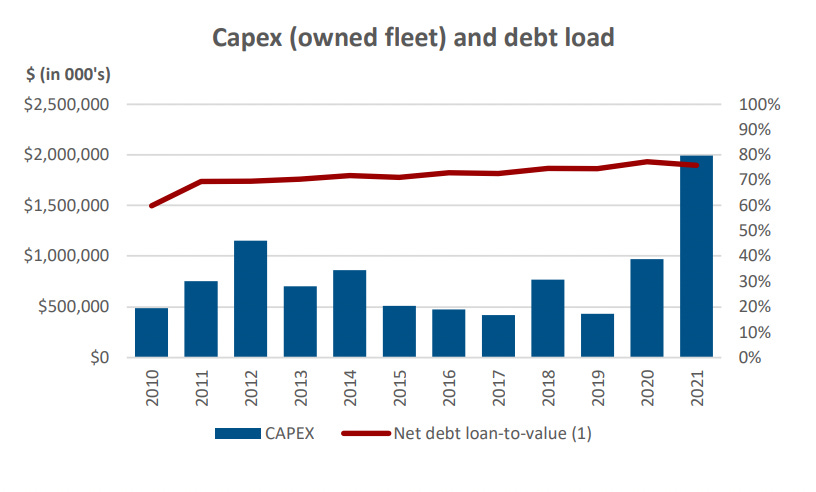

To give you a sense of how enormous Textainer’s capex was in 2021 in previous years compared to 2021:

Generally the company is doing $1bn or so in capex and did near $2bn last year. In 2022, it looks like they’ll return to a far more normal $1bn. They guided to $500mm in the first half and basically said the second half would be the same:

J. Mintzmyer

Yes. It's definitely a lot of potential. That's why we're watching it closely, and I'm hoping you'll be able to do a great job at both selling and also rolling those legacy ones on the new contracts. Last year, you had $2 billion basically in CapEx, which was -- looks like 3 or 4 years' worth of normalized CapEx for you guys. You mentioned $500 million committed so far this year. How far does that take you into the year? Is that like through like May or June or how far out would that be that $500 million?

Olivier Ghesquiere

Yes. It's -- we said it's the first half. It's probably fair to say that it will take us through May depending on the deliveries and any event that may happen in terms of the delivery of those containers and the pickup of those containers. But yes, I think trying to guess your next question here is does that trend continue for the full year? I would say, at this stage, there's no reason not to believe that the trend kind of continues at the same pace.

The dropoff in capex is being driven by inventory and container turn in data points showing the market is normalizing. Textainer even uses that normalizing verbiage in the slide below:

I think in 2022 we are going to see normal capex for the lessors against historically elevated earnings. Triton and Textainer both have locked in 12+ year leases at elevated lease rates due to craziness of the last 2 years. Now that capex is being reigned in, both companies will have more capital to allocate in the form of dividends and buybacks than in 2021. Textainer says exactly this:

And that will give us potentially more means to return capital to shareholders through our normal dividend and buybacks.

One more note on competition here. I mentioned that Triton and Textainer own about 44% of the market, but there really are five or so major players (TRTN, TGH, Florens, Seaco and CAI/Beacon, owned by Mitsubishi HC Capital). TGH and TRTN get asked about competition every call, and TGH here was asked about Mitsubishi:

We understand that the new owner is working on merging CAI with Beacon, which makes a lot of sense. But I don't think there has been any change in their approach or strategy that we can note off so far. We remain with a market that is now consolidated to 5 large players. And the 5 players are acting very responsibly. We haven't seen any sign of anybody trying to grab market share, even though we've actually, as mentioned before, seen a little bit of a normalization in demand for new containers because most ship lots are essentially already filled. But we continue to have a very stable environment there. The maturity on new leases hasn't reduced. We continue to see new leases concluded in excess of 12 years. So that's pretty much a stable situation from that point of view other than the new container prices that have eased off slightly.

This has every sign of an oligopoly to me that should steer clear of a bad prisoner’s dilemma situation of flooding the market with capex.

Overall, Textainer’s call yesterday makes me confident 2022 could be the year of capex pullback and capital returns for container lessors. I am not sure this is priced into the market as my sense is this space doesn’t get a lot of press and the existing dividend yields are good but not great (TRTN 4%, TGH 2.5%). Textainer just introduced a dividend last year after it pulled it a few years ago due to the bankruptcy of a large shipping line they were heavily exposed to.

If we get dividend bumps and buybacks and a modest amount of capex, we could see higher EPS and dividend yields unless share prices increase. I like this setup and TRTN remains one of my largest positions.