Looking for opportunities from higher rates (LADR, TGH.PRA)

Wrapping up the month with a case for "locking in" "safer" returns

It has been a crazy few months for stocks and bonds. Despite all the surprises around the Fed and economic data and energy prices in Europe and the latest headline of the day, if you bought the index on May 20th and looked now, you’d be flat.

What if you had done the same with the 10yr bond?

Not so much, as the ten year yield has gone up by a full 123bps over this time and bond prices have tanked. Many of my discussions with friends now are on whether bonds represent a more attractive opportunity than stocks (or, as the great Diligent Dollar puts it, “Are bonds cheap or are stocks expensive?”). Depending on where you look and what your desired return is, there are near investment grade opportunities that yield over your threshold rate. The 10y right now is equivalent to a stock trading at 25x earnings with no growth on the horizon, with the caveat that the cash flow produced is always guaranteed and going right back to whoever owns it.

There is comfort to being higher up in the capital structure and not having to worry as much about business risk. Last article I argued for stocks with strong balance sheets and growing “coupons” (NOW (who just had one heck of a quarter), MSFT (not so much), TRTN (reporting Tuesday)); this one I’m going to argue for “bond-like” securities where I think higher rates are giving you a chance to buy cheap streams of cash flows.

In the case of Ladder Capital ($LADR), the company’s net interest income (NII) is benefitting from higher rates as the floating rate loans it owns produce more interest, while many of its liabilities are fixed (interest expense was actually higher in the year ago period than now). In the case of Textainer’s Preferred Series A stock ($TGH.PRA), I’m getting a fixed coupon higher up than the common in the capital structure which IMO has sold off below par because of rates bumping up.

Ladder Capital (LADR)

While LADR is a public equity structured as a commercial REIT, it owns floating rate debt with mainly investment grade borrowers:

The company was founded during the height of the 2008 financial crisis to take advantage of real estate opportunities, and management often talks about itself as having core competencies in providing lending where banks will not or cannot. LADR actually participated in the first post-crisis CMBS; clearly it’s not afraid to step into opportunities when everyone else is scared.

I’ll make my LADR pitch short and sweet; the company has already benefitted from the Fed raising rates (distributable EPS up to $0.27 versus $0.14 a year ago, dividend up 15% YTD from $0.20 to $0.23 quarterly, currently a ~9% yield on the stock) and is positioned to benefit even more if we see further interest rate increases.

The Fed’s target rate is currently 3-3.25% and expected to be 4.25-4.5% by the end of the year. Assuming an 125bps interest rate increase, LADR’s earnings are going up by $0.22 without them doing anything assuming their borrowers continue to pay (note - that’s a big if, and IMO the main risk of owning the stock). That $0.22 likely can be invested in more high interest opportunities; paid back to shareholders, that’s a 24% increase on the annual dividend.

The Q3 call I think had many comments where management signaled earnings are going up. Some good excerpts:

Company is benefitting from floating rate assets and fixed rate liabilities. Note the company was actually able to upside its revolver at lower rate right before rates sky rocketed:

In the third quarter of 2022, we earned $77.4 million in interest income compared to $46.2 million in the third quarter of 2021. That is to be expected in a rising rate environment when most of our assets are floating rate instruments. What may be unexpected though is that our interest expense in the third quarter of 2022 of $48.5 million actually went down from the interest expense from a year ago, of $49.3 million. This happened in large part because of our differentiated liability structure that provides us with a very comfortable and diversified funding model, where we have 38% of our debt outstanding in unsecured corporate notes at a fixed average interest rate of 4.66% with an average maturity of 5 years from now.

Company has a lot of room to run up on dividend. This answer was in response to an analyst asking if they could raise the dividend to $0.35 (that would be a 52% increase from current and a ~13% yield on the stock):

We're certainly not going to communicate a dividend policy here for that's for the boardroom which comes up, but we are shareholder friendly. We try to raise our dividends when we can. I think another 100 basis points of rate from the Fed if it translates into LIBOR or SOFR which it should, that's probably $0.16 a year, so $0.04 a quarter, so we're already covering our dividend through just real estate and loans.

So as long as the credit is holding up and, but on the other hand, we are seeing an environment right now that we think our shareholders would love to see us investing money right now, because the ROEs we're going to generate on recent investments as well as new ones will far exceed the ROE associated with buying stock back or just raising the dividend. But it's never one or the other, it's always, all of them together.

We've been -- we have raised our dividend 15% this year. And yes, I don't know if we'll do it again in December, we might though. And this all depends on the backdrop of how -- not just how the credit is performing, but also what borrowers are saying to us. But we are not at all shy about pushing dollars into the dividend column, the stock buyback column or bond buyback column.

On company not needing more leverage to succeed in current environment:

So as far as how low to go, I don't anticipate we're going to use the revolver, but if we did in these times I think investments that we make will not require much leverage unless it's a AAA or AA security. So my guess is that, we'll probably be pretty comfortable with $100 million to $150 million of just walk around cash and revolver. We don't feel like there is anything pressing us in the near term here.

On the leverage on AAA theme, LADR mentioned the levered return on AAA CLOs is 25% right now. Assuming we don’t see a 2008-9 scenario, I’m very glad to hand over capital to a management team that generate above my threshold on AAA securities.

The existing opportunity set to invest in appears to be more attractive than bumping the dividend or buying back debt / stock, which I’m confident management will do (and has done) when rates go down. This actually feels a little similar to TRTN’s setup in late 2020, when the container leasing environment was so attractive management put aside buybacks to focus on writing as many attractive leases as possible.

If LADR trades flat, I’m realizing a return close to my 10% threshold. I think the stock could appreciate as it trades well below book ($13.63 of undepreciated book value) and is growing book value in the current environment. The risk here is that its borrowers don’t perform and they have to write down loans. Although LADR is less levered than traditional REITs and has less floating rate debt, it still is levered and in a 2008-09 scenario definitely has blow-up risk.

I think the borrower risk is mitigated by how many of LADR’s borrowers are IG+ and that the commercial office space should see higher occupancy as people go back to work in-person. On leverage, LADR was able to refinance its debt in the worst scenario imaginable in 2020 and in its Q3 call says it doesn’t need to lever more (leverage currently is at historically low levels) to produce superior returns.

Textainer Preferred Series A (TGH.PRA)

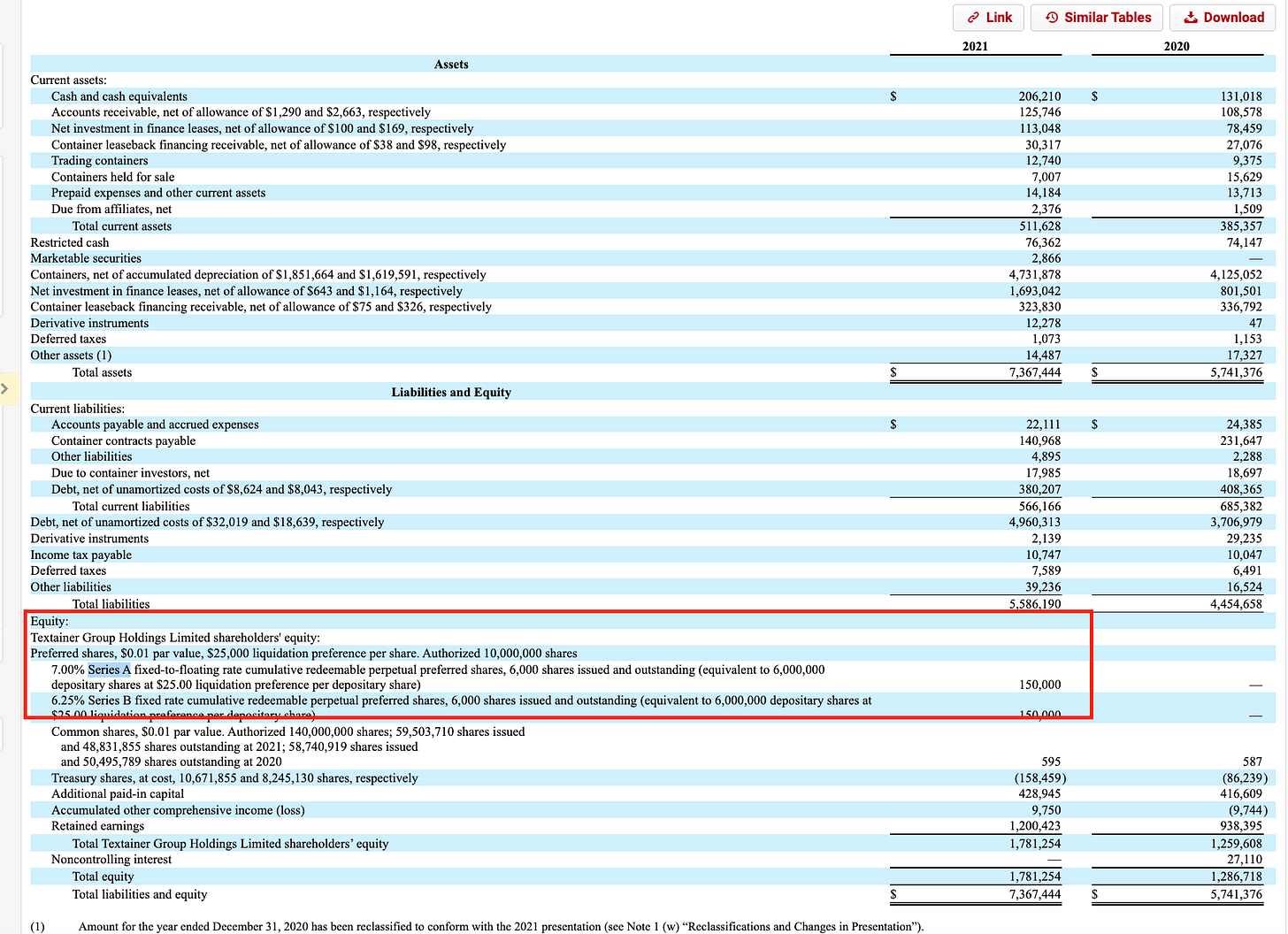

Textainer - the second part of the public container leasing oligopoly with Triton (see a good overview on my podcast with J. Mintzmeyer; also wrote about TGH here) - has a $150m preferred stock series they issued in April of last year which pays a fixed rate coupon of 7% till 2026, at which point they can call the stock at $25.

If they don’t call the preferred in 26, in June the rate resets to the 5yr treasury + 6.134%.

Assuming they do call it, the IRR here is 10% at the ~$23 price. If they don’t, you have a 7% return into 2026 (assumes flat preferred price) and then the coupon at the current rate would be 4.181% (current 5y treasury) + 6.134% = 10.315%. I’m pretty sure if rates stay elevated, TGH will be highly incentivized to pay off this preferred series rather than pay a 10%+ dividend away from the common. If rates go down, the rest of my portfolio should do well and I’d expect the preferred to go to par. It has actually traded above par for most of its history:

I think there is a case for TGH equity. Bulls think the dividend is going up (current dividend IMO is conservative as the company cut it to zero a few years back when one of their largest lessees had credit issues) and their is plenty of cash flow left for the equity after the preferred is paid. TGH has also been buying back shares for several years now (took down 10%+ of float in 2020 and 3% of its float just in Q2; just added a new buyback authorization for another $100m).

Why don’t I just buy the equity? Because I already own a good amount of Triton common and I like parking cash in a 7-10% IRR vehicle that I think is extremely well protected. Additionally, I’ve been around the block enough to know the market sees the container lessors as cyclicals, and that if we see more softening in the macro environment, I’ll have a chance to buy TGH and TRTN very, very cheap.

Overall, I believe there’s a place for “benefit from higher rates” / “capped upside” opportunities to supplement my nearly all stocks portfolio. I like the fact that LADR allows me to see some upside from the Fed raising rates and Textainer’s preferred is well-protected and paying close to my threshold rate.

Given another big sell-off, I can always swap into beaten down equities if I think those opportunities are too good to miss. Similarly, if rates go down, I’d expect LADR and TGH.PRA to do just fine (the preferred was trading above par when rates were 0; I’d expect some of LADR’s loan assets to increase in value if rates dropped).

Finally, I think both of these opportunities outperform in the scenario where rates stay higher for longer and the economy has a mild but not severe recession. IMO this is the professional economist consensus scenario, which almost certainly means it will not happen :-).