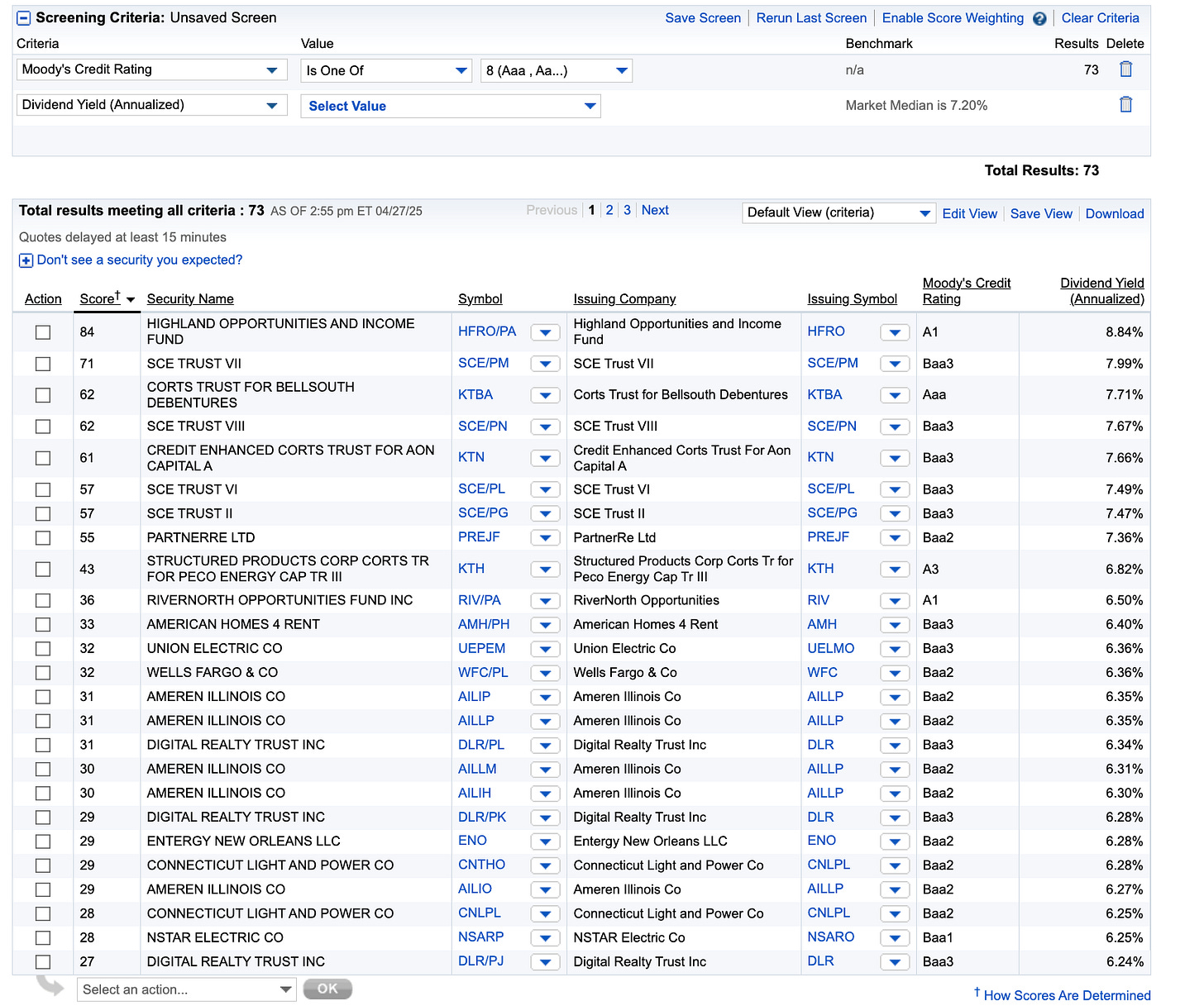

I discovered Fidelity’s preferred stock screener today. It’s a great tool that convinced me there are some very high quality 7% yields out there. In fact, per Fidelity, 7.2% is the median yield for preferred stocks:

You can download CSVs based on results - if you’re interested, here are the results in a Google Sheet of my screen for 5% or greater yields, which gets you 391 securities.

You can also screen for issuer rating. If you look at Moody’s IG (Baa3 or above), you get 73 results, many of which have 6%+ dividend yields:

Importantly, I’m strictly quoting the dividend yield on the current price here. I’m not including any of the price appreciation you get when these preferreds mature or get called, which for many might bring the yield to maturity to 10%+.

Note many of these preferreds were issued in low yield environments and have declined significantly in price. For example, HFRO/PA (where the issue really is A1 from Moody’s as of Dec. 24 and used to be A21) trades at 15 when par is 25 and traded above par for all of 2021. The coupon is 5.375%, but because of the decline in price the yield on the pref. stock is now 8.8%.

For the preferreds with higher credit ratings for the issuers, I’m guessing the price decline is entirely from rates going up. Gabelli Funds’ Aa3 rated closed end mutual fund - GPV - has two series of preferred in front of it - GDV/PH and GDV/PK. Both have $25 par values and trade at 23 and 18 (5.375% and 4.25% coupon), which give them 5.81% and 5.82% yields.

Another interesting one is CCIA, the preferred in front of Carlyle’s closed-end Credit Income Fund (CCIF), which was issued in October of 24’. CCIA has an 8.75% coupon and trades slightly over par ($25.45). The required redemption date is 10/31/28. The two year treasury yield is 3.76% and 5 year is 3.87% as of Friday so this is more than double the risk free rate. It would take a true crisis to wipe out closed end funds and eat into the preferred. Before then, I’d expect CCIF and many others would issue a bunch of equity or sell assets to try to stay alive.

Issuer rating or quality of the “protecting” common stock did not have as big an impact as I expected in this screen. Some of the highest quality banks and utilities (Wells Fargo, Union Electric) have 6% yields while highly levered CEFs that own junior CLO tranches with terrible track records have 8.6% yields (OXLCI - Oxford Lane stock meanwhile is down 77% in its 12 year history). Overall, I’m convinced this market is not efficiently priced and there are ways to get nearly the same yield at far less risk. I’ll leave this for another post, but I also think in the municipal bond market there are tax-free yields close to the preferred in this screen at significantly lower risk.

Overall, seeing the 391 preferreds from my screen and the hundreds of others I found via preferredstockchannel.com and ChatGPT/Gemini/Grok really puts the stock market into perspective. Stocks probably trade depending on the estimates you believe at a 20x forward P/E, or 5% earnings yield. It’s possible earnings come down this year.

I’ve talked in this newsletter about selling puts to back into attractive P/Es, but the reality of preferred stock is it’s like selling a put at $0 and on average right now getting a 7% yield in return. In a liquidation scenario, you can’t take losses on preferred unless the common equity truly is worthless and liabilities remain after.

As a final thought - I’m going to try to remind myself going forward that any stock I buy has to beat on risk/return a 7% basically risk-free yield. Yes, treasuries are ~5%, but IMO there are preferred opportunities out there where a true financial crisis of the 08-09 level would be necessary to take losses. What this means in practice is I have to be able to model a “safe” teens IRR to justify the risk of bringing a new stock into my portfolio at this point.

HFRO/PA is actually A2! Via Moody’s: “The Fund's solid capacity to cover preferred dividend payments from recurring earnings also serves to support the A2 ratings assigned to HFRO's preferred shares.”