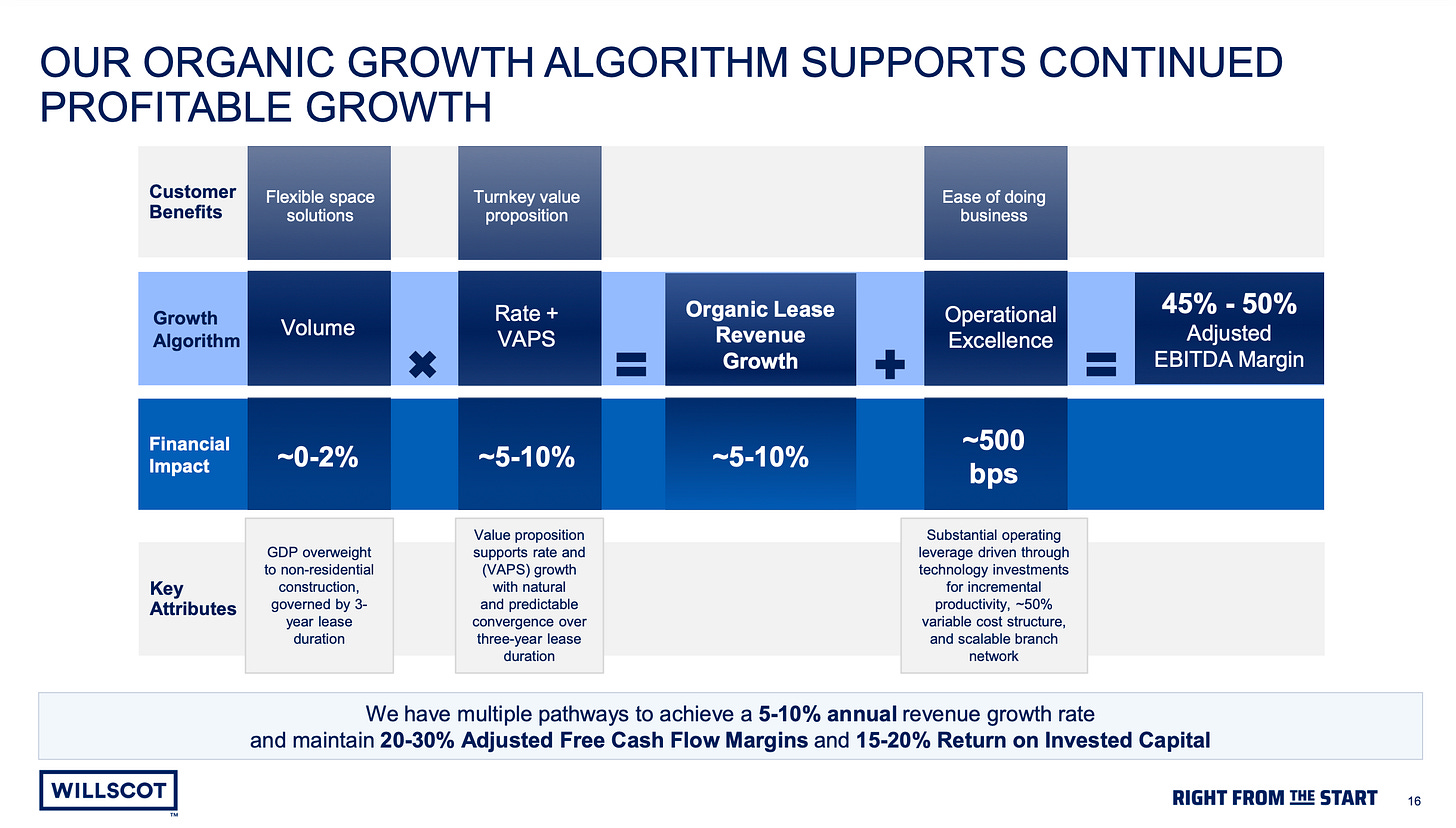

What multiple would you expect an oligopoly mobile trailer leasing business to trade at with 5-10% revenue growth, 45-50% EBITDA margins and 15-20% ROIC? The company I am about to present to you is promising exactly that. From their Q2 deck:

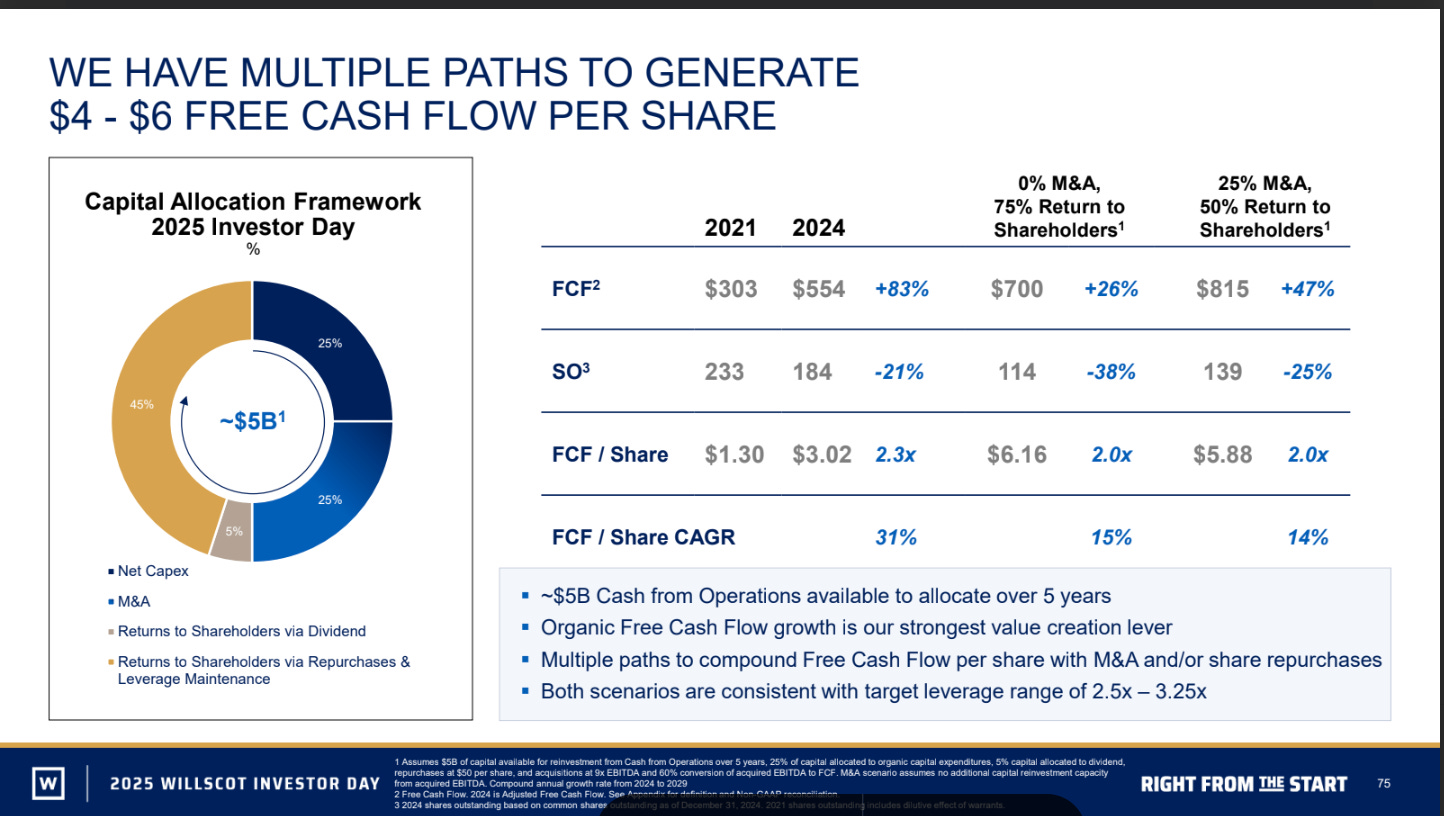

If I had confidence in these numbers, I would pay at least 10-20x FCF. For an oligopoly leasing business (assuming low-ish leverage), a 5-10% FCF yield where free cash flow is growing a little above GDP sounds like a good deal for holding for a long time based on my threshold IRR of 7-10%.

While my long-time favorites Triton and Textainer are shipping container leasing businesses, I view the motivation behind the Brookfield and Stonepeak buyouts as driven by this logic. Both traded single digit FCF multiples when in the public markets and acquirers came in at 35%+ premiums.

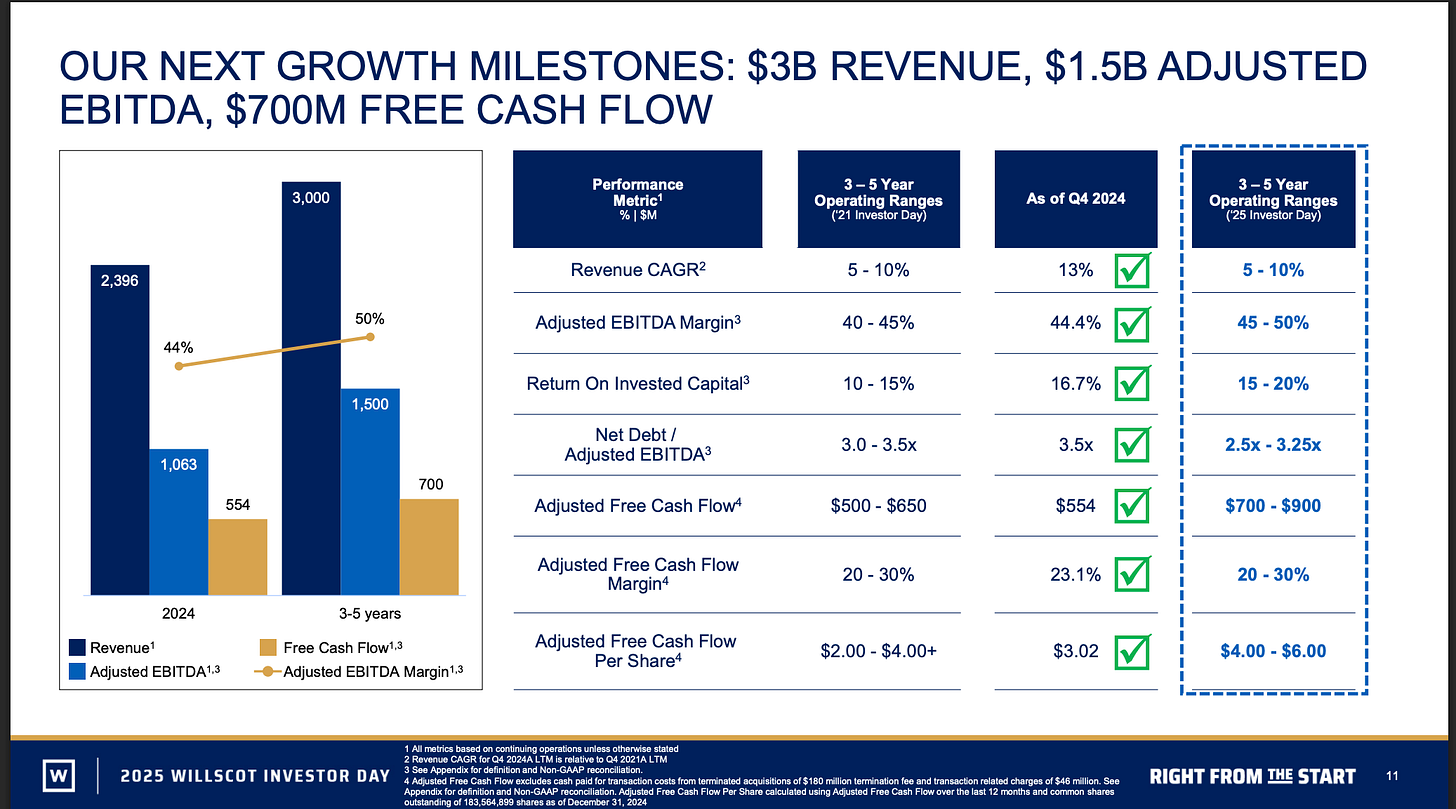

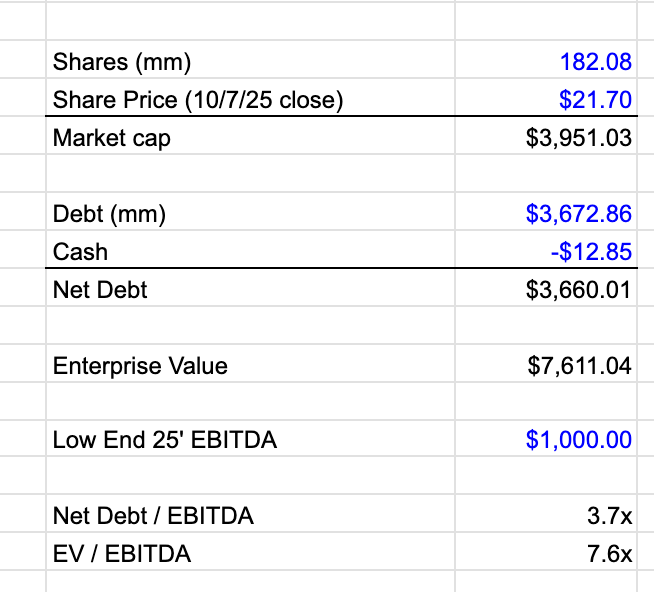

Willscot (WSC) is saying it can produce $4-$6 of FCF/s long-term and currently trades at $21 (5.25x at low end, 3.5x at high end).

The stock price tells a very different story here (-35% YTD, +21.5% over last five years versus SPY’s 93.63%) and I want to spend the next part of this post attempting to explain why the stock has fallen out of favor. In short - a failed merger attempt with a competitor, poor recent operating results with the future not looking much brighter and leverage.

You can see the stock nearly peaked on February 9, 2024, which was IMO not coincidentally right near their announcement of a (spoiler: failed) $3.8bn merger with competitor McGrath on January 29, 2024. The merger would’ve been 60/40 cash/stock and pulled WSC closer to its $700m adjusted FCF goal on a shorter timeline. The transaction would’ve been funded partly with debt; WSC would’ve upsized its ABL from $3.7bn at the time to $4.45bn (the company did say it would de-lever to 3-3.5x in 12 months following the transaction).

Unsaid in that announcement is they would’ve taken out a key competitor and had more pricing power over the market, which is exactly why the FTC opposed the merger and WillScot abandoned it in September 2024. From the FTC following the termination of the merger (emphasis mine):

“Strong competition in the markets for modular and portable storage solutions is essential to ensuring low prices and high levels of product quality and customer service for businesses and school districts nationwide. The FTC is pleased that WillScot has announced that it is terminating its proposed deal to acquire McGrath RentCorp in the face of a potential Commission challenge. FTC staff worked tirelessly to investigate the potential impacts of the proposed acquisition and found that customers in the construction, retail, education, and many other industries will benefit from continued competition between these two companies in markets across the country.”

Reading between the lines, the statement suggests to me WillScot already has significant pricing power in an oligopoly market structure and the McGrath merger would’ve given them too much.

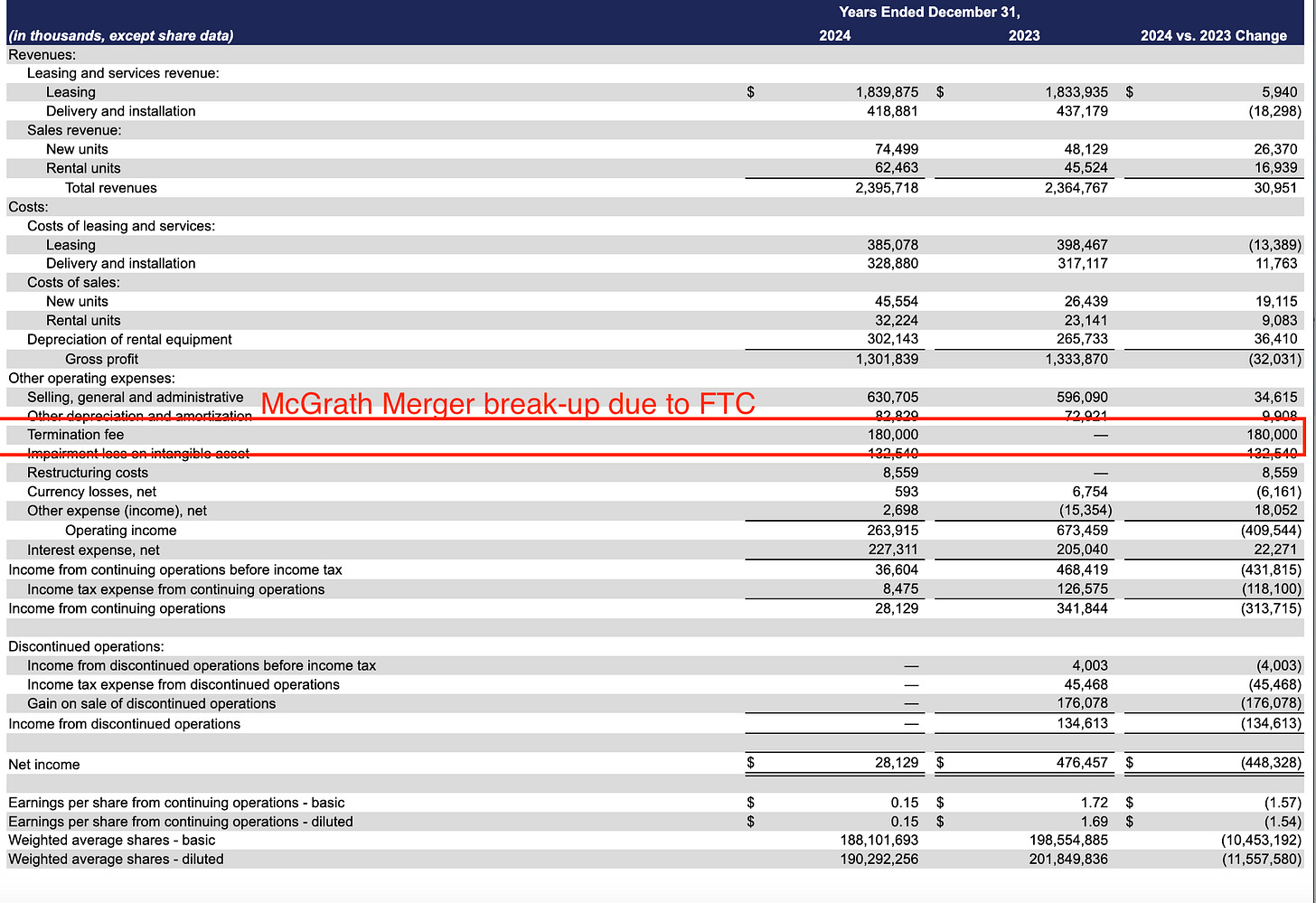

The financial impact here was an $180m termination fee which you can see depresses earnings in 24’:

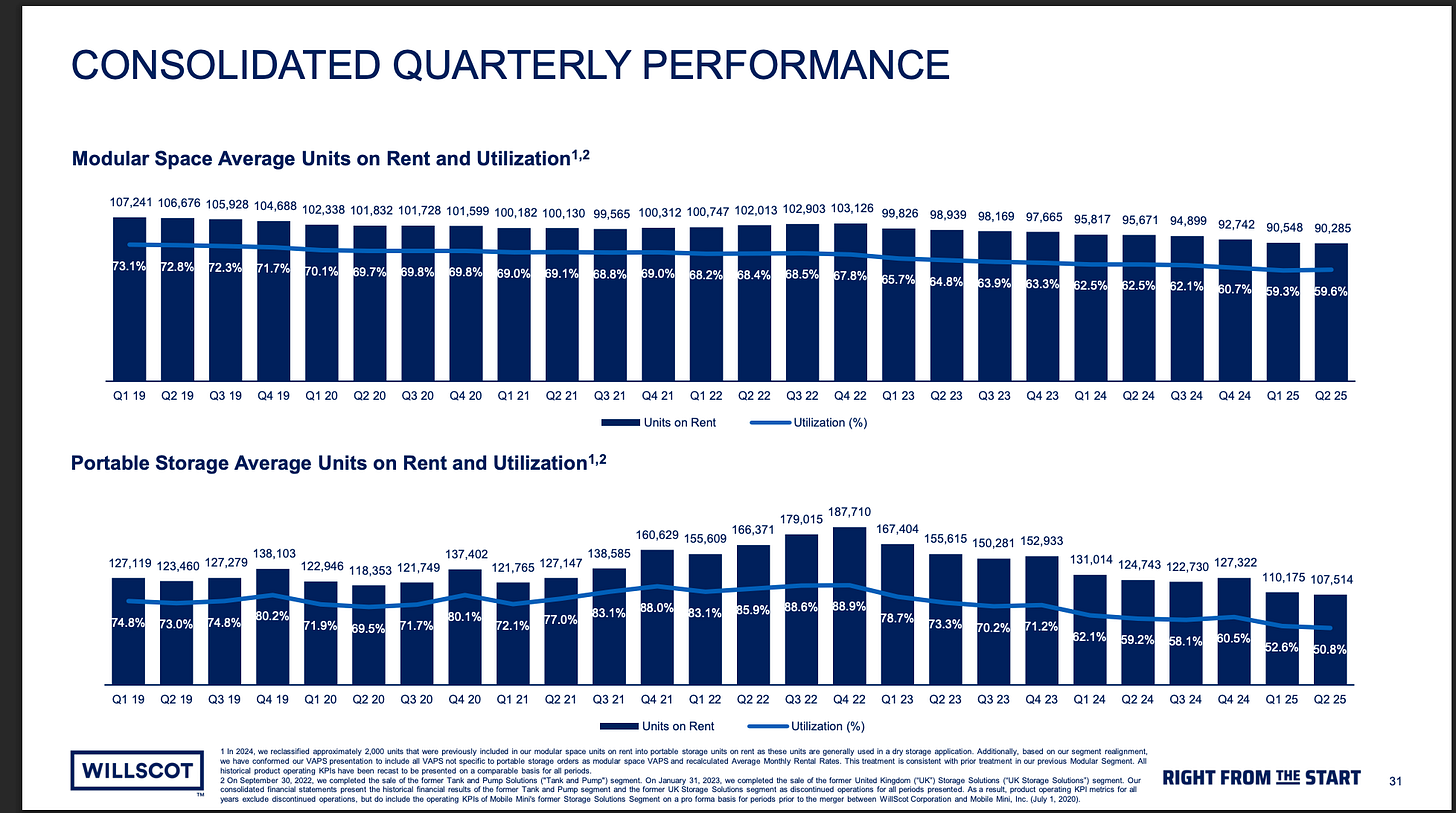

Looking ahead, I think the market has some concerns on an upcoming industrial recession and is recognizing current and potentially future weakness in utilization rates:

From the last Q:

Total revenues decreased $15.5 million, or 2.6%, to $589.1 million. Leasing revenue decreased $15.7 million, or 3.4%, driven by a decrease in total average units on rent of 22,615, or 10.3%, and partially offset by increased pricing and VAPS penetration. Reductions in non-residential construction project start activity as a result of higher interest rates reduced demand for our services, which resulted in fewer deliveries.

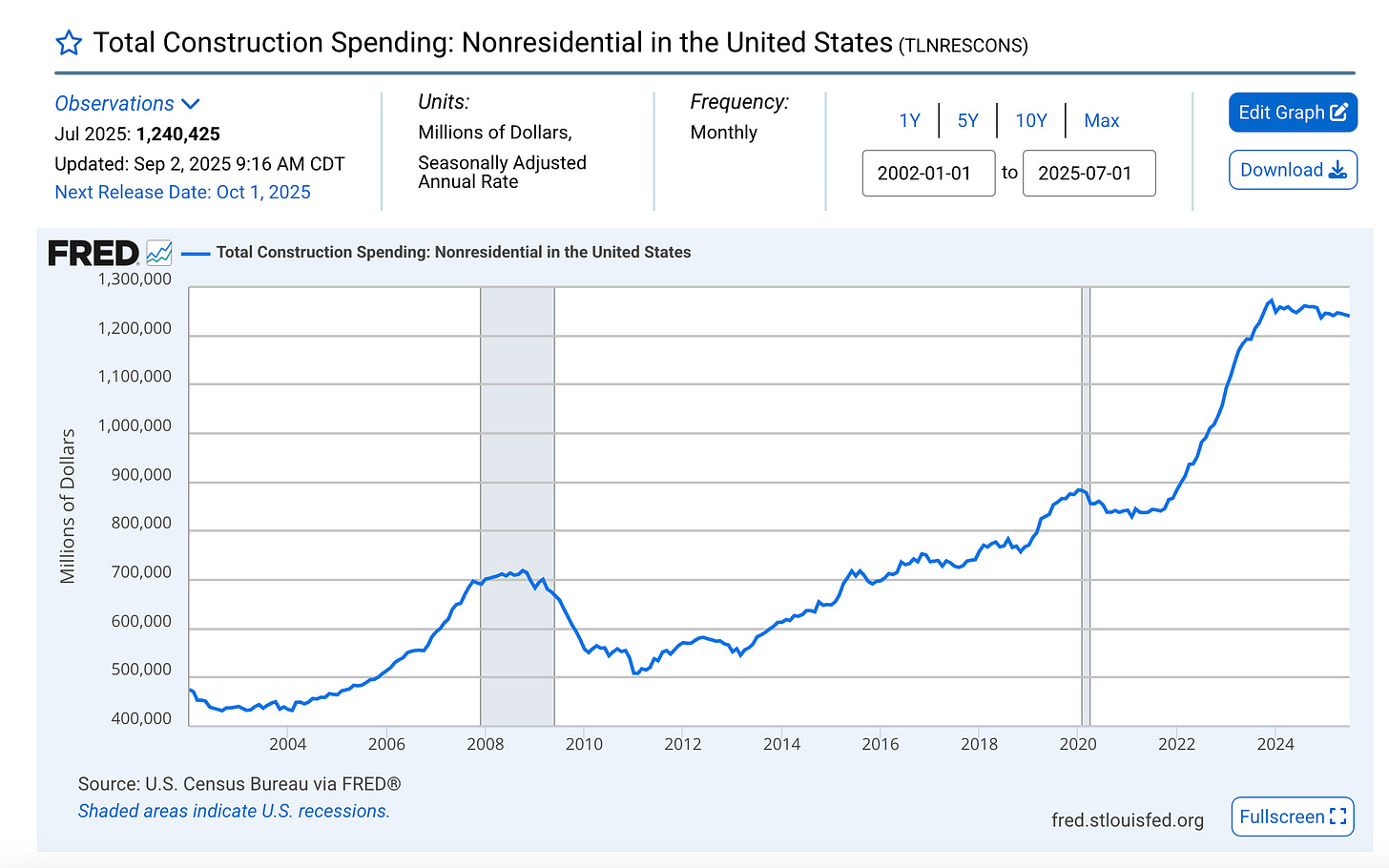

You can see non-residential construction spend has flatlined and if the future looks anything like 2008, we could see this spend go significantly lower:

I found some data on non-residential construction start forecasts from ConstructConnect from August (which I’m going to assume are too optimistic); while I think things could certainly get worse in the next 2-3 years, my view is long-term the trend is up and the company did not change its long-term $4-6 FCF/s (in 3-5 years and assumes 182m shares) forecast in Q2; it reiterated it.

I found this short thesis on WSC on Substack and it’s a great write-up for understanding why investors do not like the stock. Credit to Keith Dalrymple for the work he did on the fleet and demand for specific types of units; I agree he could be right that the fleet doesn’t have enough climate-controlled and other units customers want, and having to purchase this inventory might drive capex up. I think the claims he brings up on depreciation accounting are valid.

Where I disagree is that leverage going forward will be a problem and the company will struggle to pay off its ABL in 2027 ($1.5bn, more on this later). I think it’s hard to short a stock that generates as much cash versus its equity value as WSC right now. In the next ~5 years, I think there is a real possibility the company generates its market cap in FCF, and for that reason if it makes it past debt maturities, I think to short the stock you have to believe management is truly terrible at capital allocation.

Additionally, the last year I think has had some interesting forcing functions for improvement (activist, new CEO) and I think to an extent the stock price bakes in an industrial recession.

In the McGrath breakup announcement, the company announced it increased its share buyback authorization by $1bn and strongly hinted it would buy back the shares in size (when the stock was trading at ~$37+):

“Our long term outlook remains clear. With the obvious overhang on our valuation related to the McGrath transaction, our Board of Directors increased our share repurchase authorization to $1 billion. We will deploy the repurchase authorization thoughtfully, as we have in the past, while funding organic investments in our business and pursuing smart tuck-in acquisitions,” said Tim Boswell, President and Chief Financial Officer of WillScot. “At current valuation levels, we will prioritize investing in our own stock given the embedded growth in our earnings. As we progress into 2025, we will continue to execute the disciplined approach to capital allocation that we initiated in 2021, which has resulted in the return of over $2 billion of capital to our shareholders and nearly a 25% reduction in our economic share count. Combined with the execution of our growth strategy, capital allocation will remain a powerful lever to compound returns for shareholders over time.”

In addition to the attractive valuation and the commitment from management to buy back shares (the company has a strong history here, more on this later), another thing I like about this setup is some activist pressure to sell the company to private equity. In November 2024, activist investor Toms Capital started building a stake in the company and calling for a sale.

In late January 2025, rumors circulated there were several PE buyers interested.

I want to reiterate here during that September - January timeframe the stock was trading in the mid 30s with more shares outstanding than today (184m shares as of 10/23/24; 182m today and likely going lower). Based on share count and the ~50% price decline, the returns for PE are much more attractive now than when the company was in the news exploring a sale.

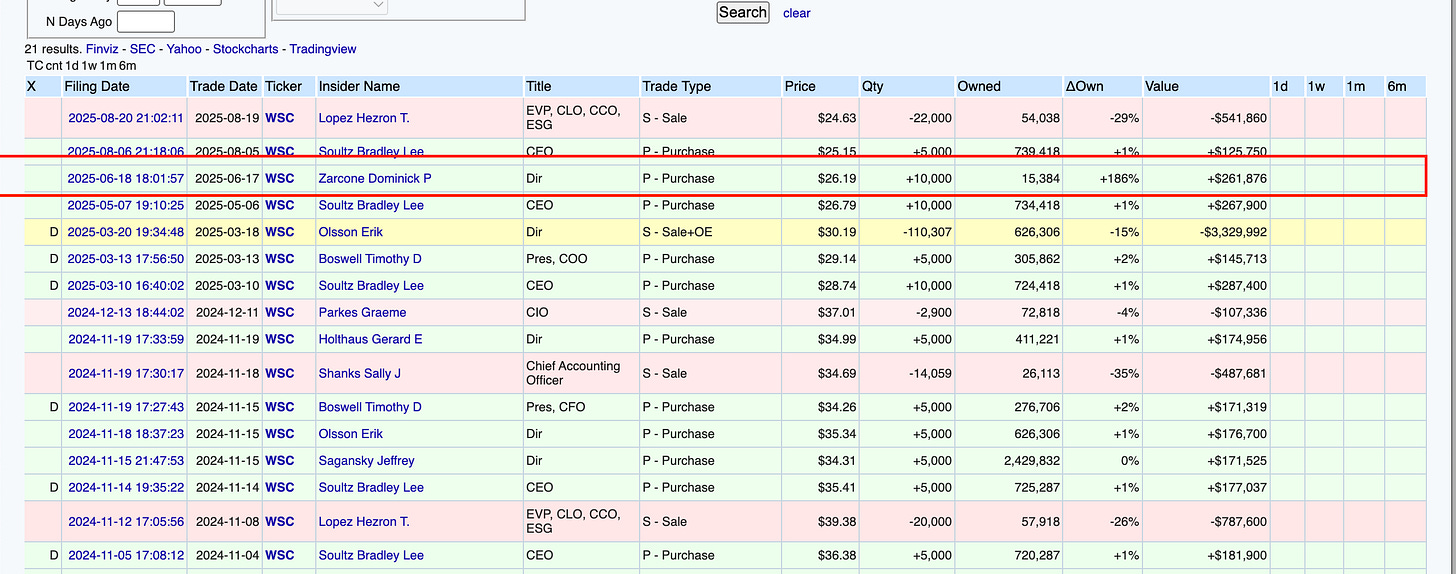

In March 2025, the company showed TOMS they’re listening and put Nick Zarcone on the board. That PR release had both WSC and TOMS Chief Investment Officer and co-founder Benjamin Pass complimenting each other and suggested they’re working together. Zarcone did buy ~$262K of stock on the open market in June when the stock was trading at $26:

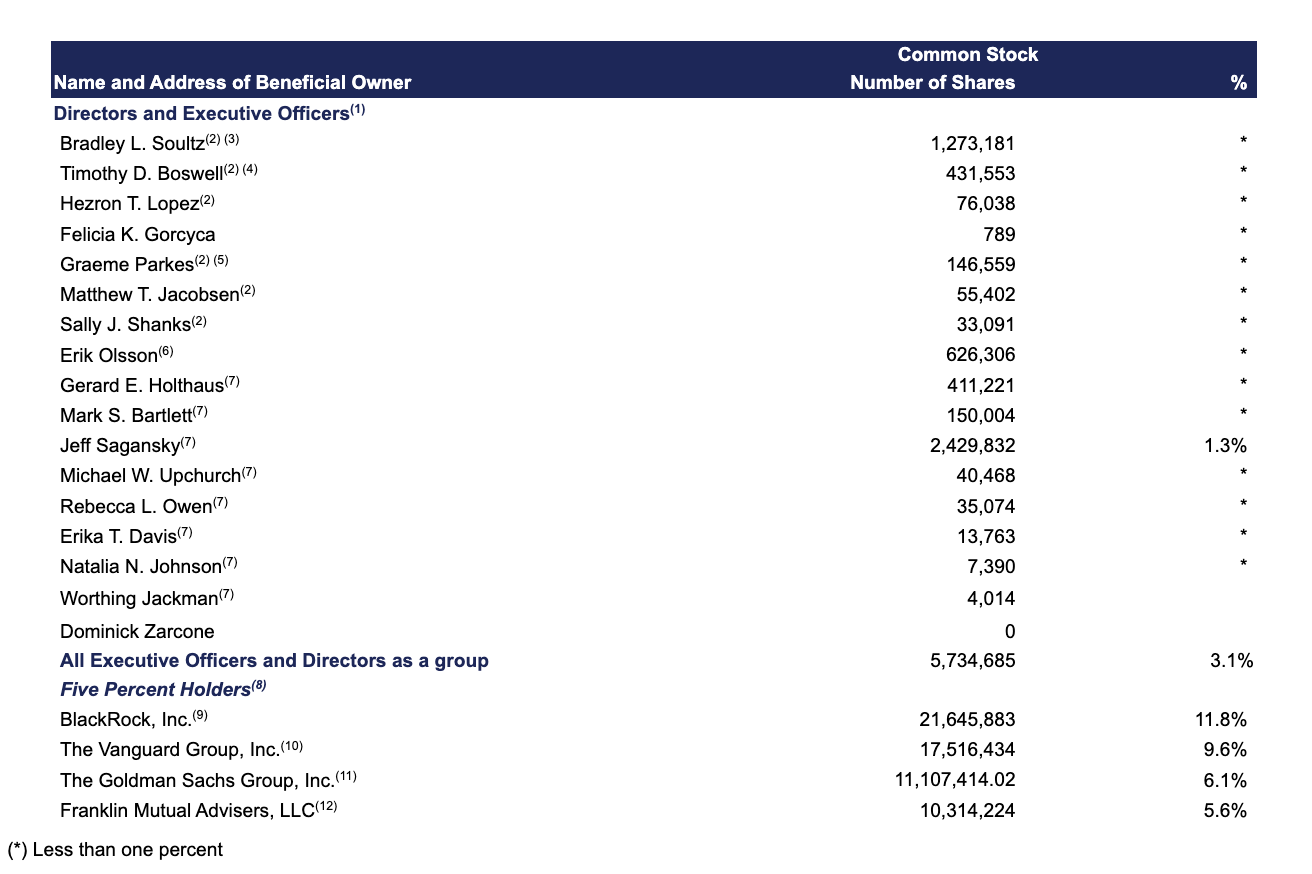

I do want to note TOMS doesn’t appear to own a meaningful amount of stock as per the last proxy (filed 4/21/25) they are not listed as owning more than 5%1:

In September 2025, WillScot promoted a new CEO when the now former one retired. The new CEO Timothy Boswell (formerly COO and before that CFO) has a background in PE:

In June 2012, Mr. Boswell was a Vice President at Sterling Partners, a Chicago-based private equity firm with $4 billion of assets under management, responsible for principal investing and portfolio company management.

One more PE thought - WSC (founded 1955) has been under PE ownership before. The company went public on NASDAQ in 2005 and two years later was acquired by mobile office and storage building company Algeco, which at the time was a portfolio company of TDR Capital. Cypress - another PE firm - owned about 27% of the company at the time of acquisition per that article. Algeco / TDR exited via a SPAC in 2017 which made the company public again.

I’ve spent most of this post talking about the last year of meaningful corporate events and want to talk about why I like the business now. WSC has been around for 70 years and has expanded over time via a series of acquisitions, including Mobile Mini in 2020. ~50% of adjusted EBITDA growth has been acquired.

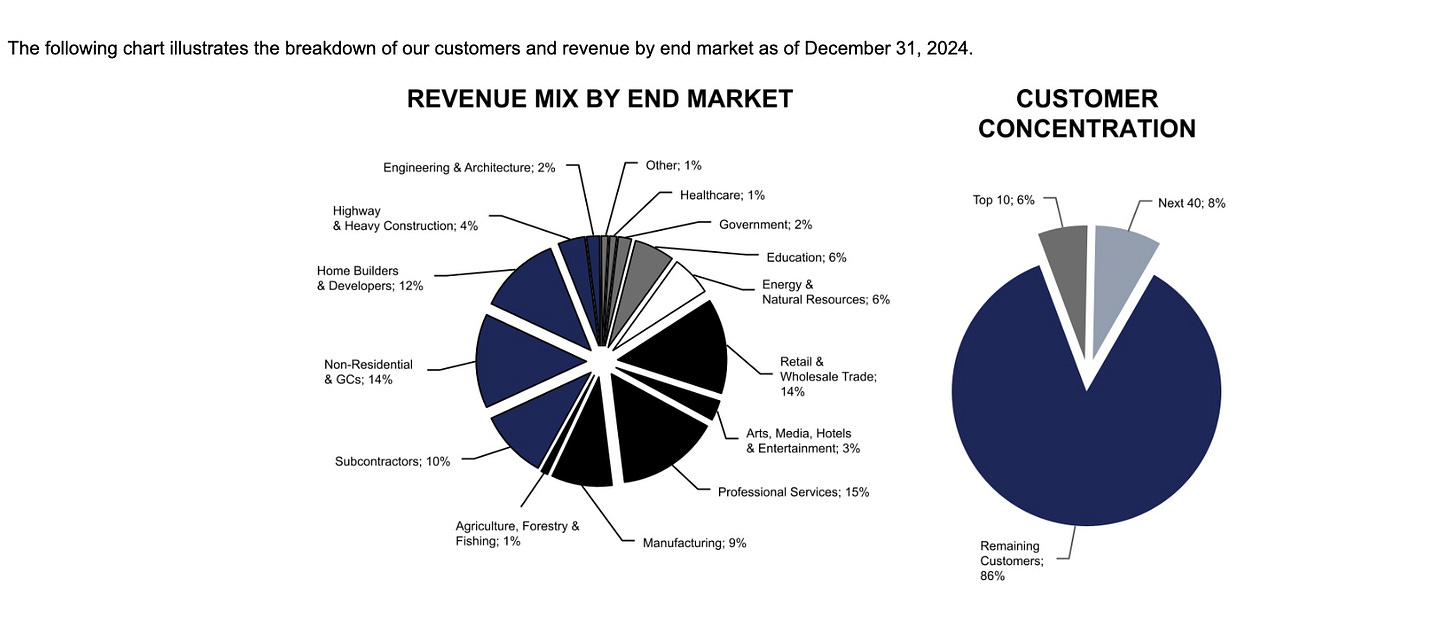

I’m sure most people reading this have seen the trailers that serve as temporary space for construction and other projects; I saw a few recently when a new high school was going up in my hometown. WSC leases these trailers to a variety of end customers (see graph below for industry breakdown) and as of 12/31/24 owned 152K modular space units (think of as temporary buildings) and 210K portable storage units (think of as containers to store stuff and not people). About 60% of the revenue is modular space and 40% is storage.

Average lease term for FY 2024 was 41 months (3.4 years); 90% of leases use a standard agreement. Per the last 10-K, customers are responsible for many parts of the equipment upkeep / setup:

Customers are responsible for the costs of delivery and set-up, dismantling and pick-up, customer-specified modifications, costs to return custom modifications back to standard configuration at end of lease, and any loss or damage beyond normal wear and tear. Our leases generally require customers to maintain liability and property insurance covering the units during the lease term and to indemnify us from losses caused by the negligence of the customer or their employees.

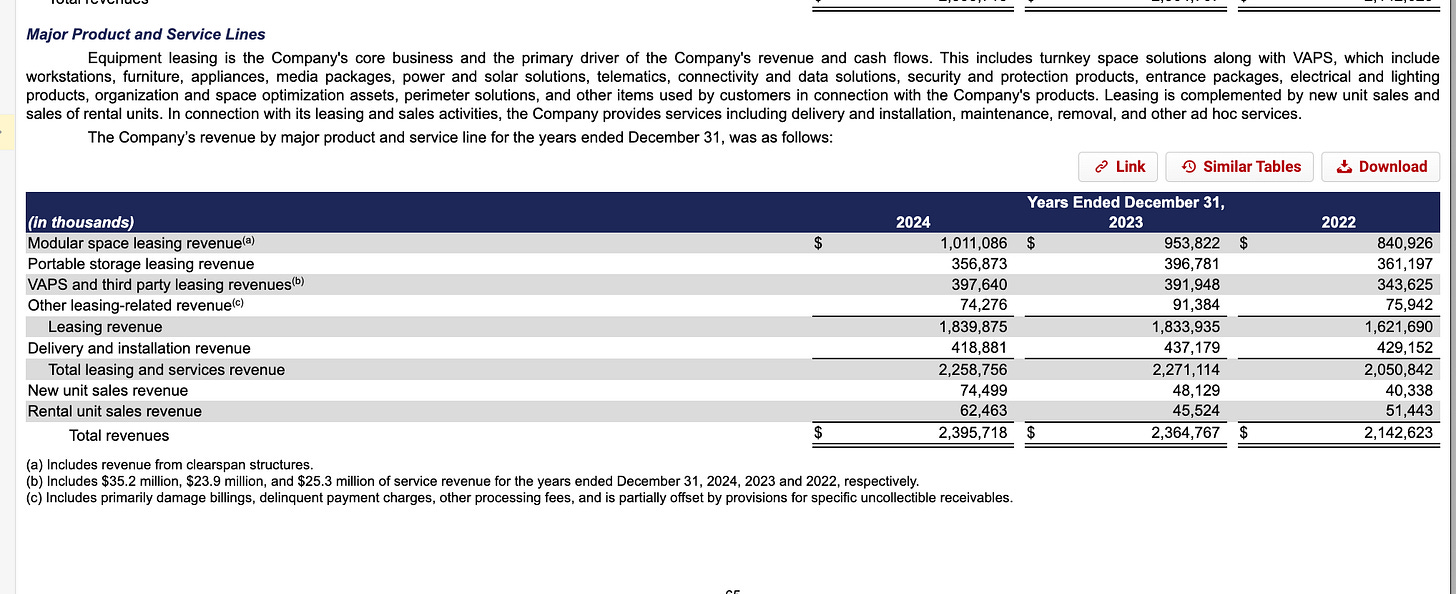

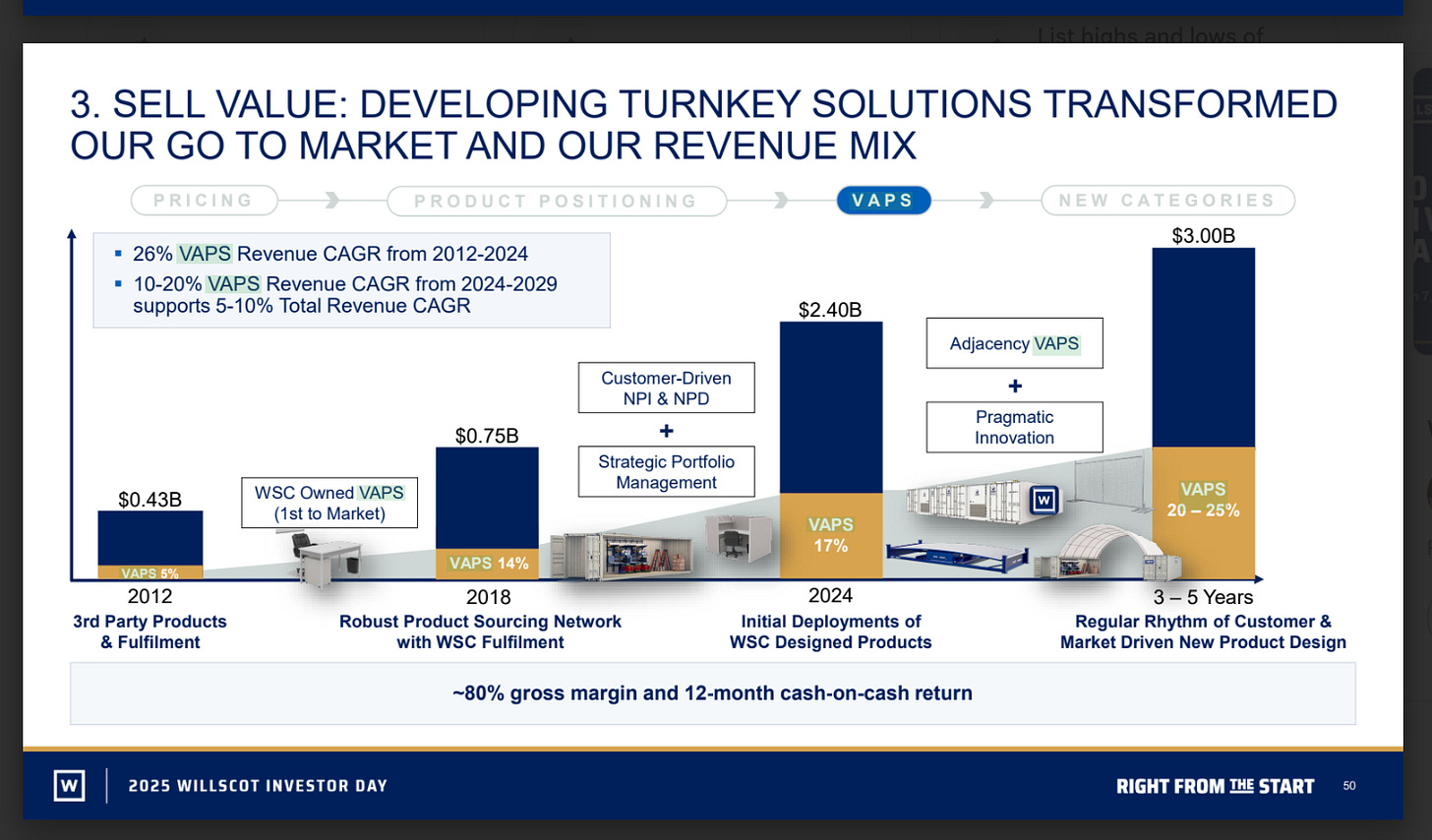

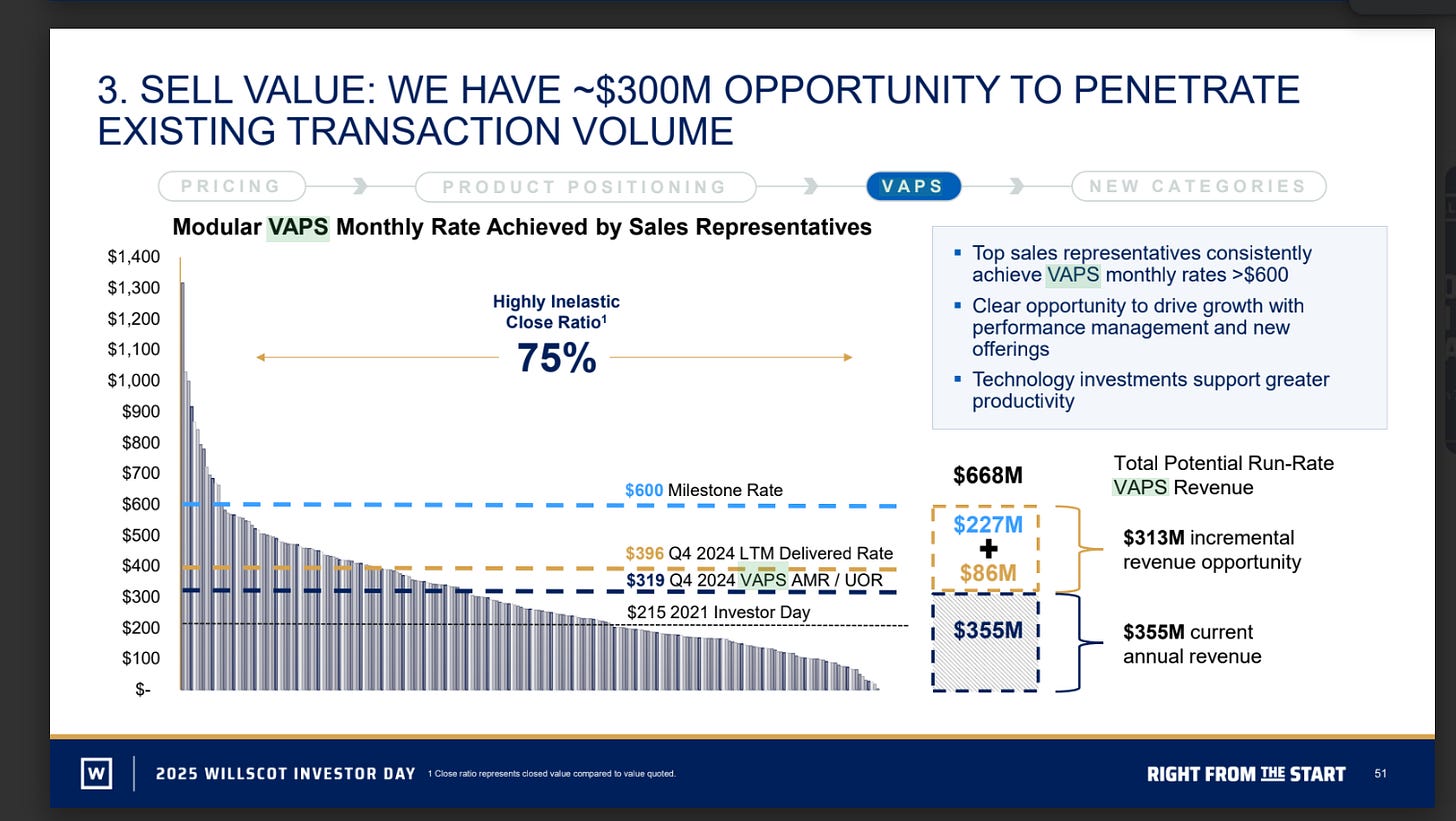

The company also makes a small but high-margin portion of revenue on Value Added Products and Services, or VAPS. VAPS include services like adding HVAC, internet or furniture to a unit and per the company is 70% gross margin. The company cites VAPS as one reason EBITDA margins have been able to flex 40%+. Per the last investor day, VAPS is a significant part of the margin and sales growth story:

I’m always tempted to compare leasing businesses to Triton and Textainer but I think where the comparison falls apart here is 1) duration of leases / renewal risk and 2) residuals. Shipping containers might be on lease by the same company for decades; for WSC, once a lessee completes a construction project, they don’t need the trailer anymore.

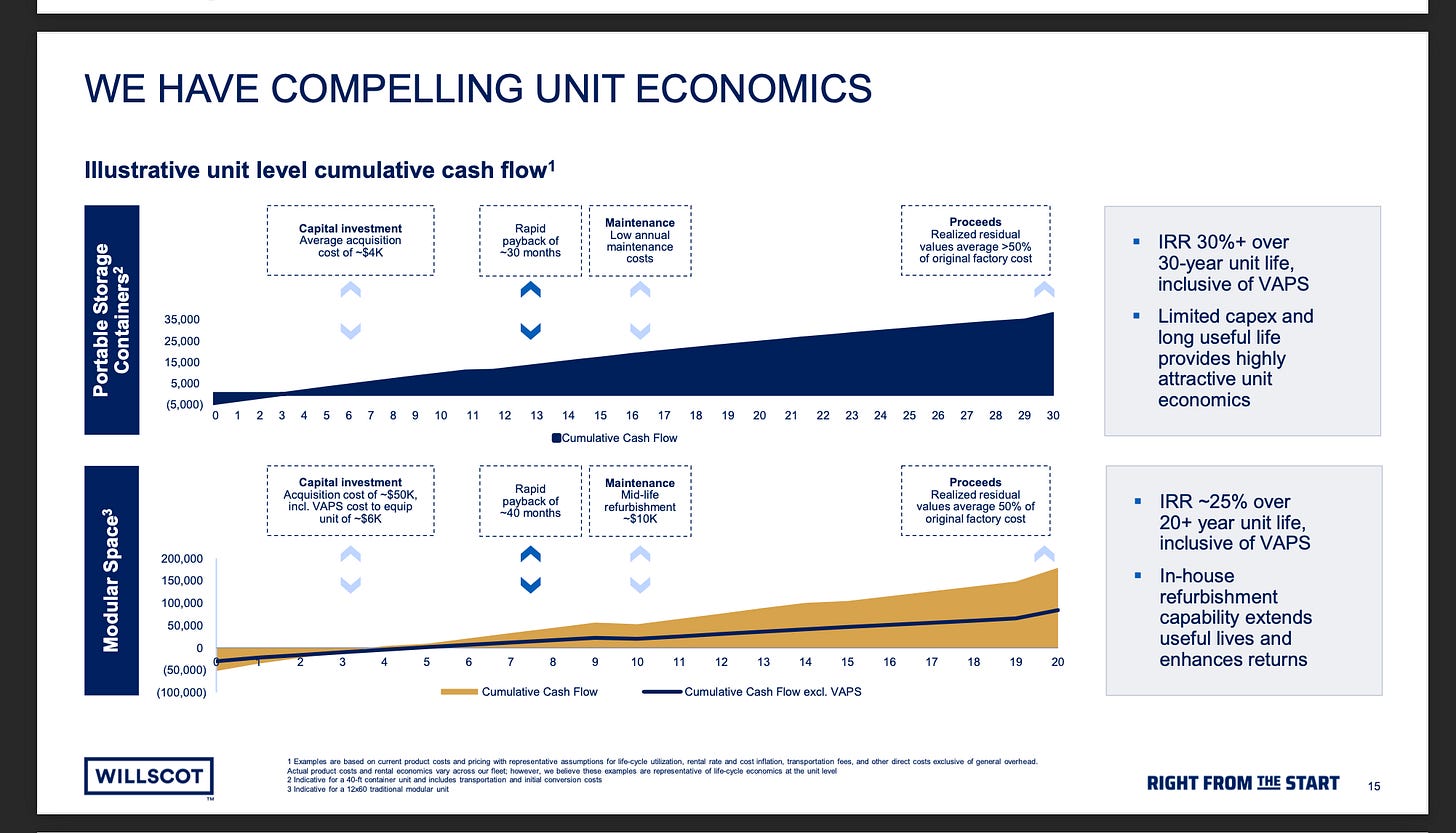

On residuals, shipping containers have strong secondary uses and a lot of metal for scrap; I have less confidence on residual values for temporary living space trailers (the company says 0-55% of the original value). So, I think the IRRs of 25%+ the company shows us in its investor deck on unit economics need to be haircut to be safe; especially in an economic soft patch, residuals might be closer to 0%:

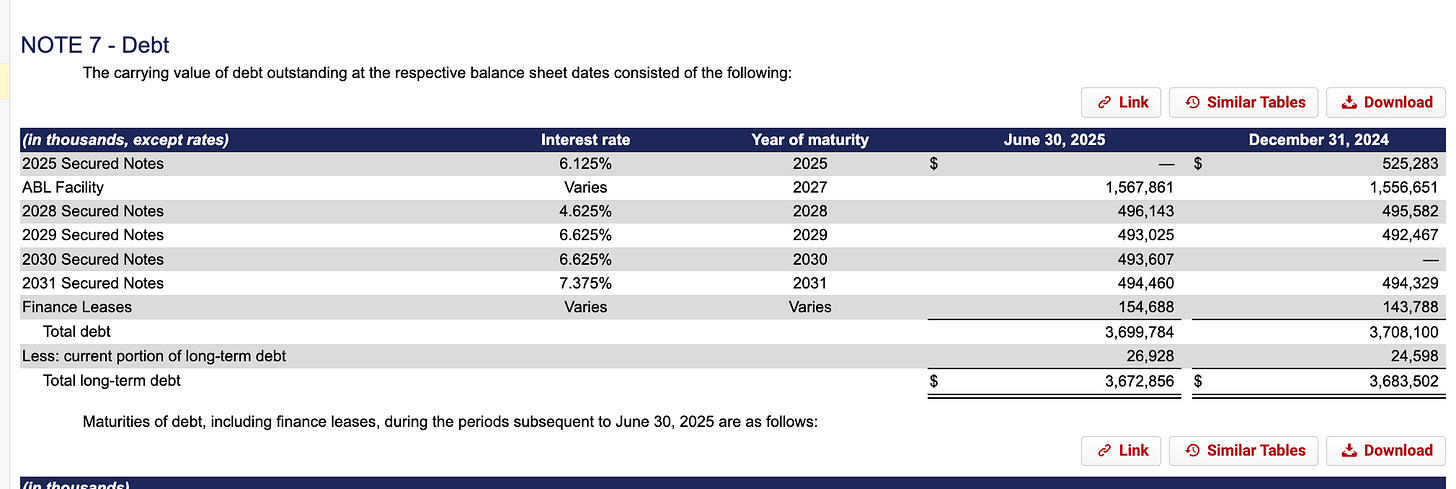

In short, while I don’t think the unit economics are as good as Triton / Textainer, I think they’re good and the 40%+ EBITDA margins, teens ROIC and FCF generation are real. One question shorts have brought up that needs to be addressed - will the company make it past debt maturities to realize these returns? Here is the current debt stack:

The ABL has step-ups based on leverage ratio, which based on my read is measured off of adjusted EBITDA. WSC did $477m of adjusted EBITDA through the first half of the year and is projecting $1bn on the low end for the full year. The 3-5 year forecast is for leverage of 2.5x-3.25x (3.6x for Q2, 3.7x if you just put in the full year).

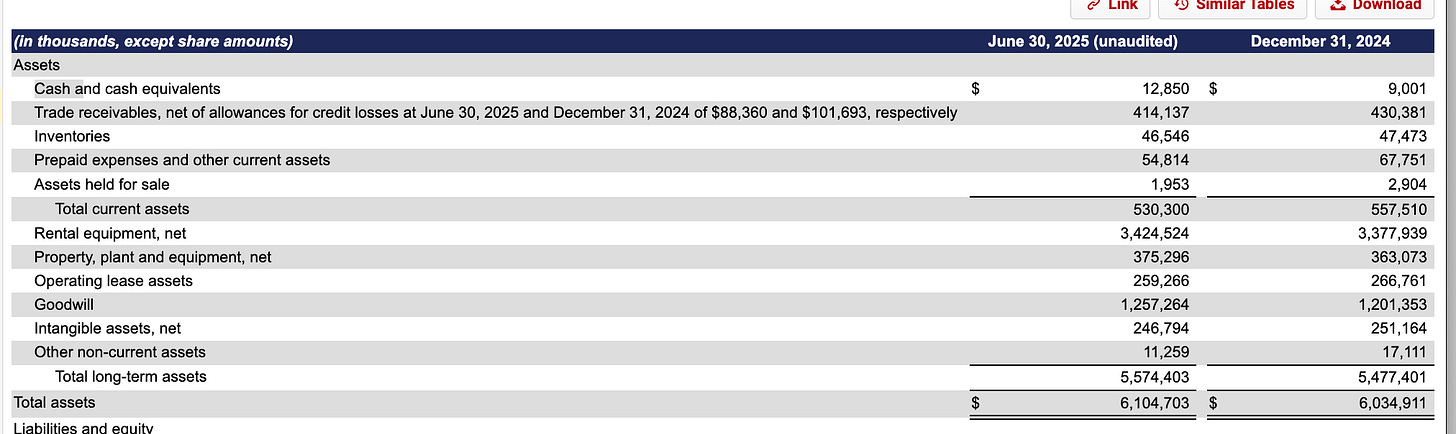

There also are a lot of assets for lenders and even when haircut you have a borrowing base for lenders likely above $2bn at least (marked at $3.4bn; note I have not read the full ABL agreement):

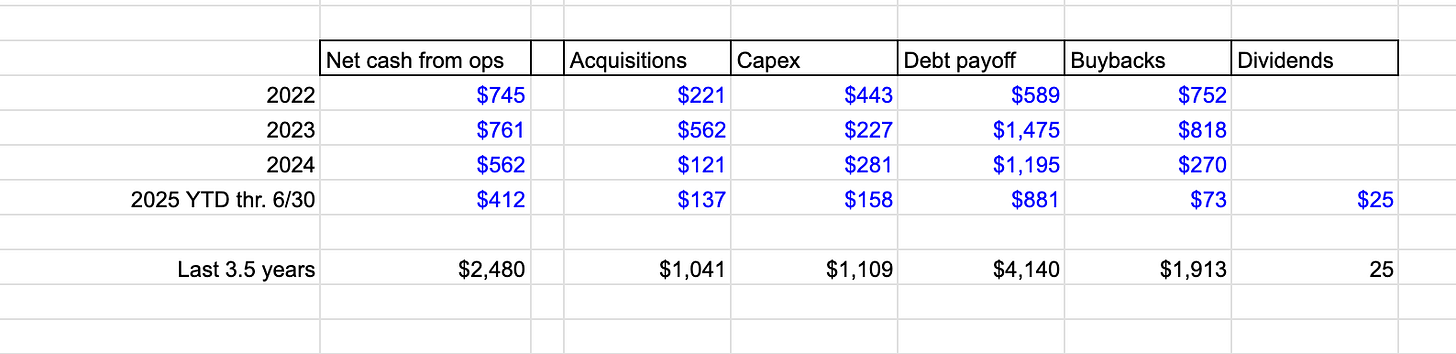

Finally, just looking at capital allocation, WSC could turn off buybacks and the dividend to free up cash to pay lenders. They’ve generated in the last 3.5 years almost $2.5bn of net cash from operating activities and paid back $4bn of debt (granted, a lot of this is noise from refinancing). Since 2022, here is what capital allocation looks like:

Were I a lender here, I would not want to take the keys in 2027 given WSC’s ability to pay me back with cash flow generation and the assets behind the ABL having real value. To some degree, acquisitions and capex also could be turned off in addition to buybacks and dividends. This route would hurt the equity short-term, but I believe in the long-term we eventually will see an upcycle in construction and if the company can hit a cash flow year similar to 2023 the stock will look very cheap on an FCF basis.

Overall, WSC’s multiple IMO is cheap for real reasons right now - a bad economic cycle, a failed merger with a big termination fee and leverage concerns. I think looking out a few years, all of these issues go away and are incentivized to go away based on a management team looking to sell to PE.

I don’t love that insiders own no meaningful stock and the only 1%+ owner is Jeff Sagansky, who I believe led the SPAC and has a history of leading SPACs.